Over the last several decades, the Grífols family has turned the collection of blood — often from impoverished Americans and Mexicans looking for quick cash — into one of the world’s largest medical fortunes.

Now, for the first time in the Grífols business empire’s century-old existence, the Spanish billionaire family is no longer at the helm. Last week, Executive Chairman Thomas Glanzmann took over as chief executive officer, replacing two family members who were co-CEOs, ending the reign of four generations of Grífols.

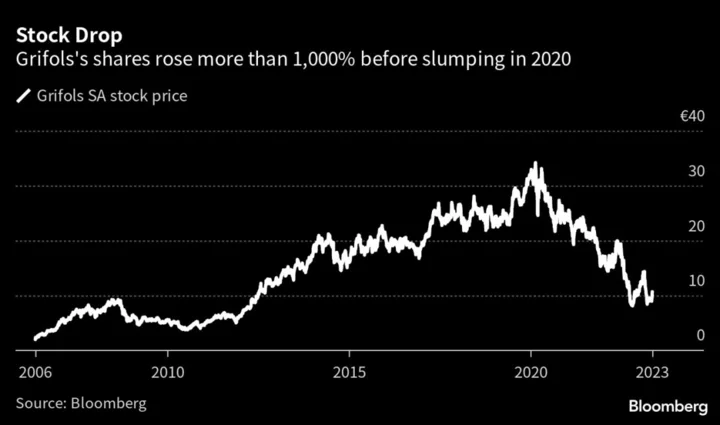

The move capped a chaotic period after the pandemic slashed blood plasma collections and fears grew over the company's debt pile, leading to the family’s fortune more than halving since early 2020. It now has a combined net worth of about $1.6 billion, mostly through a stake of about 35% in the Barcelona-based business, Bloomberg Billionaires Index data shows.

By turning to an outsider to run the business, the family is attempting to reverse its fortunes and spur a rebound in its shares, which skyrocketed in the decade to 2020 before tumbling 40% on concerns over the slump in business and Grifols SA’s debt-fueled acquisition binge in the US and Asia. Profit slipped to €188 million ($204 million) last year from €637 million in 2019.

“What they’re doing is the right thing, stepping aside and leaving professionals to take the reins of their company,” said Xavi Brun, head of equities for Europe at Trea Asset Management. “The company has grown so much that it is no longer a family business.”

The group’s history goes back to 1909, when José Antonio Grífols Roig founded a blood-analysis laboratory in Barcelona shortly after getting his medical degree. Working at one point out of his apartment located on the city’s tree-lined Rambla street, he used a row of hutches on the balconies to rear rabbits and guinea pigs for experiments.

José Antonio founded a successor business with his sons in 1940, developing vaccines and blood transfusions for a population scarred by the Spanish Civil War and internationally isolated by the Franco regime. His sons pioneered techniques that allowed people to donate blood more frequently with no side effects. The business expanded globally through the dynasty’s third generation, after Victor Grifols succeed his father in 1987.

Víctor’s brother, Raimon, and his namesake son became joint CEOs in 2017. In October, Víctor stepped down as non-executive chairman, becoming honorary chairperson. The younger Víctor, 46, is now chief operating officer, while 59-year-old Raimon is chief corporate officer, after they ceded their CEO roles last week.

Read more: Grifols Founder Family Loses CEO Post as Chairman Takes Over

Grifols, which launched Spain’s first private blood bank in 1945, relies significantly on the US, one of the few countries where people can be paid to donate blood. The US alone provides nearly two-thirds of all the blood plasma available in the world.

Plasma is the liquid portion of blood with a wide variety of medical uses. Drugs derived from plasma are used for treating ailments such as hemophilia and have shown promise in slowing the progression of Alzheimer’s. It’s also a big business, and at times a contentious one — critics say the industry takes advantage of the poor.

With just under 400 plasma donation centers in the US, Canada, Europe, China and the Middle East, Grifols has one of the largest such networks in the world. Before announcing a cost-cutting plan this year, which led to the closure of 25 centers in the US, the company ran about 300 plasma donor outlets across that country. Many of them close to the US southern border in California, Arizona, New Mexico and Texas openly lure Mexicans, with Facebook pages in Spanish and posts advertising rewards for those donating the most frequently.

In 2021, Grifols and rival CSL challenged a US ban on Mexicans crossing the border to sell blood. With a judge lifting the ban in September, the company expects to collect 1 million liters of blood a year at those centers.

“Grifols is on the rebound,” Chairman Glanzmann said in an emailed statement to Bloomberg. “We are excited about the opportunities that lie ahead.”

While the family has ceded the top spots at the company, it still stands to gain immensely from any turnaround. If objectives are met, 220 employees — including Víctor and Raimon — can buy a total of 4 million shares at €8.96 a piece. Shares last traded just over 11 euros.

“We continue to see near-term upside earnings risk, reflecting strengthening industry trends and a highly motivated and incentivised management team at Grifols,” Citi analysts wrote in a note on Wednesday.

The Grífols family has collectively received more than $300 million in dividends over the past two decades, according to Bloomberg data, allowing it to diversify into real estate and private equity.

Scranton Enterprises, a Netherlands-based investment vehicle for the family, holds part of the dynasty’s stake in Grifols and also has dealings with its major operating assets. It ponied up more than $500 million to buy blood plasma firms Haema AG and Biotest US Corp from Grifols in 2018, and owns the company’s headquarters and facilities in Barcelona. It recently sold real estate and other peripheral assets to pay down debt.

Grifols has debt issues of its own, with two bonds totaling €2 billion maturing in early 2025. Investors are expecting the company to sell part or all of a stake in Chinese rival Shanghai RAAS it bought for about $1.9 billion in 2019, and target annual savings of €400 million.

Will the steps help Grifols bounce back? It’s anyone’s guess, said Trea’s Brun.

“Like all family businesses, the family can create it and then it can destroy it” he said. “Grífols is no exception.”

(Adds comment from Citi note in 15th paragraph)