Asian stocks are poised for a mixed opening, reflecting Wall Street’s cautious start to a week with rate decisions by major central banks that will likely set the tone for global markets for the rest of the year.

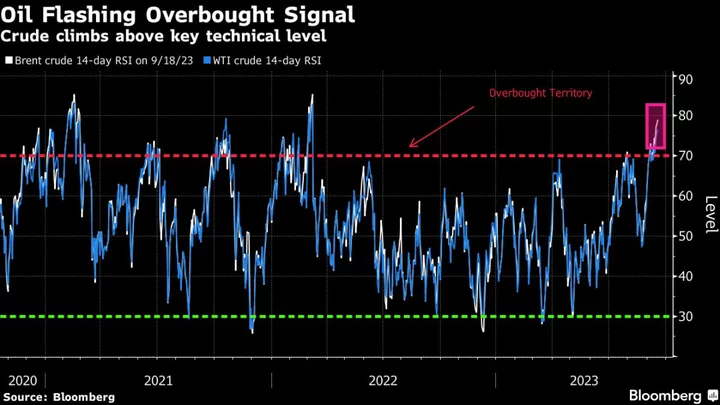

Futures in Japan and Australia point to marginal declines, while Hong Kong shares may edge higher. Stocks, bonds and the dollar saw small moves on Monday, with the S&P 500 closing near 4,450. Brent oil pared gains after almost hitting $95 a barrel earlier in the session in a move that added to inflation concerns.

Apple Inc. climbed, while Tesla Inc. dropped as Goldman Sachs Group Inc. lowered its earnings estimates for the electric-vehicle giant. Treasury 10-year yields edged lower and those on two-year notes remained above 5%. Grocery delivery business Instacart became one of the biggest companies to go public this year when its priced its initial public offering at the top of a marketed range in the second marquee listing in a week.

Read: Powell & Co. Risk Wage-Price Spiral as Labor Fumes: Surveillance

While investors on Tuesday will study the tone of the Reserve Bank of Australia’s minutes from its September policy meeting for fresh clues on its inflation fight, monetary policy will be determined at key meetings across half of the Group of 20 from Wednesday with the Federal Reserve. Advanced-economy central banks may draw particular focus as global policymakers adapt to the theme US officials set out at Jackson Hole in August: Rates will likely stay higher for longer.

With the Fed widely expected to keep rates on hold this week, traders will be focused on the so-called dot plot summary of economic forecasts. The two main questions are whether policymakers will retain their projections for one more 25 basis-point hike by year-end — and how much easing they are penciling in for 2024. In June, they projected 1 percentage point of cuts.

“We think the Fed will take a ‘hawkish pause’ this week and the futures market will reprice a higher probability for another rate hike before year end,” said Megan Horneman, chief investment officer at Verdence Capital Advisors. “Unfortunately, inflation is very easy to reignite especially if energy prices begin to filter into broad prices. Therefore, we think the Fed will need to insinuate they may not be done raising rates.”

The Fed will probably continue to sound hawkish, with one remaining hike still penciled in for 2023 and the prospect of very slow easing, according to David Kelly, chief global strategist at JPMorgan Asset Management. Still, while policymakers may plan for a gentle drop in rates, there’s risk of an economic downturn that would trigger much more rapid easing, he noted.

“It makes sense to be well diversified, with a relatively defensive position across equities and extending duration in within fixed income, as the risk of an economic stumble grows on the descent from the mountain of monetary tightening, Kelly added.

Read: Morgan Stanley’s Wilson Says Clients See Tough 2024 for Stocks

To Paul Nolte at Murphy & Sylvest Wealth Management, the two weakest months of the year are living up to expectations and following the typical pattern.

“That playbook would argue for further weakness into mid/late October before a year-end rally,” Nolte added. “Much of the rally is on the back of expectations that earnings will rise this quarter. Those higher earnings typically push stocks higher, but much of the market is already richly priced on a historical basis, so there may not be much room to push.”

Meanwhile, oil’s ascent into overbought territory leaves the market vulnerable to a correction. Earlier in the session, crude dropped more than $1 after Saudi Aramco CEO Amin Nasser lowered the company’s long-term demand outlook and Saudi Energy Minister Prince Abdulaziz bin Salman said “the jury is still out” on China consumption.

China remains in the spotlight, with its central bank Governor Pan Gongsheng vowing on Monday at a symposium attended by representatives from companies including JPMorgan Chase & Co. and Tesla Inc. that it will strengthen efforts to stabilize trade and improve the business environment for foreign firms. Meanwhile, Treasury Secretary Janet Yellen said in New York that the trade relationship between the US and China is a “win-win” and it would disastrous for the two largest economies to decouple.

Corporate Highlights

- Arm Holdings Plc fell after Bernstein started coverage on the newly public chip designer with an underperform rating, suggesting it may not be the beneficiary of artificial intelligence that some investors expect.

- Nikola Corp. climbed after the company appointed former General Motors Co. president Mary Chan as its new chief operating officer.

- Micron Technology Inc. rose after the chipmaker was raised to buy from hold at Deutsche Bank AG, with the broker noting that prices for DRAM chips have started to improve faster than expected.

- Walt Disney Co. has held preliminary talks with potential buyers for its India streaming and television business including billionaire Mukesh Ambani’s Reliance Industries Ltd., according to people familiar with the matter.

- Amazon.com Inc. is hiring Microsoft Corp.’s product chief to run the division responsible for the voice-activated Alexa assistant and Echo smart speakers, according to people familiar with the situation.

Key events this week:

- This week, Ukrainian President Volodymyr Zelenskiy is expected to meet with Joe Biden at the White House, attend United Nations General Assembly in New York.

- Reserve Bank of Australia issues minutes of September policy meeting, Tuesday

- OECD releases interim economic outlook report on the global economy, Tuesday

- Eurozone CPI, Tuesday

- Bloomberg Future of Finance Conference in Frankfurt, with speakers to include German Finance Minister Christian Lindner, Tuesday

- US housing starts, Tuesday

- Japan trade, Wednesday

- China loan prime rates, Wednesday

- UK CPI, Wednesday

- Federal Reserve policy meeting followed by Fed Chair Jerome Powell’s news conference, Wednesday

- Bank of Canada issues summary of September’s policy meeting, Wednesday

- Eurozone consumer confidence, Thursday

- Bank of England policy meeting, Thursday

- US leading index, initial jobless claims, existing home sales, Thursday

- China’s Bund Summit, Friday

- Japan CPI, PMIs, Friday

- Bank of Japan rate decision, Friday

- Eurozone S&P Global Eurozone PMIs, Friday

- US S&P Global Manufacturing PMI, Friday

Some of the main moves in markets:

Stocks

- S&P futures were little changed as of 8:01 a.m. Tokyo time. The S&P 500 closed little changed in New York

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.2%

- Hang Seng futures rose 0.1%

- Australia’s S&P/ASX futures fell 0.3%

- Nikkei 225 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0692

- The yen was little changed at 147.62 per dollar

- The offshore yuan was little changed at 7.2923 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $26,868.99

- Ether rose 0.3% to $1,641.81

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.30%

- Australia’s 10-year yield declined two basis points to 4.19%

Commodities

- West Texas Intermediate crude rose 0.8% to $92.25 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.