WE Soda canceled its London initial public offering just two weeks after unveiling its plan for a listing, dashing the city’s hopes to recover from the ongoing drought.

The world’s largest producer of natural soda ash cited “extreme investor caution” in the British capital for its decision. The company, which was seeking to be valued at around $7.5 billion, wasn’t able to get investors to agree to a valuation “that we believe reflects our unique financial and operating characteristics,” it said in a regulatory filing Wednesday.

“The reality is that investors, particularly in the UK, remain extremely cautious about the IPO market,” WE Soda Chief Executive Officer Alasdair Warren said in a statement.

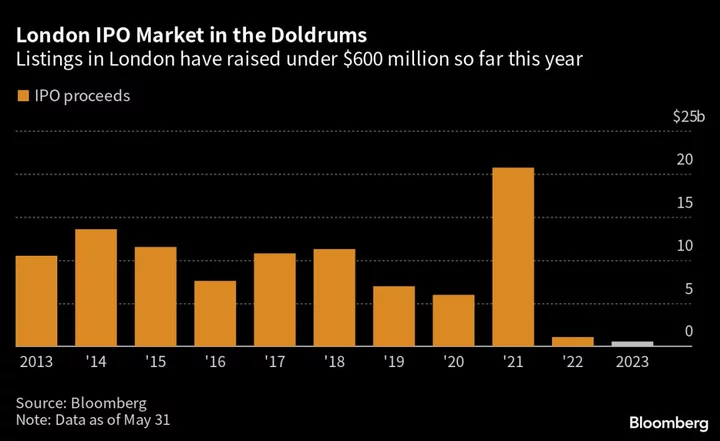

It’s yet another blow to London after losing out on the IPO of UK chip designer Arm Ltd. Just under $600 million has been raised so far this year, according to data compiled by Bloomberg, and the last high profile IPO in the UK capital was Oxford Nanopore Technologies Ltd. in 2021.

This also underlines London’s struggle to maintain its status as a leading financial center since Brexit, with high inflation, rising rates and political and economic uncertainty adding to the UK’s woes.

“This is fresh blow for London just as confidence in the city as an IPO launch pad appeared to be edging back upwards,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown Plc. “The uncertainty ahead is clearly off-putting and companies considering IPOs may continue to set their sights on New York instead.”

After a tumultuous 2022 during which it lost the top spot among Europe’s stock markets, London got hit this year by an exodus of companies — including Arm, a crown jewel in Britain’s technology industry — which have decided to ditch local listings in favor of the US. Firms including CRH Plc, one of Europe’s largest building materials producers, see capital markets across the Atlantic as more attractive.

The MSCI UK share index trades at a record 47% discount to its US counterpart, based on forward price-to-earnings ratios.

“I think it’s further indication of the valuation discount prevalent in the UK IPO market,” said Janet Mui, head of market analysis at RBC Brewin Dolphin. “Companies listed in the US are perceived to have a premium over those listed in the UK.”

‘Extremely Cautious’

WE Soda’s decision is ominous for flagging IPOs in the UK. It also sets back efforts to transform what is widely perceived to be a dinosaur equity market that’s overly reliant on old economy sectors such as oil and banks. Coming at a time of stalling economic growth, it could mean more money leaving domestic equity funds after record outflows of $26.3 billion last year.

What’s more, UK pension funds have also been drastically cutting their exposure to equities in their home market over the past 25 years, sucking out a whopping £400 billion of demand, according to a March report.

WE Soda, backed by Turkish industrial conglomerate Ciner Group, is one of the lowest-cost producers of a key material that’s used in glassmaking and in electric car batteries. Ciner Group operates the BloombergHT television channel in Turkey under a deal with Bloomberg LP, the parent of Bloomberg News.

The focus now shifts to pending London share swales, with cross-border payments firm CAB Payments Holdings Ltd. announcing its listing plan last week.

--With assistance from Michael Msika and Joe Easton.

(Updates to add background, comments)