By Jamie McGeever

A look at the day ahead in Asian markets from Jamie McGeever, financial markets columnist.

Asian markets will get key economic signals this week that could determine monetary policy in the continent's two biggest economies - retail sales and industrial production and house prices from China, and Japanese GDP and inflation.

Markets also will watch for interest rate decisions from New Zealand and the Philippines, inflation figures from India and major corporate earnings reports from China, including Tencent, Lenovo CNOOC and JD.com.

The biggest fireworks on Monday's economic data calendar could come from India. Annual consumer price inflation is expected to show a sharp rebound in July to 6.40% from 4.8%, and a slowdown in wholesale price deflation to -2.4% from -4.1%.

The wider market mood will likely be one of caution after last week - the Nasdaq posted its first back-to-back weekly decline of the year, and the MSCI Asia ex-Japan equity index lost 2% on its way to a one-month low.

Caution may morph into outright gloom on Monday, however, after China's biggest privately-owned developer Country Garden said it will suspend trading of its 11 onshore bonds.

The firm's shares are at a record low, it didn't pay two dollar bond coupons due on Aug. 6 totalling $22.5 million, it has liabilities of around $200 billion and last week warned it could report a loss of up to $7.6 billion for the first half.

Investors are wondering how long Beijing will resist pressure to inject any kind of stimulus into an economy that is now officially in deflation with the weakest credit impulse since 2009.

Another batch of sub-par data this week could force authorities' hand.

Investors and the Bank of Japan, meanwhile, will be paying close attention to Japanese inflation data later in the week. Economists polled by Reuters expect the annual rate of core CPI inflation to slow to 3.1% in July from 3.3% in June.

A lower print could tempt the market to price in a more gradual change to the BOJ's 'yield curve control' policy, stickier inflation could have the opposite effect.

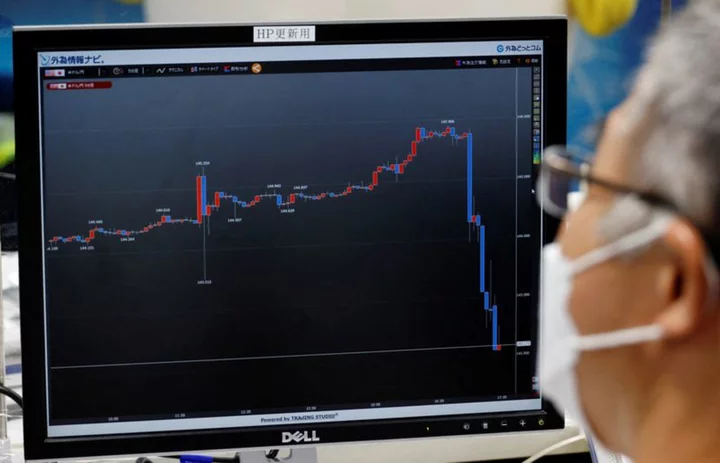

Either way, the yen will be under scrutiny - it slumped to a 15-year low against the euro lat week and is flirting with levels against the dollar that last year prompted massive yen-buying intervention from Japanese authorities.

Asian stocks have badly underperformed this year, largely due to worries over China which is battling weak growth, deflation, and capital outflows. Chinese blue chip stocks are flat this year and Hong Kong's Hang Seng index is down 4%.

The MSCI Asia ex-Japan equity index index has now fallen two weeks in a row for the first time since April, and is up only twice in the last eight weeks.

Here are key developments that could provide more direction to markets on Monday:

- India consumer inflation (July)

- India wholesale inflation (July)

- Germany wholesale inflation (July)

(By Jamie McGeever; editing by Diane Craft)