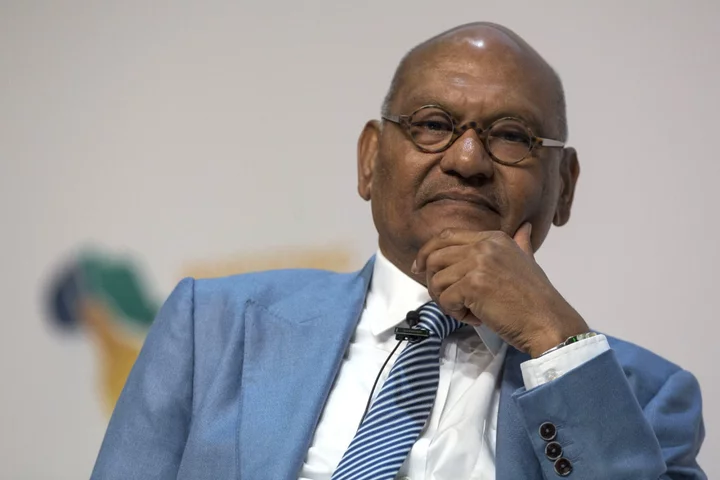

Shares in Anil Agarwal’s Vedanta Ltd. rose Tuesday, the first trading day after the Indian tycoon announced an overhaul of his sprawling metals-to-oil empire, although concerns over a multibillion dollar debt burden remain.

The stock climbed as much as 5% in Mumbai, before paring gains to trade up 4.3% as of 11:12 a.m. local time. Hindustan Zinc Ltd. fell 0.6%, while Sterlite Technologies Ltd. dipped 0.5%. Both Hindustan Zinc and Vedanta had surged on Friday, ahead of the group’s announcement on its split.

At least four brokers including CLSA and IIFL have upgraded Vedanta’s rating since Friday’s news.

“The demerger might help in the long term,” Sameer Kalra, founder of Target Investing in Mumbai, said. “But in the near term, the debt repayment and restructuring are the main issues. If they continue to face problems, then the next couple of quarters will be very difficult to navigate.”

If successful, the plan announced late last week will see Vedanta Ltd. splitting into six listed entities: aluminum; base metals; power; steel and ferrous materials; oil and gas; and an incubator for new businesses including semiconductors. The shake-up could pave the way for the group to bring in new investors, improve the valuation of its component parts and even sell all or part of some assets to reduce its debt load.

Vedanta’s cash-generating Hindustan Zinc unit said separately that it would split into three entities, consisting of zinc and lead, silver, and recycling — with similar ambitions.

The restructuring is likely to take some time, given it will require require regulatory, shareholder and government approval. In the meantime, Agarwal’s headaches will continue. Vedanta Resources, parent of Vedanta Ltd., has $2 billion of bond repayments due in 2024 and another $1.2 billion in 2025.

Vedanta has said it expects to complete the demerger in the financial year ending March 2025.

Centrum Broking Ltd. analyst Kunal Kothari said the demerger would not offer a quick fix: “It has insufficient revenues and hence the likely course of action is refinancing or stake sale in subsidiaries,” he said in a note.

Vedanta has yet to provide details on how exactly the group’s debt will be distributed under the new structure, or how shares currently being used to secure debt will be treated. According to stock exchange data, the group has pledged virtually all of its majority holding in both Vedanta Ltd. and Hindustan Zinc Ltd.

Deven Choksey, managing director of brokerage KRChoksey Shares & Securities Pvt., said the demerger did solve some issues for the company and could help appease some lenders — but options remained limited.

“The cash generating businesses cannot be sold, so the only choice is to sell those that are consuming higher amount of capital, such as steel, iron ore, and power,” he said by phone from Mumbai.