Australia’s unemployment rate rose more than expected in July as the economy surprisingly shed jobs, signaling the labor market may be approaching a turning point and sending the currency lower.

The jobless rate climbed to 3.7% from 3.5% a month earlier, having hovered in a range of 3.4%-3.7% since June last year, Australian Bureau of Statistics data showed Thursday. The economy lost 14,600 roles, confounding estimates for a 15,000 gain.

The data cements the case for the Reserve Bank to stand pat at 4.1% for a third straight month at its Sept. 5 meeting following 12 interest-rate increases. Money markets scaled back bets on further tightening, sending the Australian dollar and government bond yields lower.

“July is usually a softer month but the prints are weaker across the board,” said Prashant Newnaha, senior Asia-Pacific rates strategist at Toronto Dominion Bank in Singapore. “There is nothing here to swerve the RBA off from the sidelines.”

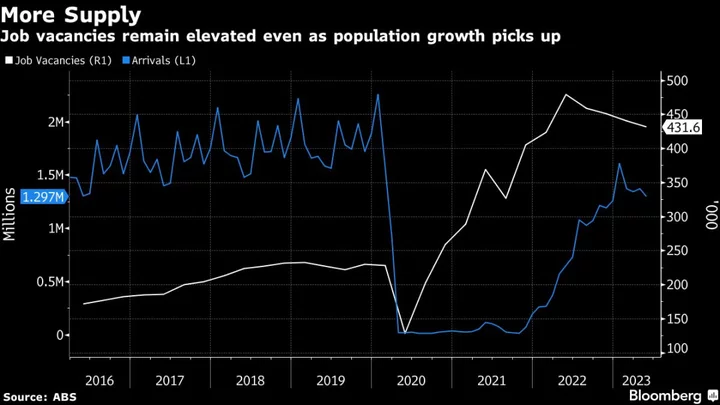

Thursday’s data signal a potential pivot in the jobs market, as highlighted by the RBA in minutes of its Aug. 1 meeting which cited fewer vacancies and underemployment edging up. Governor Philip Lowe has said the board will closely monitor employment and prices and has warned further tightening “may be required” to tame persistent inflation.

The report is “consistent with the RBA remaining on hold at its next meeting in September,” said Diana Mousina, deputy chief economist at AMP Capital Markets. For the RBA to lift rates, “there would need to be signs that inflation has picked up again or that wages growth will be higher than expected which we think is unlikely.”

Employment strength has been a key factor in the RBA’s confidence that Australia can avoid a recession. Thursday’s figures showed that annual jobs growth eased to 2.9% from 3.1% at the start of the year. The pace is expected to moderate further given leading indicators like job advertisements are now edging down.

What Bloomberg Economics Says...

“Weaker-than-expected jobs growth adds weight to our view that the RBA’s tightening cycle is over.”

— James McIntyre, economist.

For the full note, click here

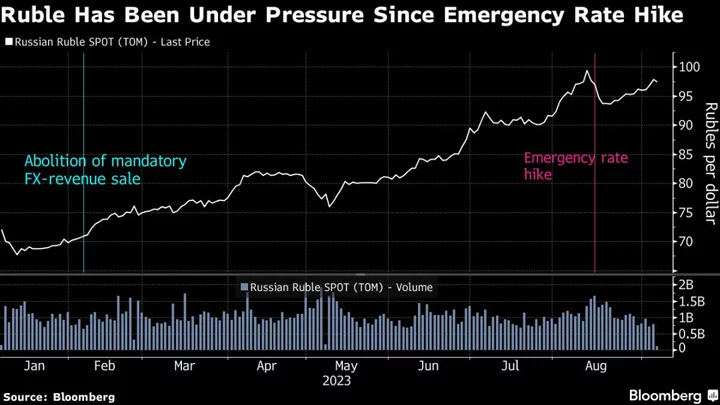

The weak jobs report also adds to the pressure on the Aussie dollar, down 5% this month and the worst performer among major developed market peers. It’s been weighed down by a stronger greenback as the Federal Reserve signals rates will be higher for longer and amid concerns over China’s outlook.

Thursday’s data showed:

- The participation rate declined to 66.7%

- Underemployment remained at 6.4%

- Full-time roles fell by 24,200 while part-time rose 9,600

- The employment to population ratio fell to 64.3%

The figures also support expectations Australia will avoid the wage-price spiral seen in many developed economies, with annual pay gains currently at 3.6% and expected to peak around 4%.

The RBA has hiked by 4 percentage points since May 2022 as it grapples with sticky inflation. The central bank estimates the jobless rate will need to reach 4.5% to achieve sustainable inflation around the 2-3% target.

--With assistance from Tomoko Sato and Matthew Burgess.

(Adds comments from economists.)