A look at the day ahead in U.S. and global markets from Mike Dolan

U.S. stocks have surfed through multiple crosscurrents over the past week - from the blistering spike in Treasury yields to the Middle East shock at the weekend - but they remain on board amid what the IMF sees as "remarkable" U.S. economic strength.

With third-quarter earnings set to stream in later this week, Wall St stock indices hit their highest in almost three weeks on Monday having rallied back from early losses over the last two sessions. Stock futures are higher once again ahead of the bell today.

The initial market jolt from the weekend attacks on Israel seemed to dissipate quickly as a modest pop in oil prices levelled off far below recent highs. U.S. crude hovered just above $86 per barrel on Tuesday, still off almost 10% from the peaks of late September and down 5% year-on-year.

As cash Treasury markets returned from Monday's Columbus Day holiday to a week of heavy long-term debt auctions, they were also greeted with rekindled optimism about the Federal Reserve's policy rate trajectory.

Specifically, the typically hawkish Dallas Fed boss Lorie Logan suggested the recent tightening in bond markets may have done the Fed's work for it and lessened the need for another policy rate hike. Fed futures tend to agree and now see only about a one-in-four chance of further rate rise.

"If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate," said Logan, referring to creeping risk premia on holding long-term Treasury bonds.

Fed Vice Chair Philip Jefferson chimed: "I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy".

Ten-year U.S. Treasury yields are set to kick off Tuesday's U.S. trading day at some 4.65% - almost a quarter of a percentage point below the peak set just after Friday's blowout September jobs report.

It was that exceptional U.S. economic strength the International Monetary Fund spotlighted in its latest World Economic Outlook, released at the annual meetings of the IMF and World Bank in Marrakesh on Tuesday.

While the IMF cut its growth forecast for China and the euro area, it left its overall global forecast unchanged due to what it called the "remarkable strength" of the U.S. economy.

The Fund upgraded both its 2023 and 2024 U.S. growth forecasts by 0.3 and 0.5 percentage points respectively to 2.1% and 1.5% annual clips.

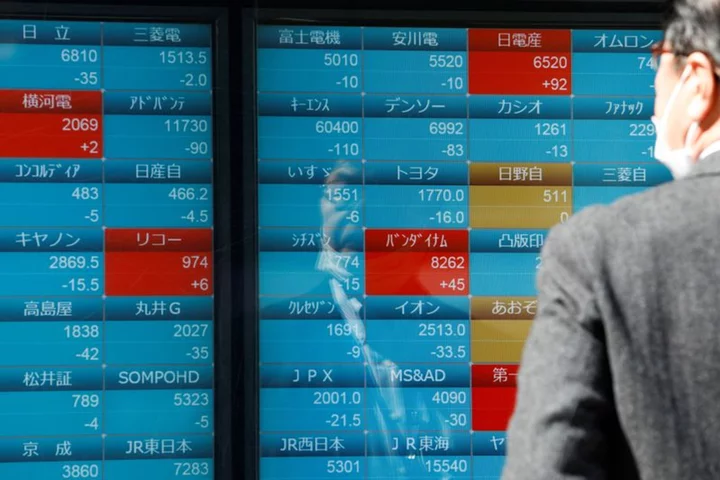

China's ongoing struggles were amply illustrated by the latest worrying twist in its ongoing property bust on Tuesday - which saw its main benchmark stock indices fall again.

Country Garden extended losses and closed down over 10% after the embattled developer said it might not be able to meet all of its offshore payment obligations when due or within the relevant grace periods.

And once again reports suggest the Chinese fiscal policy response will be modest at best.

Bloomberg News reported on Tuesday that Beijing was looking to increase its budget deficit and is weighing the issuance of at least 1 trillion yuan ($137.1 billion) of additional sovereign debt for spending on infrastructure.

The after-hours report was enough to lift European infrastructure stocks, however, and the euro also got a lift. The dollar was easier more generally on the softer Fed view.

U.S.-listed shares of Chinese firms, including Alibaba Group Holding, JD.com and Baidu, rose between 1.1% and 2.4% ahead of the U.S. bell.

Elsewhere, PepsiCo edged 0.8% higher ahead of the beverage maker's third-quarter results and Unity jumped 6.4% after the video-game software maker said its CEO John Riccitiello would retire.

Key developments that should provide more direction to U.S. markets later on Monday:

* U.S. NFIB Sept small business survey, U.S. Aug wholesale sales and inventories, NY Fed's inflation expectations survey

* Annual meetings of World Bank and IMF in Marrakesh

* Federal Reserve Board Governor Christopher Waller, Minneapolis Fed President Neel Kashkari, San Francisco Fed chief Mary Daly and Atlanta Fed chief Raphael Bostic all speak

* U.S. Treasury auctions 3-year notes, 3- and 6-month bills

* U.S. corporate earnings: PepsiCo

(This story has been corrected to say 0.3 and 0.5 percentage points respectively to 2.1% and 1.5% annual clips, in paragraph 12)

(By Mike Dolan, editing by Ed Osmond mike.dolan@thomsonreuters.com. Twitter: @reutersMikeD); ((mike.dolan@thomsonreuters.com; +44 207 542 8488; Reuters Messaging:)