Elon Musk is getting more firepower for his electric-vehicle price war thanks to President Joe Biden’s signature climate legislation.

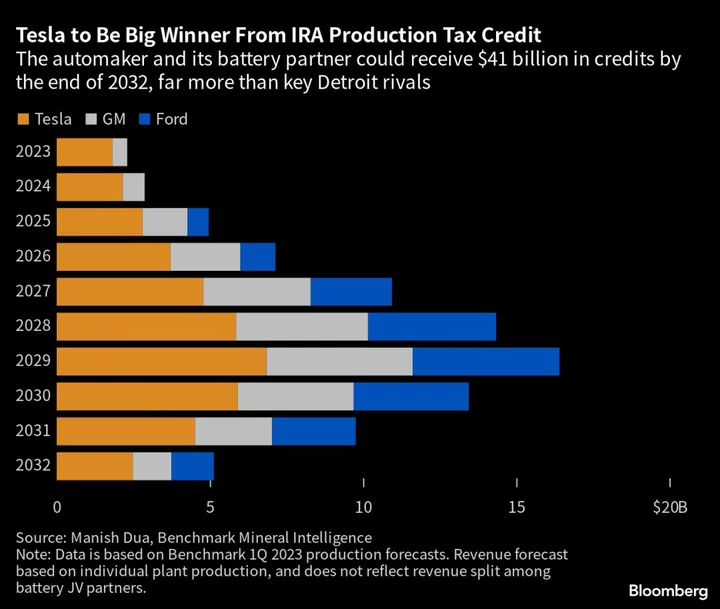

Tesla Inc. and its battery partner are poised to receive about $1.8 billion in production tax credits this year under the Inflation Reduction Act, according to forecasts from researcher Benchmark Mineral Intelligence – a windfall that far exceeds an estimated $480 million haul for General Motors Co. and LG Energy Solution. Another rival, Ford Motor Co., won’t begin to reap any benefits from the law’s battery manufacturing credits until 2025.

The disparity reflects the design of the law, which gives hefty incentives to battery suppliers and automakers that produce in the US, and, crucially, rewards scale: The more batteries and EVs a company makes stateside, the more money it gets via tax credits.

And Tesla – which broke ground nearly a decade ago on a Nevada battery plant it operates with Panasonic Holdings Corp. – is far ahead of the legacy automakers in churning out products eligible for the largesse.

“We’re pretty well-positioned over the coming years to take advantage of this,” Zachary Kirkhorn, Tesla’s CFO, told investors in January.

Tesla has said it expects to use the money from the credit to keep slashing prices for consumers, part of a strategy to sacrifice short-term profit margins to boost sales volumes against a backdrop of inflation and greater competition. Musk’s pricing crusade creates pressure for incumbent automakers like GM and Ford to follow suit, adding to the extraordinary profitability challenges the old guard already faces in electrifying their lineups.

Read More: Musk Bets the House of Tesla on Low Prices

Tesla’s average selling price could fall by $125 a unit every quarter for the next two years, without impacting margins, because of the production tax credits, estimates Piper Sandler analyst Alexander Potter.

Even Musk has nodded at the law’s enormous potential reward. In a recent interview with CNBC, he called the credits “helpful” and said the IRA was a “very well-written” bill.

The outsize benefit Tesla reaps from the law makes for an inconvenient political reality for Musk: His company has gained an advantage from the key policy achievement of a president he has derided as a “damp sock puppet.”

First-Mover Advantage

In the immediate wake of the IRA’s passage, the industry and analysts focused largely on how the law’s EV tax credits for consumers might reshape the market. Now, it’s sinking in that the production credits are the real prize — especially for Tesla, given that it already has commanding share of the market.

The incentives — which cover many aspects of the EV supply chain, from mining and processing raw materials like lithium to making batteries in the US — allow Tesla to build on its first-mover advantage. In addition to the battery factory near Reno, Nevada, that it jointly operates with Panasonic, Tesla is ramping production of its own battery plant in Austin and broke ground on a lithium refinery in Corpus Christi, Texas, in early May.

Read More: Tesla Invests $3.6 Billion in Nevada Battery, Truck Capacity

GM and Ford, meanwhile, are making massive investments to produce batteries in the US, but it will take years for their domestic output to match Tesla’s. GM’s battery joint venture with LG in Ohio has already started making batteries, and it has two other plants with LG in Tennessee and Michigan that will come online in 2024 and 2025, respectively. It’s also planning a new US plant with Samsung SDI.

Ford and its battery joint-venture partner SK Innovation are setting up three battery plants across Tennessee and Kentucky, and the company will own 100% of a Michigan battery plant that licenses technology from China’s Contemporary Amperex Technology Co., but production will not begin until 2026.

“Tesla will generate more benefit from the IRA than anyone else because they are already making batteries in high volumes,” said Austin Devaney, the chief commercial officer of Piedmont Lithium Inc., which has supply agreements with Tesla and battery maker LG.

In the time since the bill passed in August, competitors have gotten a clearer sense of what Musk will do with the spoils. In January, Tesla lowered prices across its lineup, and has regularly tweaked them since then based on ordering trends.

Kirkhorn told investors earlier this year that executives “want to use these incentives to improve affordability.”

‘Dog Fight’

The manufacturing tax credit in the IRA, known in policy circles as “Section 45X,” is part of an effort to decarbonize the economy by drastically reducing the cost of batteries for both EVs and the nation’s electric grid while also building a robust domestic supply chain that doesn’t depend on China.

It provides $45 per kilowatt-hour (kWh) for battery packs made in the US: $35 per kWh for the battery cells, and $10 per kWh for the battery modules. Most EVs in the US have 60 kWh to 100 kWh batteries. That translates to tax credits of roughly $2,700 to $4,500 per vehicle.

It’s difficult to estimate exactly how much Tesla, or any automaker or battery manufacturer, will receive in tax credits for 2023 and beyond because the figure depends on how many EVs are sold with US-made batteries. The Treasury Department has yet to release its final rules on 45X, which are expected later this year.

The reimbursement also depends on revenue-split arrangements between companies, especially in joint ventures like GM’s Ultium JV with LG, or Ford’s partnership with SK Innovation. The companies typically don’t disclose such terms, and the bonanza of IRA dollars is likely to lead to renegotiations of supply agreements between automakers and battery companies.

These variables may explain why Tesla’s own expectation for its haul from the credits is lower than the one by Benchmark Minerals, which includes Panasonic’s share of the credits. Production forecasts may also vary. Kirkhorn said in January that Tesla expects the manufacturing tax credit in the IRA could mean $150 million to $250 million per quarter for the company in 2023, or up to $1 billion for the year.

GM said it expects to earn $300 million in tax credits this year, and aims to build 1 million EVs a year by 2025, which would yield between $3.5 billion and $5.5 billion if all of its production is sold out.

Ford declined to provide an estimate for what it will receive in credits, but said in an emailed statement it plans for annual production run rates of 600,000 EVs globally by the end of this year and 2 million by the end of 2026.

The production credit begins to phase out in 2030, so there’s urgency to get battery plants up and running quickly. As more car companies receive the credits in higher volumes, the profusion of new EV models will intensify the price war, said Sam Abuelsamid, a Guidehouse Insights analyst based in Ypsilanti, Michigan.

“The next three to five years are going to be tough for everybody in the industry, and it’s going to be a dog fight,” he said.

Automakers will have to figure out how to compete on price without discounting their products so much that it tarnishes their brand.

The IRA could one day come on the political chopping block, particularly if Biden does not win reelection. House Republicans have attacked its price tag, which Goldman Sachs Group Inc. says could reach $1.2 trillion — triple the government’s estimate.

“It’s a real risk. People are not giving it 100% likelihood to survive,” said Mark Wakefield, head of the automotive practice at consultant AlixPartners.

For now, though, the credits give Tesla room to try to bolster consumer demand. Potter, the Piper Sandler analyst, wrote in a research note that the automaker’s sticker prices can “march steadily lower thanks to Uncle Sam.”

--With assistance from David Welch.