Asian stock futures made small advances as global investors await a US inflation report later Wednesday that will help shape the outlook for interest rates in the world’s biggest economy.

Contracts for benchmarks in Japan and Australia rose 0.3% and 0.5%, respectively, suggesting a mildly positive tone as markets in the region open. Futures for Hong Kong climbed 0.6% and an index of US-listed Chinese shares advanced 1.6% as traders warmed to government measures to bolster the nation’s struggling property sector.

In the run-up to the consumer price index release, the S&P 500 extended its advance beyond the 4,400 mark while the Dow Jones Industrial Average added almost 1%. Energy producers led gains as West Texas Intermediate oil topped its key 100-day moving average. Activision Blizzard Inc. surged 10% as Microsoft Corp. won a US court’s OK to proceed with its $69 billion takeover deal.

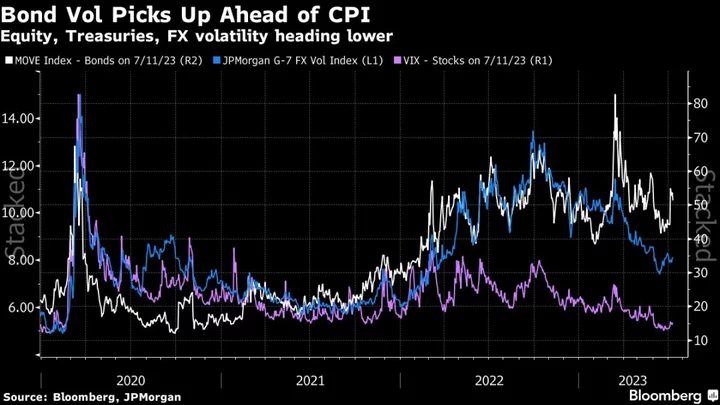

Forecasters surveyed by Bloomberg expect the year-over-year rate of increase in core inflation moderating to 5%, according to the median estimate. But the slowdown will possibly not be enough to prevent additional policy tightening, with Federal Reserve officials widely expected to resume interest-rate increases later this month.

A survey conducted by 22V Research shows that 65% of respondents believe the core CPI — which excludes volatile food and energy prices — will be lower than consensus.

“If economic data keeps tilting towards a soft landing, the markets are increasingly likely to price in that outcome, with investors reallocating to risk assets,” said Jason Draho, head of asset allocation Americas at UBS Global Wealth Management.

A gauge of the dollar slid Tuesday while two-year Treasury yields rose and rates on 10-year bonds fell. Major currencies were mostly steady early on Wednesday, with the yen little changed near 140 after advancing to its strongest level against the dollar since mid-June.

The New Zealand dollar will also be in focus during the Asian session, with the nation’s central bank expected to leave interest rates unchanged. That would end a streak of 12 consecutive hikes as the economy cools and inflation starts to wane.

Meanwhile in the US, after surging by a four-decade high in June 2022, CPI has pulled back steadily in the face of the Fed’s monetary policy onslaught. That slowdown has given support to the stock-market’s surge this year, and bulls have strong precedent for their enthusiasm.

Since the 1950s, inflation peaks have almost always been followed by double-digit equity gains, according to data compiled by the Leuthold Group. The S&P 500 has gained more than 20% since it bottomed out in October, placing it up about 15% since the peak CPI data was released last year.

Elsewhere, oil steadied Wednesday after rising amid indications that Russian crude production is dropping, signaling the market’s supply glut may be coming to an end. Adding to bullish sentiment is news that China will take more steps to revive its economy.

Key events this week:

- Canada rate decision, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- US CPI, Wednesday

- Federal Reserve issues Beige Book, Wednesday

- Fed speakers include Neel Kashkari, Loretta Mester, Raphael Bostic, Wednesday

- China trade, Thursday

- Eurozone industrial production, Thursday

- US initial jobless claims, PPI, Thursday

- US University of Michigan consumer sentiment, Friday

- US banks kick off earnings, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:09 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.5%

- Nikkei 225 futures rose 0.3%

- Australia’s S&P/ASX 200 Index futures rose 0.5%

- Hang Seng Index futures rose 0.6%

Currencies

- The euro was unchanged at $1.1009

- The Japanese yen was little changed at 140.29 per dollar

- The offshore yuan was little changed at 7.2120 per dollar

- The Australian dollar was little changed at $0.6688

Cryptocurrencies

- Bitcoin was little changed at $30,590.64

- Ether rose 0.2% to $1,877.58

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.97%

Commodities

- West Texas Intermediate crude was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.