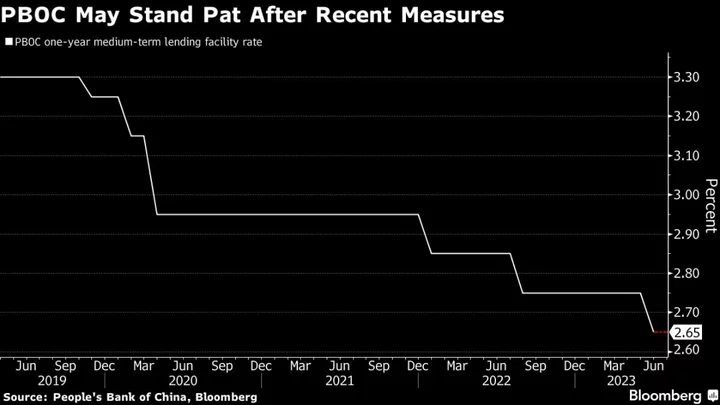

China will likely keep a key borrowing rate unchanged next week as it assesses the impact of its rate cuts last month as well as the recent support measures to bolster the property sector.

The People’s Bank of China will keep the interest rate on its medium-term policy loans unchanged at 2.65%, according to all 10 analysts surveyed by Bloomberg. That’s after it slashed that rate last month for the first time since August while also lowering short-term borrowing rates.

The urgency for a rate cut this month has abated after banks sped up loans to clients last in June — a sign that the economy may be picking up. Regulators have also stepped up pressure on banks to ease terms for property firms by encouraging negotiations to extend outstanding loans. Moreover, the PBOC has never cut the rate on the so-called medium lending facility, or MLF, for two straight months.

“The stronger than expected credit data in June indicates that the previous rate cuts in June have been effective, affording the PBOC more time to adopt a wait-and-see strategy,” Tommy Xie, an economist at Oversea-Chinese Banking Corp. “In the current context, monetary policy alone isn’t a panacea. Without fiscal policy support, the risk-reward balance for outright interest rate reductions might not be that appealing.”

China’s yield curve steepened in July as the PBOC’s easing bias weighed on short-term yields while expectations of more fiscal stimulus to support the economy kept long-term rates elevated. The gap between the nation’s one and 10-year yields grew to over 80 basis points this month, the most since November.

“Monetary easing may have to continue but may do little to address the current difficulty of spurring consumption and investment, while fiscal stimulus may be more paced,” said Stephen Chiu, a Bloomberg Intelligence strategist.

The PBOC may still show its support to the market on Monday while keeping the MLF rate unchanged. The “PBOC may make some net injection to show its easing bias,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd. He expects the central bank to add more than the 100 billion yuan ($14 billion) coming due.

--With assistance from Wenjin Lv.