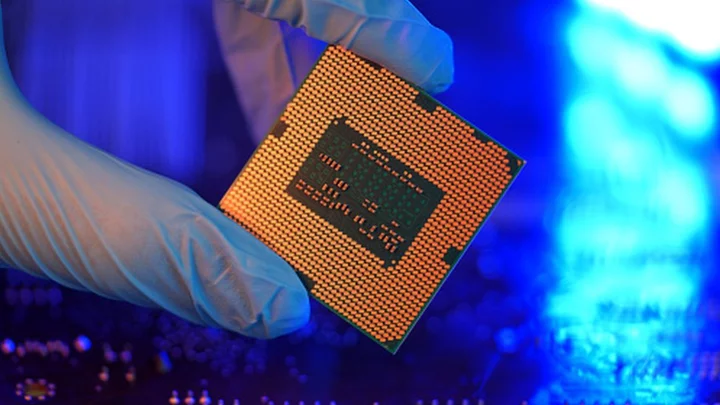

Semiconductors: Can India become a global chip powerhouse?

India has ambitious plans for semiconductor manufacturing, but there are challenges along the way.

2023-07-27 05:57

Meta earnings beat market expectations as ads revive

Facebook parent Meta on Wednesday beat market expectations for quarterly earnings powered by a reviving...

2023-07-27 05:24

Billionaire whose family trust owns Spurs denies insider trading – reports

British billionaire Joe Lewis – whose family trust owns Tottenham – has been bailed by a judge in New York after pleading not guilty to charges of giving insider trading tips, according to reports. The 86-year-old, who faces 16 counts of securities fraud and three counts of conspiracy, appeared at an arraignment hearing at Manhattan Federal Court on Wednesday. After entering a not guilty plea Lewis was released on a bail of 300 million US dollars (£230m), reportedly secured by a yacht and private aircraft equivalent to that amount. Lewis, and two of his pilots who are also facing charges, must remain in the United States. Prosecutors say Lewis, who was arrested on Wednesday morning, is alleged to have used his access to confidential information to provide stock tips to individuals close to him, with the indictment referring to one girlfriend having made 849,000 US dollars (£657,000) on one of those tip-offs. Lewis’ legal counsel David Zornow, from the Skadden, Arps, Slate, Meagher & Flom firm, said: “The government has made an egregious error in judgment in charging Mr Lewis, an 86-year-old man of impeccable integrity and prodigious accomplishment. “Mr Lewis has come to the US voluntarily to answer these ill-conceived charges, and we will defend him vigorously in court.” Each of the first 13 counts of securities fraud carries a maximum sentence of 20 years in prison, Manhattan prosecutors said in a statement issued on Wednesday. The US Attorney for the Southern District of New York, Damian Williams, announced on Tuesday that Lewis had been indicted over a “brazen insider trading scheme”. Prosecutors said Lewis, by virtue of his investments in certain companies, received material and non-public information about these companies. A release from prosecutors on Wednesday alleged Lewis had “misused and misappropriated this confidential information to provide stock tips to various individuals in his life, including his employees, romantic partners, and friends, as a way to provide them with compensation and gifts”. It added: “These individuals, in turn, traded on the tips provided by Lewis for vast personal gain.” Lewis bought a controlling stake in Spurs in 2001 for £22million. He officially ceded control of the club last year, with Bahamian lawyer Bryan A Glinton replacing him as a director according to Companies House. His stake in the club – which he held through the ENIC Group alongside Daniel Levy – was formally handed to a family trust last year. Family members of Lewis remain beneficiaries of the trust. PA understands the Premier League does not consider Lewis as a person with control at Tottenham, and is therefore not subject to its owners’ and directors’ test. A Tottenham spokesperson said: “This is a legal matter unconnected with the club and as such we have no comment.” US prosecutors said Lewis is also alleged to have falsely disclosed the extent of his ownership shares in a pharmaceutical company, Mirati, “through an elaborate array of shell companies and other entities, including an offshore trust purportedly for the benefit of his granddaughter”. As a result of this alleged false disclosure, prosecutors said he was able to exercise warrants in Mirati that he would otherwise not have been able to exercise, “at vast financial gain”. Also charged were Patrick O’Connor and Bryan Waugh, two pilots employed by Lewis to fly his private aircraft. In one instance, it is alleged Lewis loaned each of them 500,000 US dollars (more than £387,000) to buy shares in a company before it publicly announced favourable information about some clinical results. This type of behaviour - blatant disregard for the law - is not only illegal but undermines the integrity of our financial markets. Christie M Curtis, FBI Federal Bureau of Investigation (FBI) acting assistant director in charge Christie M Curtis said: “As alleged, Mr Lewis treated material, non-public information at his disposal as though it was something he could give his friends and associates for their benefit. “This type of behaviour – blatant disregard for the law – is not only illegal but undermines the integrity of our financial markets. “The FBI is determined to ensure that anyone willing to perpetrate insider trading schemes is held accountable in the United States criminal justice system.” Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Kylian Mbappe reportedly turns down chance to discuss move to Al Hilal Sussex head coach Paul Farbrace says Jofra Archer is ‘on course’ for World Cup Tom Latham and Will Jacks both make 99 as Surrey build lead over Somerset

2023-07-27 04:47

Facebook parent Meta forecasts quarterly revenue above estimates

By Katie Paul and Yuvraj Malik (Reuters) -Meta Platforms forecast third-quarter revenue above market expectations on Wednesday, sending shares up

2023-07-27 04:22

New Gap chief executive boosted Barbie as Mattel president

US clothing chain Gap announced Wednesday that it tapped as its next CEO Richard Dickson, the current Mattel president who has...

2023-07-27 03:58

Canada: Prime Minister holds major cabinet shakeup

In seeking a fourth term, Justin Trudeau has overhauled his team ahead of Canada's next election.

2023-07-27 03:16

Coca-Cola eyes more price hikes in emerging markets

Coca-Cola lifted its full-year earnings targets Wednesday after second-quarter results topped estimates as it described plans to limit additional price hikes to emerging markets...

2023-07-27 02:56

U.S. House spending bill clears procedural hurdle in party-line vote

WASHINGTON The first of 12 fiscal 2024 spending bills overcame a procedural hurdle in the Republican-controlled U.S. House

2023-07-27 02:23

Bank of Canada discussed delaying rate hike at last meeting - minutes

By Steve Scherer and David Ljunggren OTTAWA, July 26 The Bank of Canada discussed delaying a hike to

2023-07-27 01:50

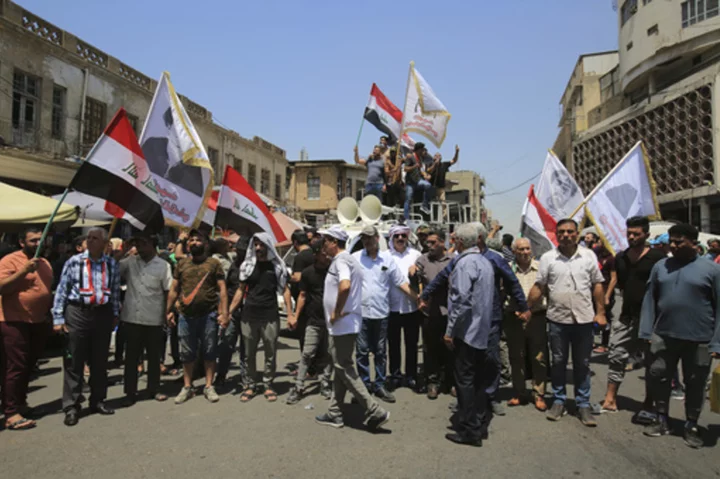

Bank owners and citizens protest deterioration of the Iraqi dinar following US ban on Iraqi banks

Dozens of people have protested in front of the Central Bank of Iraq in Baghdad and bank owners called for official action to stem a sharp increase in the dollar exchange rate

2023-07-27 01:50

New SEC rule requires public companies to disclose cybersecurity breaches in 4 days

The Securities and Exchange Commission has adopted rules to require public companies to disclose within four days all cybersecurity breaches that could affect their bottom lines

2023-07-27 01:28

Consumer goods makers flex pricing power in second quarter

By Richa Naidu and Chandini Monnappa (Reuters) -Consumer products giants including Unilever, Coca-Cola and Reckitt have shown they can raise

2023-07-27 01:26

You Might Like...

Deutsche Bank to pay $75 mn in Epstein victim settlement: report

Save 86% on a lifetime license to Microsoft Office Professional for Windows

Julz Dunne teases fans with Olivia Dunne and Angel Reese's Sports Illustrated magazine cover on IG

Germany's Scholz praises auto industry amid protests, announces EV expansion law

Rita Ora spent almost two years working on Primark collection

Amazon Prime Members Get Another Free Year of Grubhub+ Food Delivery

US oil giant Chevron to buy rival Hess for $53 bn

Trial of disgraced crypto star Bankman-Fried begins