The Bank of Japan’s decision to stick with its ultra-easy monetary policy points to increasing appetite for shorter-tenor yen credit as uncertainty over long-term rates remains.

Rising coupons on Japanese five-year corporate bonds have attracted investors seeking bigger returns without taking on the risk from longer-duration credit, especially after the BOJ’s unexpected step to loosen its grip on yield curve control in late July helped push up rates on 10-year debt.

“Credit investors will probably continue buying shorter notes, such as five-year corporate bonds, as they offer attractive coupons compared with a year ago,” said Hidetoshi Ohashi, chief credit strategist at Mizuho Securities Co. “Demand for 10-year notes may stay somewhat weaker.”

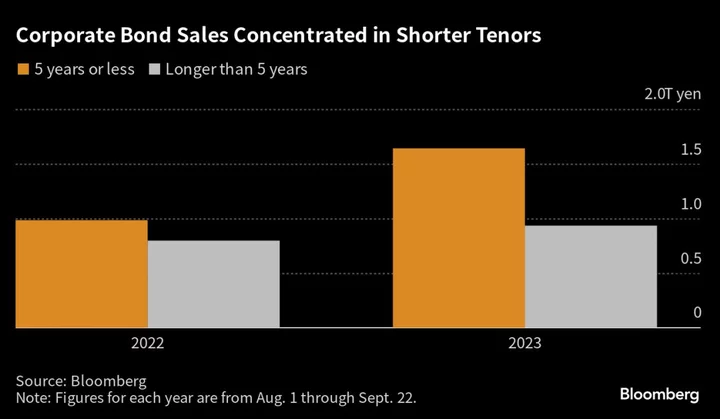

Issuance of notes with a tenor of five years or less has jumped 67% to ¥1.64 trillion ($11 billion) since the start of August, while sales of maturities longer than five years have increased just 17%, according to data compiled by Bloomberg. The shift to shorter-dated bonds comes as sales of yen bonds overall so far this year have reached the strongest on record.

An average coupon for five-year corporate debt sold since the BOJ’s July meeting is 0.639%, compared with 0.472% in the same period last year, according to data compiled by Bloomberg.

The central bank needs to patiently continue with monetary easing, and will prioritize managing the risks of acting too soon, Governor Kazuo Ueda said at a press conference Friday after the BOJ meeting. His comments are dovish, and positive for the credit market for the time being, Ohashi said.