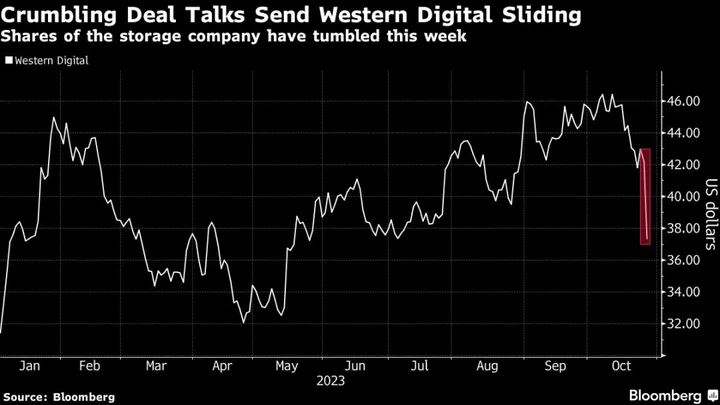

Western Digital Corp. fell as much as 16% after deal negotiations with Kioxia Holdings Corp. broke down, quashing hopes for a combination of their flash memory businesses.

Discussions between the two companies have ended for now, according to people familiar with the situation, following remarks by SK Hynix Inc. that it wouldn’t support the merger. That company, the world’s No. 2 memory chipmaker, is an indirect shareholder in Kioxia and felt the transaction would undervalue its stake.

It’s possible discussions could eventually resume, according to the people, who asked not to be identified because the deliberations are private. A representative for San Jose, California-based Western Digital declined to comment. Japan’s Kioxia and South Korea-based SK Hynix didn’t immediately respond to requests for comment after business hours in Asia.

In a post-earnings conference call earlier, SK Hynix said it was “not agreeing to the deal at this time in light of the overall impact on the value of the company’s investment” in Kioxia. The company “will make a decision for the sake of all stakeholders, including not only the shareholders but also Kioxia,” Chief Financial Officer Kim Woohyun said.

SK Hynix couldn’t disclose more specific reasons nor comment further on the deal process because of confidentiality agreements, he added.

Nikkei previously reported that Western Digital and Kioxia had scrapped the deal.

Western Digital fell as low as $35.62 on Thursday, marking its worst intraday drop since August 2020. It pared the losses later in the session, trading at $38.43 as of 3:01 p.m. in New York. The shares had been up 34% this year through Wednesday’s close.

SK Hynix, which also competes in the flash memory business, became an indirect shareholder in Kioxia when a Bain Capital-led consortium bought a controlling stake from Toshiba Corp.

The Bain-led group purchased Toshiba’s memory chip unit in 2018, and SK Hynix invested 395 billion yen in the deal. Based on an agreement at the time, SK Hynix planned to finance 129 billion yen of that total via convertible bonds that could allow it to take an equity stake of up to 15% in future.

The Korean company put the remaining 266 billion yen in a fund set up by Bain as an investment.

Western Digital and Kioxia have talked for years about a possible combination, but discussions have been stymied over issues of control, leadership, economics and politics. In theory, merging the two operations would help the companies compete against the memory chip industry’s largest players.

The pair had looked to wrap up negotiations this month and aimed to announce a transaction no later than when the US firm reports earnings Oct. 30. Kioxia also had approached Japan Investment Corp. about making a capital infusion to speed up the deal.

(Updates shares reaction in seventh paragraph.)

Author: Liana Baker, Yoolim Lee and Ian King