European stocks fell on Friday to their lowest level in more than five weeks, as concerns over higher interest rates and a slowing Chinese economy further sapped this year’s rally.

The Stoxx 600 Index was down 0.6% by 8:29 a.m. in London, extending a drop into a fourth session as miners and auto stocks fell. While the losses were broad-based, among individual stocks, Dino Polska dropped after the Polish supermarket operator’s earnings missed expectations. Swiss semiconductor device maker u-blox Holding AG plunged after cutting its full-year guidance.

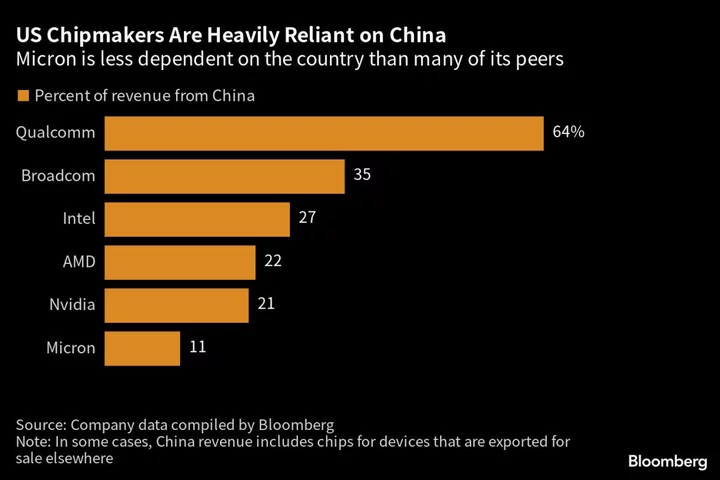

Investor concerns over interest rates remaining higher for longer, rising bond yields and a crisis in China’s property sector have seen gains for European stocks cool in August. The Stoxx 600 Index is down 4.8% in August, with the month’s biggest laggards including basic resources, autos and industrials — sectors which are both particularly sensitive to the economic cycle and have significant exposure to China.

This month’s weakness in equity markets is comforting strategists into their view that gains are done for the year. They see the Stoxx Europe 600 at 453 points by year-end, according to the average of 15 forecasts in a Bloomberg survey, just a touch below last Wednesday’s close.

Recent minutes from the Federal Reserve’s latest July policy meeting showed that the risk of higher inflation could warrant further tightening. With earnings season coming to an end, investors are weighing whether the mounting risks will be too much to revive the momentum in equities.

“The earnings season has been luckluster showing that European equities are facing profitability pressures as recession concerns mount and activity slows,” Aneeka Gupta, director macroeconomic research at Wisdomtree, said.

SECTORS IN FOCUS:

- European chip-tool makers after Applied Materials, the largest US maker of chipmaking machinery, gave a bullish forecast for the current quarter, indicating that an industry slump may be fading.

- Retailers after UK retail sales fell more than expected in July after a spell of cool and rainy weather kept people out of shops.

For more on equity markets:

- For Strategists, the 2023 Rally Is Definitely Over: Taking Stock

- M&A Watch Europe: Suse, EQT, Intesa, GAM, Spie, Arm, Novartis

- New York’s SPAC Boom Ends in a Crash for UK Companies: ECM Watch

- US Stock Futures Fall; Farfetch, Keysight Fall

- BAE Buys a $5.6 Billion Aerospace Business: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.