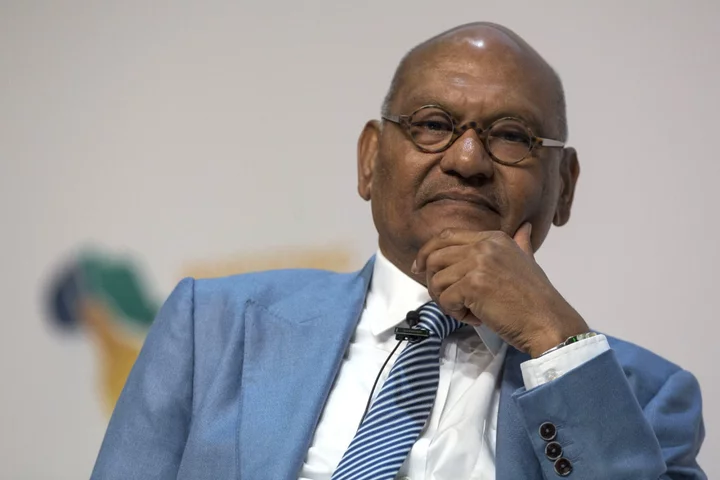

Singapore’s monetary policy “remains appropriately tight,” according to the city state’s central bank chief Ravi Menon who signaled that authorities aren’t necessarily under pressure to do more even as regional peers turn hawkish.

Policymakers in the Philippines and Indonesia this month delivered surprise rate hikes to prop up their currencies and stem inflationary pressures. Goldman Sachs Group Inc. economists expect the two Southeast Asian nations to take the rates higher.

Unlike most central banks that rely on interest rates to manage inflation, trade-reliant Singapore uses the exchange rate. The Monetary Authority of Singapore kept monetary settings unchanged earlier this month and maintained the appreciating path of its exchange rate at its twice-yearly reviews in 2023. It will announce policy decisions quarterly from 2024.

“That’s the beauty of the trade-weighted exchange rate,” the MAS managing director said in an Oct. 27 interview when asked whether he sees the need for Singapore to tighten policy further. “It’s regardless of how other countries’ exchange rates move.”

Keeping it on an appreciating path means it is continuing to strengthen against other currencies and lowering imported inflation, exerting a restraining effect on the economy, Menon told Bloomberg Television’s Haslinda Amin.

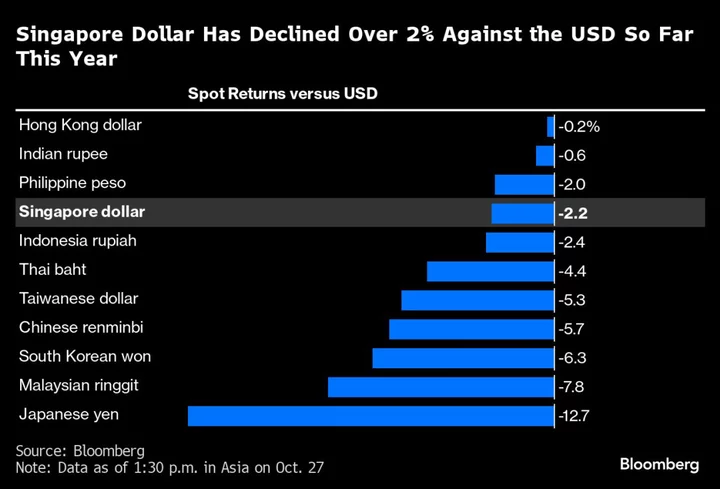

While the Singapore currency has declined against the dollar this year on a spot return basis, it has strengthened against seven of 10 larger peers in Asia including the Malaysian ringgit and yuan.

Menon, who is stepping down as MAS chief after 12 years and retiring from public service on Dec. 31, stressed that the more frequent policy announcement doesn’t mean more frequent tweaks. The central bank, which made two unscheduled moves in 2022, is still keeping to its medium-term orientation, he said.

Markets understand that sometimes central banks have to adjust policy out of cycle, Menon said. But if it happens too frequently then it creates “apprehension,” he added.

Singapore’s monetary policy “remains appropriately tight” with the MAS’s closely-watched core inflation gauge expected to hit 2.5% to 3% at the year end, he said. “So it’s mission not accomplished yet, but it’s on track.”

Menon, 59, started at the central bank in 1987. He didn’t disclose his post-MAS plans.

Singapore’s inflation cooled to an 18-month low in September and the economy did better than forecast in the third quarter. Still, declining exports are a worry.

The MAS was among the first to start tightening policy in the region in October 2021 to tame inflation even before price gains became pronounced. The rapid pace of price increases sparked by the post-pandemic reopening and exacerbated by the war in Ukraine caught policymakers and economists by surprise, Menon said.

“Nobody saw this coming,” he said. “In forecasting, you will never get it right all the time.” Generally, central banks have also done a decent job of managing price pressures and economic growth, he added.

Menon is optimistic the broader economic spillovers from the conflict in the Middle East will be limited, as long as it doesn’t develop into something more serious.

“Many of us, including myself, thought that as central banks tightened monetary policy — and this is the most rapid pace of tightening in decades — that economies would necessarily have to tip into recession in order to purge out price pressures,” Menon said.

“At least now, we can imagine a pathway to lower inflation without necessarily having a recession,” he said, which authorities were less sure about a year ago.

--With assistance from Low De Wei, Suvashree Ghosh, Haslinda Amin, Richard Lewis and Paul Dobson.