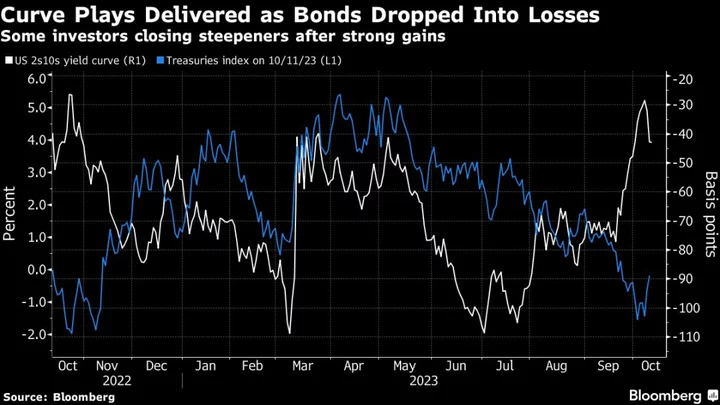

Japan’s auction of 20-year government bonds met with strong investor demand as long-term US debt yields continued to fall and the yen’s strengthening cooled speculation that a central bank policy change was imminent.

The minimum bid price for bonds due in two decades was ¥101.05 on Tuesday, higher than market forecast of ¥101, suggesting that investors were willing to pay more for the debt. The bid-to-cover ratio was 3.54, higher than the previous auction. The tail, the difference between the average bid price and the minimum bid price that indicates a strong bid if it’s small, was ¥0.14, lower than the previous auction.

Some investors expected demand at today’s auction to be weak after slides in yields, and “those who were bearish will probably respond by buying,” said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management.

Japan’s benchmark 10-year bond yield fell 4.5 basis points after the auction to 0.695%, its lowest level since September.

Yields on Japan’s 20-year sovereign bonds have fallen from a decade-high level of 1.73% at the start of November, to 1.395% Tuesday. Both US and Japanese long-term debt yields have faced downward pressure in response to slower-than-expected US inflation data and a bigger-than-expected contraction in Japan’s gross domestic product last quarter.

--With assistance from Hidenori Yamanaka and Saburo Funabiki.