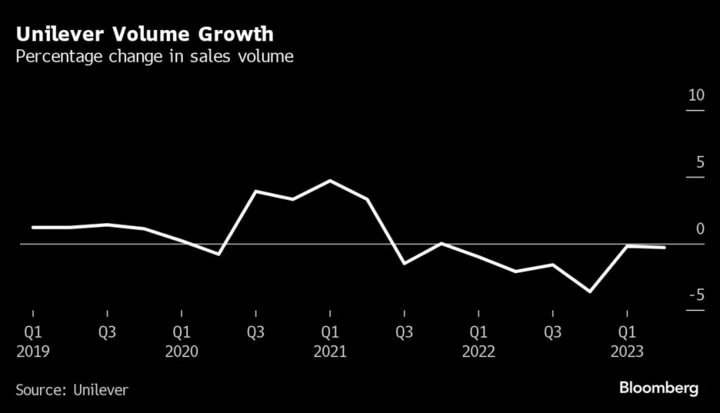

UK retail sales fell unexpectedly in October, adding to the impression that a string of interest-rate hikes designed to beat down inflation is beginning to stymie economic activity.

The volume of goods sold online and in store dropped 0.3%, the Office for National Statistics said Friday. That follows a downwardly revised 1.1% decline in September, when unusually warm weather held back spending on clothing.

Economists were expecting a rise of 0.4% for October. Instead, sales fell to their lowest since February 2021 when Covid restrictions were in place, with retailers citing the cost-of-living crisis and bad weather for the poor performance. It bodes ill for the “golden quarter,” the run-up to Christmas when stores can make a majority of their yearly profits.

“Consumers held onto the purse strings in October,” said Samantha Phillips, Partner at McKinsey & Co. “Despite CPI inflation continuing to drop, it’s a disappointing start to the golden quarter which may reflect the generally low level of consumer sentiment. It’s potentially also a sign of shoppers holding out for Black Friday bargains and other festive promotions.”

It’s the latest indication that the UK economy is beginning to feel the effects of 14 consecutive rate hikes from the Bank of England in its battle against inflation. It will fuel expectations that the BOE is done raising interest rates. Traders are betting that policymakers could cut rates as early as May.

The pound fell after the release. It traded as much as 0.3% weaker at $1.2380, set for its third day of losses against the greenback.

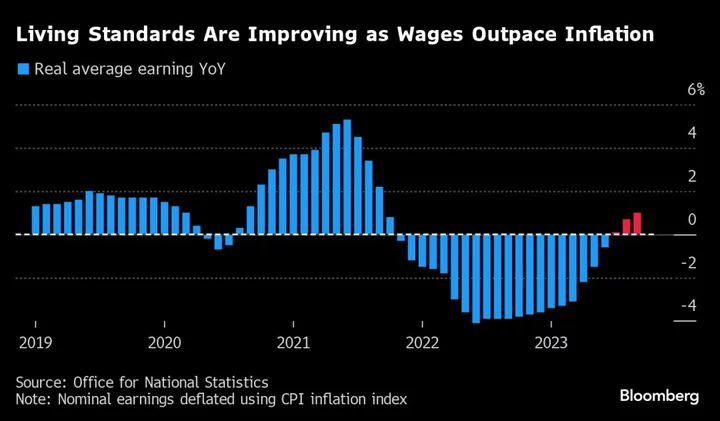

While living standards are improving with inflation dropping below the pace of wage growth, higher mortgage rates are continuing to keep up the pressure on family budgets. There are worries that consumer caution could tip the economy into recession next year.

All retail sectors saw sales decline last month, except for non-store retailing and “other stores,” which includes everything from pharmacies to book shops, the ONS said. Sales at household goods shops and auto fuel stations posted the biggest declines. A drop in food sales was blamed on consumers prioritizing essential goods over discretionary spending. Sales excluding fuel fell 0.1%.

Some economists remained upbeat, saying that falling inflation and strong wage growth would underpin consumer spending.

“Looking ahead, we think a recovery in real incomes will cause retail sales to rebound,” said Gabriella Dickens at Pantheon Macroeconomics. “Average weekly wages likely will rise more quickly than the CPI, which will be restrained by negligible increases in goods prices.”

The figures showed the impact of the surge in inflation. Total sales were 16.9% higher in value terms than in February 2020, before the pandemic struck, but volumes were 3.1% lower.

--With assistance from Joel Rinneby and Mark Evans.

(Adds charts, comment)