The rally in US equities will broaden beyond megacap technology names if history is any guide, Goldman Sachs Group Inc. strategists said in a report raising their year-end target for the S&P 500.

The gauge will end 2023 at 4,500, strategists including David J. Kostin wrote in a note dated June 9, increasing the forecast from 4,000. That implies a 4.7% increase from Friday’s close and almost half of the returns envisaged by the consensus over the next 12 months, according to data compiled by Bloomberg.

The rally is expected to widen beyond tech as “prior episodes of sharply narrowing breadth have been followed by a catch-up from a broader valuation re-rating,” they wrote. Since 1980, the gauge has seen nine such key episodes, which were eventually followed by a catch-up in other stocks that ultimately benefited the S&P 500, they added.

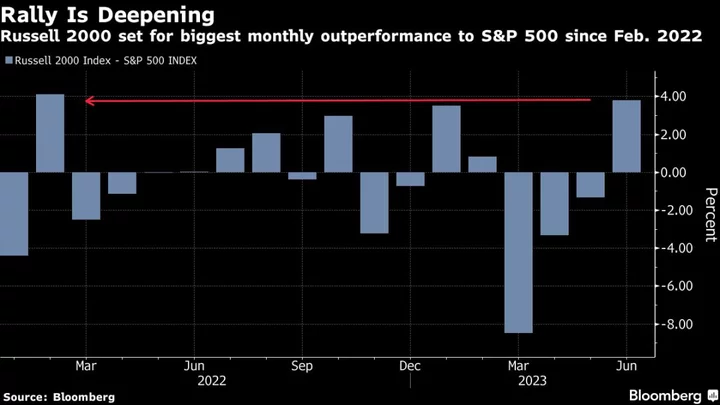

The gauge has gained 20% from its October low, joining the Stoxx Europe 600, Germany’s DAX and South Korea’s Kospi in its fifth technical bull market in about three decades. Concerns about sticky inflation and slowing growth have been replaced by predictions of a pause in interest-rate rises and strong profitability. The rally has also started showing signs of broadening, with the Russell 2000 Index outperforming the S&P 500 since the start of June.

Kostin and his colleagues on Feb. 10 said European and Asian stocks are better for investors to buy than US equities this year due to an expected decline in corporate profits in 2023. Since then, the S&P 500 is up 5.1%, while key gauges for Asia and Europe are little changed.

Goldman’s call for greater returns from the S&P 500 chimes with the outlook by Bank of America Corp.’s Savita Subramanian, whose analysis shows S&P 500 has extended gains in the 12 months after crossing the 20% turning point 92% of the time in data going back to the 1950s.

BofA Says Stock Bull-Market Means More Gains 92% of the Time

Meanwhile Morgan Stanley’s Michael Wilson, who was one of the few Wall Street strategists to see the 2022 meltdown coming, earning him the top spot in last year’s Institutional Investor magazine survey, remains skeptical. He sees the narrow breadth of the rally as a warning sign, along with lofty valuations and outperformance of defensive stocks.

Goldman sees downside risks mainly from an unexpected downturn in growth and stubborn inflation triggering a hawkish path for the Federal Reserve’s policy.

While the S&P 500 is trading at its highest earnings-based valuation since April 2022, the Goldman team said the combination of slowing inflation, healthy growth, and elevated market concentration suggests that current valuations may persist.

“Our economic and earnings forecasts also suggest that a catch-up is more likely” they wrote, saying their probability of recession over the next 12 months is lower than consensus, while earnings forecast is higher than peers.

The potential profit boost from the boom in artificial intelligence has also “improved the distribution of equity outcomes” they said.