Clued-in investors big and small are bidding up stocks, a fresh sign of confidence that November’s impressive equity rally has room to run.

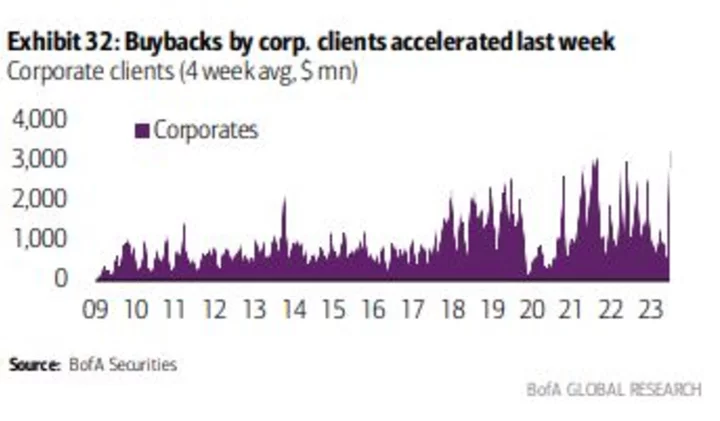

In a month where $5 trillion has been added to share values, Goldman Sachs Group Inc.’s corporate clients showed a “big tick up” in repurchase activity. Same thing at the buyback desk at Bank of America Corp., which just had the busiest week of execution orders in the firm’s data history.

The people in charge of the businesses are in buying mode, too. Corporate executives and officers have snapped up shares of their own firms in November, with the ratio of buyers to sellers set to touch a six-month high, according to data compiled by the Washington Service.

The splurge comes as stocks recover from their worst retreat of the year, with a rally underpinned by growing expectations that the Federal Reserve will halt its rate-hike campaign as inflation cools. While skeptics point to the threat of a 2024 recession, corporate insiders have a strong track record in timing the market in recent years.

“We could see insiders buying into the bull case of inflation down, rate hikes over, mission accomplished. Insiders want to take more ownership of that message and they are willing to pony up real money to do so,” said Mike Bailey, director of research at FBB Capital Partners. “That is a double-barreled sign of optimism, with companies and individual executives buying back their stock.”

As of Monday, almost 900 corporate insiders have purchased their own stock in November, more than double the previous month. While the number of sellers also rose, the pace of increases was smaller. As a result, the buy-sell ratio jumped to 0.54, the highest level since May.

The buying impetus pales next to March 2020, when insider buyers outnumbered sellers by a ratio of 2-to-1 at the exact bottom of the pandemic crash. Still, the bullish stance is a departure from July, when stocks climbed and insiders rushed to dump stocks. That exit proved prescient as the S&P 500 sank 10% over the following three months.

Newfound vigor among business leaders echoes burgeoning bullishness elsewhere. From retail investors to big-money managers, bearish wagers are being unwound and fear of missing out is driving the S&P 500 toward one of its best Novembers in history. At Barclays Plc, strategists including Venu Krishna just raised their 2024 price target for the index by 300 points to 4,800.

The benchmark gauge was little changed at 4,551 as of 2:40 p.m. in New York after climbing more than 8% this month.

After refraining from buybacks earlier this year, American firms are now embracing them. Repurchases among BofA’s clients have stayed above seasonal levels for three weeks in a row, including one in which a record $4.8 billion was bought, according to data compiled by the firm’s strategists including Jill Carey Hall and Savita Subramanian.

Corporate buybacks will likely be running at $5 billion a day until the market enters an earnings-related blackout on Dec. 8, according to Scott Rubner, a managing director at Goldman, who has studied the flow of funds for two decades. Once the blackout window opens, the flow may drop by 35%, he estimates.

That may set the stage for choppy trading in the short term, especially after fast-money managers such as trend followers boosted stock holdings, making them more inclined to trim exposure should things go sour, Rubner warns.

“Corporate demand will start to fade next week,” the Goldman veteran wrote in a note. “Then the pain trade moves to the downside, no longer upside.”

Viewed in a wider lens, however, buybacks can still offer support. By the tally from Goldman strategists including Cormac Conners, US firms have announced roughly $900 billion of share repurchases this year, poised for the third-highest annual total on record.

Corporations in the S&P 500 returned to positive earnings growth during the third quarter after a streak of contractions, data compiled by Bloomberg Intelligence show. With profit expansions forecast to accelerate next year while interest rates are expected to drop, stocks can be viewed as an attractive investment — particularly those that were left in the dust during the 2023 rally that’s been dominated by the seven largest tech giants, dubbed the Magnificent Seven, according to Bailey at FBB.

“There are plenty of profitable and growing companies outside of the Magnificent 7 that have languishing stock prices this year,” he said. “Insiders could be chomping at the bit to buy these under-performers now on hopes of that we could see a reversal next year, with smaller companies beating the megacaps.”