Turkey’s state-run banks re-entered the foreign-currency market on Monday, selling as much as $1 billion by midday to prop up the lira, according to traders.

As the currency’s decline deepened after last week’s public holidays, state banks stepped in to prevent it from falling much past 26.07 per dollar, the traders said, asking not to be named because they weren’t authorized to speak publicly on the matter.

The currency depreciated as much as 0.4% on the day and was trading 0.3% lower at 26.08 per dollar at 3:25 p.m. in Istanbul. Turkey’s state banks don’t comment on their interventions in the foreign-exchange market.

The interventions hit Turkish dollar bonds and raised default insurance costs, as markets factored in the impact on the central bank’s already-depleted foreign exchange reserves. Five-year credit default swaps rose nine basis points on the day to 496 basis points, while 10-year dollar bonds erased earlier gains and fell 14 cents to 85.1 cents.

State banks had halted their regular interventions after the appointment of a new economy team, which had signaled it was in favor of curbing dollar sales and letting the market establish the currency’s value.

However, they have since stepped in sporadically to prevent too sharp a lira slide, especially after the central bank’s June 22 meeting that disappointed investors with a smaller-than-expected hike in the benchmark one-week repo rate. That’s sent the lira almost 10% lower.

“For the lira to stabilize and start appreciating, the new economic team has to impress foreign investors with a quick implementation of structural reforms,” said Piotr Matys, senior currency analyst at In Touch Capital Markets Ltd.

“Something will have to give - Turkey doesn’t have sufficient FX reserves left so it seems inevitable that the lira will be allowed to trade more freely.”

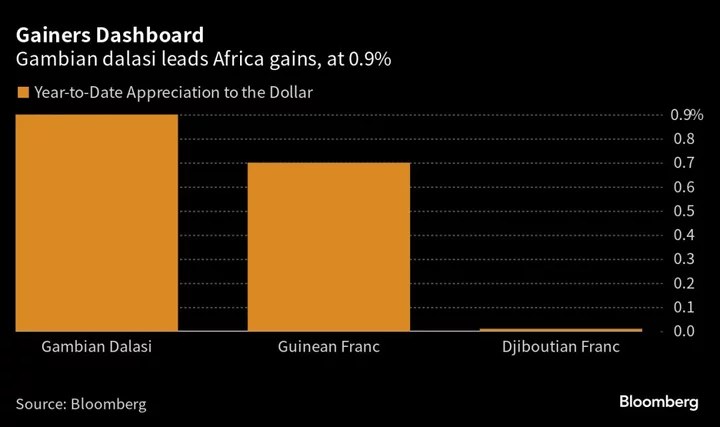

The lira’s year-to-date losses now amount to 28%, the biggest loss among peers after the Argentinian peso.

(Updates with market reaction in eurobonds and CDS levels in first and fourth paragraphs.)