Turkish state lenders returned to supporting the lira after a temporary halt to dollar sales on Wednesday triggered the currency’s biggest drop in more than a year and sent it to an all-time low.

The lira still declined Thursday — trading 0.5% weaker at 23.3653 as of 10:54 a.m. in Istanbul — though nowhere near as dramatically as the previous day. The currency has now depreciated for 13 days in a row, the longest losing streak since 1996.

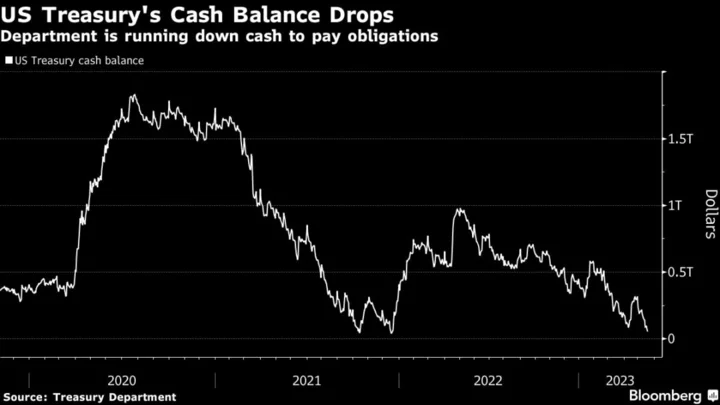

A 2018 protocol between the Turkish Treasury and the central bank allows the latter to intervene in the currency market through foreign-exchange sales by state lenders. This week’s sharp depreciation, which culminated in a 7% plunge on Wednesday, came after the suspension of that protocol by the Treasury, according to people with knowledge of the discussions.

That decision has now been reversed, the people said, asking not to be named because the matter was private. The central bank and the Treasury and Finance Ministry both declined to comment.

Newly appointed Treasury and Finance Minister Mehmet Simsek, a former Merrill Lynch strategist, rejoined President Recep Tayyip Erdogan’s government following the Turkish leader’s reelection last month. Simsek champions conventional policymaking, including raising interest rates to curb inflation.

The central bank had been ramping up currency-market interventions to keep the lira relatively stable prior to the elections. With Simsek’s arrival, there appeared to be a policy pivot toward letting the lira gradually weaken but without spooking markets.

Author: Kerim Karakaya, Cagan Koc and Beril Akman