Codelco, the world’s biggest copper producer, is shipping less of the metal to China after a burst of new domestic capacity in the Asian nation, according to the Chilean company’s chairman Maximo Pacheco.

China will remain a “very strategic market” for the state-owned Chilean producer, Pacheco said. But he added that its sales volumes of cathode — or refined copper — are under pressure as China’s own output of the metal grows at a double-digit percentage.

“We see clearly that the sales of cathodes in China is decreasing because of the expansion of smelting capacity in China” and elsewhere in Asia, Pacheco said during Asia Copper Week, a major industry gathering.

Read more: China Tightens Grip on Copper, Key to World’s Energy Transition

Codelco’s copper sales to China have traditionally been a benchmark for the entire market, with the company’s annual negotiations over prices and volumes a key indicator of sentiment. It has slashed the premium it is seeking to charge Chinese customers for next year by 36%.

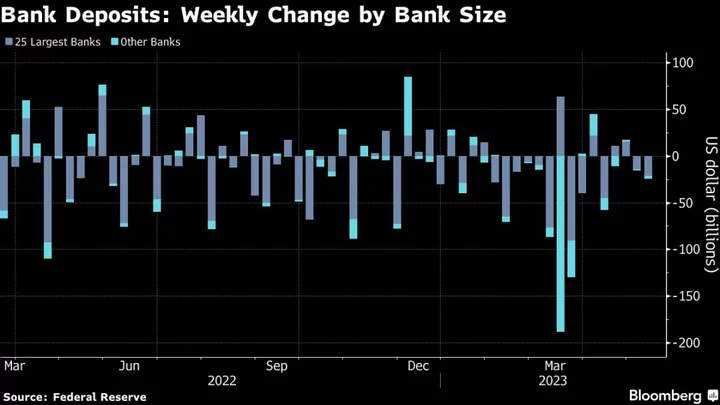

China’s total imports of refined copper from Chile — where Codelco dominates production — are on track this year for their lowest annual volume since 2008, according to Chinese customs data. China is buying more copper in the form of concentrated ore, instead of metal.

Pacheco said he remained “very optimistic” about overall Chinese demand for copper, which he estimated had risen 5% this year. China is moving “very fast” on the energy transition, he said, while housing completions — a key source of copper consumption — were holding up despite the country’s prolonged property slump.

Asia would continue to represent at least 40% of Codelco’s copper sales in the future, the chairman said, compared to 47% last year and around 60% a decade ago.

Too Much

China’s smelter boom adds to expansions in other nations from Indonesia to India and the Democratic Republic of Congo, which threaten to weigh on copper prices in the coming year. The International Copper Study Group predicts an oversupply of 467,000 tons of refined metal in 2024.

There is a bifurcation in the global copper market, with Chinese demand rebounding, while the rest of the world — particularly Europe — looks much weaker. Prices on the London Metal Exchange are not far off where they were a year ago.

Pacheco endorsed a Chilean government plan to build a new copper smelter in Chile, saying that “there’s room for everybody” in the market. While Codelco would support the project by supplying raw material, the company itself does not intend to build a smelter. Codelco has to focus on delivering several big, long-delayed mining projects, he said.

The chairman reiterated the company’s recent forecast for copper production to be 1.315 million tons this year, increasing slightly to 1.34 million tons in 2024.