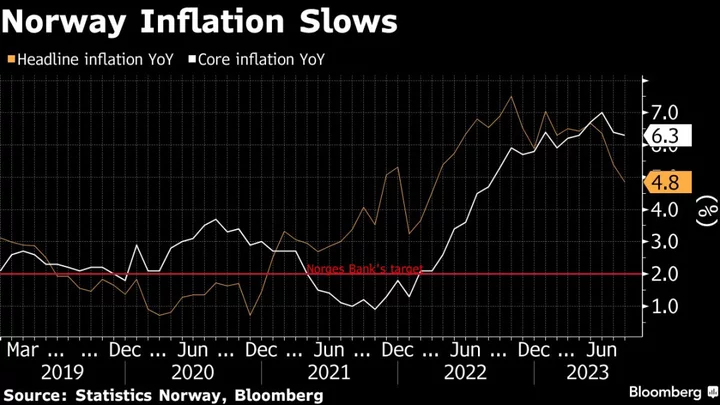

Norway’s inflation unexpectedly slowed last month, suggesting that Norges Bank is likely to end monetary tightening after an expected quarter-point hike next week.

Headline inflation rate declined to a year-on-year rate of 4.8%, a 17-month low, while core price growth slowed to 6.3% in August, according to a statement from the statistics office on Monday. Both measures were below all forecasts in a Bloomberg survey of 10 analysts and Norges Bank’s projections of 6.1% and 6.4%, respectively.

The figures are likely to cement bets that policymakers will end interest-rate hikes after an expected quarter percentage-point raise of borrowing costs next week to 4.25%.

“In particular, the decline in headline will be reassuring for the central bank as headline inflation usually leads core inflation,” Nordea Bank Abp’s analysts Dane Cekov and Kjetil Olsen said in a note to clients. “We expect Norges Bank to hike by a final 25 basis points next week and believe the hurdle will be quite high for further hikes after September.”

The krone, the second-worst performer in the G-10 space of major currencies this year, weakened 0.3% immediately following the news, before trading little changed versus the euro at 11.4263 at 8:43 a.m. in Oslo.

Norwegian households have gradually pulled back spending in the past months over rising prices and credit costs — slowing the economy to a standstill last quarter — even if they’ve been more resilient to the cost-of-living surge than most of their regional peers.

Read More: Norway’s Economy Grinds to a Halt After Year of Growth

The August data for core inflation, watched more closely by analysts as a better indicator of Norges Bank’s actions, comes against a backdrop of a slowdown in July from a record of 7% in the prior month.

Danske Bank A/S’s analyst Frank Jullum pointed out that food prices didn’t rebound as feared, with air fares and car prices pulling transport inflation lower amid a broad-based slowdown. Imported inflation, driven by krone weakness, seems to have peaked in April, he said. The release “changes nothing” on the expected quarter-point rate hike next week, while it makes a following hike less likely, Jullum said.

In neighboring Denmark, the annual inflation rate for August fell to 2.4%, the lowest in almost two years, according to data published by the local statistics agency on Monday. The rate had risen in July for the first time in nine months, but resumed the decline in August, led by developments in natural gas and electricity prices.

“We had expected that inflation would be more or less unchanged in August so today’s data is really good news that bodes well,” Palle Sorensen, chief economist at Nykredit Realkredit A/S, said in a note. “The reading confirms again that Danish wages fortunately rise faster than prices.”

--With assistance from Joel Rinneby and Christian Wienberg.

(Updates with analyst comments, Danish data from fourth paragraph)