Global stocks were mixed Tuesday ahead of a Federal Reserve decision as oil prices reached fresh multi-month peaks before pulling back.

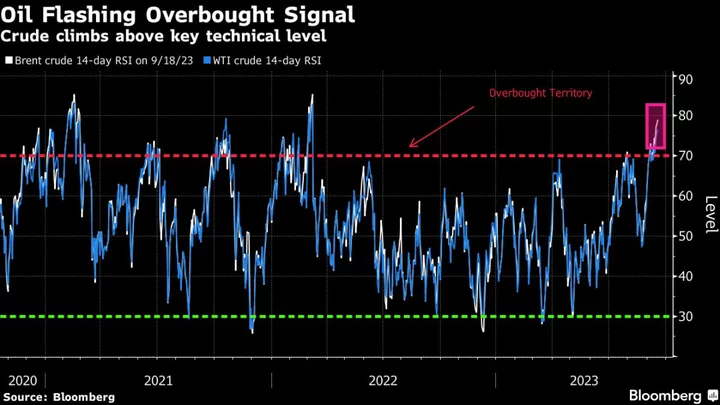

Brent North Sea crude oil traded above $95 per barrel Tuesday for the first time since November last year, supported by recent production cutbacks announced by Saudi Arabia and Russia.

But crude prices retreated later in the day, finishing the session modestly lower amid concerns about demand.

The dip in oil prices coincided with a modest bounce in US equities. Major indices concluded the day lower, but ended well above session lows, with the S&P 500 losing 0.2 percent.

The Fed is widely expected on Wednesday to keep interest rates unchanged, but markets are focused on the risk of additional interest rate hikes later in 2023.

"Investors remain on edge about policymakers' economic and interest rate projections," said a note from Charles Schwab that pointed to "narrow, choppy trading typical of the days approaching a Federal Reserve interest rate decision."

The Bank of England and Bank of Japan also announce monetary policy decisions this week, along with peers in Norway, Sweden and Switzerland.

"In a classic case of calm before the storm, investors have seemingly taken a wait-and-see mode ahead of the Fed, BoE and BoJ meetings," said Rodrigo Catril at National Australia Bank.

In Asian trading, Hong Kong managed a gain while Shanghai was flat.

Europe's main markets ended the day mixed, with London and Paris stocks just scraping into positive territory.

The Organization for Economic Co-operation and Development raised its global economic outlook for 2023 but cut the growth forecast for next year as "painful" interest-rate hikes aimed at curbing inflation take their toll.

The world economy is expected to grow 3.0 percent this year, up from the 2.7 percent forecast in the June outlook of the OECD.

Official data Tuesday showed eurozone inflation slowed slightly in August.

Consumer prices in the 20-country single currency area fell to 5.2 percent in August from 5.3 percent in July, according to Eurostat.

"The battle against inflation still hasn't been won, and there will be fresh skirmishes ahead especially if recent disinflationary forces ease off," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

- Key figures around 2030 GMT -

New York - Dow: DOWN 0.3 percent at 34,517.73 (close)

New York - S&P 500: DOWN 0.2 percent at 4,443.95 (close)

New York - Nasdaq: DOWN 0.2 percent at 13,678.19 (close)

London - FTSE 100: UP 0.1 percent at 7,660.20 (close)

Frankfurt - DAX: DOWN 0.4 percent at 15,664.48 (close)

Paris - CAC 40: UP 0.1 percent at 7,282.12 (close)

EURO STOXX 50: DOWN 0.1 percent at 4,242.70 (close)

Tokyo - Nikkei 225: DOWN 0.9 percent at 33,242.59 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 17,997.17 (close)

Shanghai - Composite: FLAT at 3,124.96 (close)

Euro/dollar: DOWN at $1.0681 from $1.0692 on Monday

Pound/dollar: UP at $1.2393 from $1.2383

Dollar/yen: UP at 147.86 yen from 147.61 yen

Euro/pound: DOWN at 86.17 pence from 86.34 pence

Brent North Sea crude: DOWN 0.1 percent at $94.34 per barrel

West Texas Intermediate: DOWN 0.3 percent at $91.20 per barrel

burs-jmb/caw