Mexico halted its steepest-ever series of interest rate rises and promised to keep them stable for an extended period after inflation slowed sharply and the peso rallied to a seven-year high.

The central bank held its key rate at 11.25% on Thursday, the first board meeting in two years where policymakers didn’t raise borrowing costs. The unanimous decision was in line with expectations.

“The inflation outlook will be complicated and uncertain during the policy horizon, with upside risks,” policymakers wrote in a statement accompanying their decision. “It will be necessary to keep the key rate at its current level for a prolongued period” in order to bring inflation to the target.

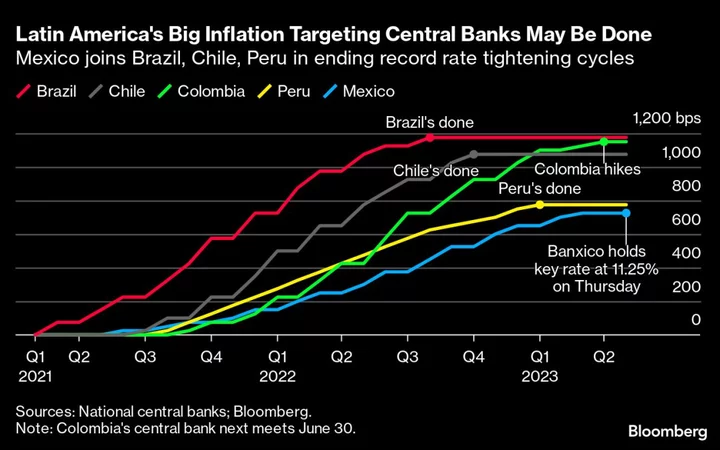

Brazil, Peru and Chile have already halted monetary tightening, and Colombia is forecast to follow suit next month. Investors are now trying to gauge when Latin America’s major economies will start to cut interest rates as inflationary pressures and economic growth cool across the region.

Mexico’s annual inflation slowed to an 18-month low of 6.25% last month, which is still more than double the 3% target.

The central bank’s battle to tame inflation was helped by the peso, which has been the top performer in emerging markets this year. This month, the currency reached 17.43 per dollar, its strongest level since 2016, as investors were attracted by Mexico’s high interest rates.

Read more: Mexican Peso Will Remain the EM Carry Trade à La Mode

“The disinflation process will be slow, but inflation has surprisingly been heading downward for several months, and that has helped lower inflation expectations,” said Pamela Diaz Loubet, Mexico economist at BNP Paribas.

Before Thursday’s decision, Banxico had increased its key rate 725 basis points over a record 15 straight hikes starting in June 2021. Borrowing costs are now higher than at any time since the central bank started targeting inflation in 2008.

Growth Outlook

Mexican economic growth was stronger than expected in the first quarter, helped by strong demand from the US. In March, exports reached an all-time high of $53.6 billion.

But with a likely slowdown in the world’s largest economy, Mexico’s growth is also forecast to cool.

Mexico’s economy will expand 1.8% this year, from 3.1% in 2022, according to an estimate by the International Monetary Fund. That would be faster growth than in Brazil, Colombia and Chile, though slower than Peru’s, according to the IMF.

--With assistance from Rafael Gayol and Robert Jameson.

(Updates with comment from central bank statement in third paragraph.)