India’s $1 trillion government bond market has struggled for years to rise above the criticism of being insular.

That is set to change after JPMorgan Chase & Co. Thursday became the first global index provider to include them on its emerging markets index. The decision sets the stage for billions of dollars of inflows just when the bond market is straining under record government borrowings.

“This could be a push-factor to prompt foreign inflows into India and foreign investors are likely to be more active in the Indian fixed-income market,” Morgan Stanley strategists led by Min Dai wrote in a note, calling the index inclusion a “milestone event.”

The move buttresses India’s aspirations for a bigger global heft as it boasts one of the world’s fastest rates of economic growth and positions itself as an alternative to China. At the same time, the inclusion will open up the nation’s public finances to greater scrutiny from foreign investors, likely increasing the volatility of local markets.

Inclusion starts in phases from June 2024. India will reach a maximum 10% weighting in JPMorgan’s key emerging market index, which has $213 billion benchmarked to it.

Goldman Sachs Group Inc. expects inflows of more than $40 billion from active and passive funds over the next 18 months. The purchases will be “front-loaded, beginning immediately, as investors pre-position for inclusion,” strategists led by Danny Suwanapruti wrote in a note Friday.

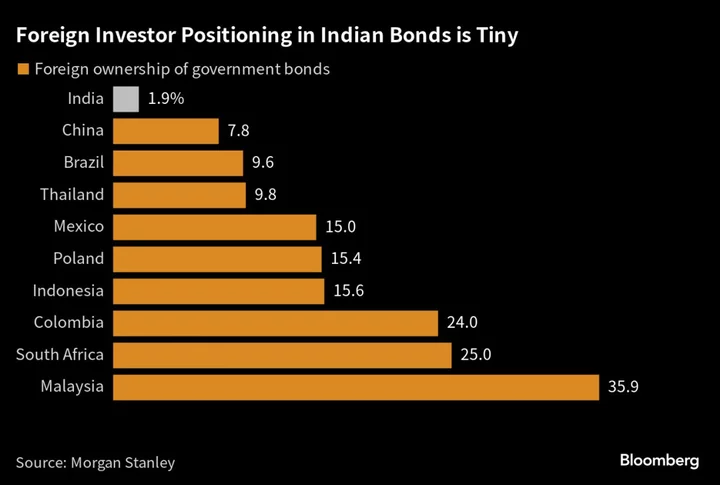

Foreign investors currently hold less than 2% of government securities. Officials have in the past worried about the consequences of outsized debt inflows, leaving local banks and mutual funds as the main buyers of bonds.

The index news “should structurally augur well for rates and forex markets, leading to lower cost of borrowings for the economy and more accountable fiscal policy-making,” said Madhavi Arora, lead economist at Emkay Global Financial Services Ltd.

Kotak Mahindra Bank expects foreign ownership to rise to 3.5%-4% by the end of fiscal 2025, as investors plow money into a high-yielding market.

Benchmark 10-year yields can drop to 6.9%-6.95% over the next six to eight months if the global environment improves, said Jayesh Mehta, India country treasurer at Bank of America in Mumbai.

They closed at 7.19% on Friday.

Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which administers indexes that compete with those from other service providers.

--With assistance from Selcuk Gokoluk.

Author: Subhadip Sircar, Ronojoy Mazumdar and Malavika Kaur Makol