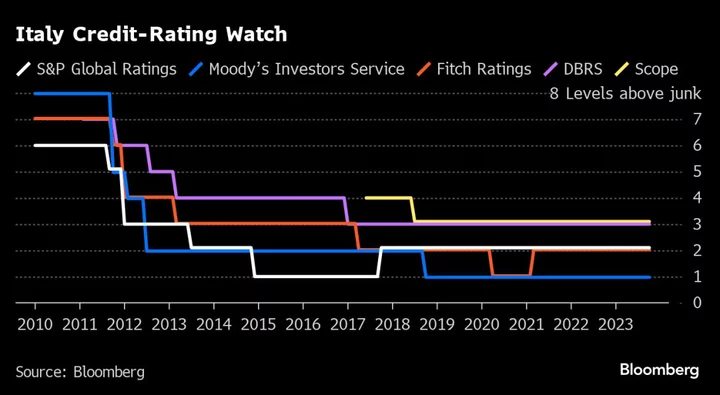

Italy’s credit rating was confirmed at three steps above junk at DBRS Morningstar as Premier Giorgia Meloni’s government weathers the second in a slew of upcoming assessments.

The company left its grade unchanged at BBBH with stable outlook, according to a statement released late on Friday.

Italy benefits from European Union membership and ECB support, a “large and diversified” economy and the “rapid recovery in its current account as well as the country’s positive net international investment position,” DBRS said.

“However, the ratings remain constrained by a very high level of public debt, weak potential GDP growth, and a political environment that hinders government stability and ability to address economic challenges,” it said.

The current rating is three notches above junk, two higher than the assessment of rival Moody’s Investors Service.

Friday’s confirmation at DBRS is good news for Meloni and her populist coalition whose recent wider deficit forecasts had unnerved some investors, pushing the spread between Italian and German 10-year bonds higher.

That common measure of risk has widened sharply since the end of August and currently stands at 197 basis points.

Friday’s verdict is one in a series by ratings companies that will intensify scrutiny on the country’s public finances. Moody’s has a negative outlook on the country, and is scheduled to potentially release its own view on Nov. 17.

A deteriorating credit outlook showcases how Meloni faces a hard road ahead as she confronts weak economic output, which is seen growing just 0.7% this year, according to the Bank of Italy. Higher borrowing costs and slumping global trade are also hurting Italian businesses.

The government is still trying to keep promises to voters, including tax cuts and aid to lower income families. That’s making it difficult to bring the deficit as a percentage of gross domestic product below the European Union’s limit of 3% until 2026 — a year later than originally planned.

Meloni’s government has pledged growth-boosting investments, but it’s also struggling to spend EU Recovery funds that could help improve infrastructure.

Italian growth will probably slow further to just 0.5% in 2024, according to Confindustria — the country’s main business association. That’s down from a March estimate of 1.2%.

“The slowdown is due to the negative effect of high interest rates on businesses and families, and to a negative trend in international trade in the current year,” it said Saturday.

Asked about the Confindustria estimates, Bank of Italy Governor Ignazio Visco acknowledged that Italy once again finds itself “in a very difficult situation,” Ansa reported. Italian companies can and must continue to invest even with tighter monetary conditions and should look to capital markets, not just banks for financing, he said.

(Updates with growth prospects in final paragraphs)