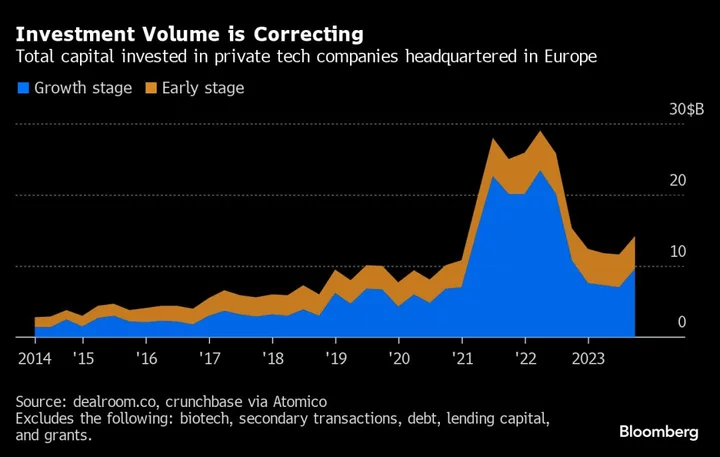

Overseas investment into Europe’s latter-stage technology startups dropped to a four-year low, according to a report from venture capital firm Atomico.

That drawback came primarily from major investment funds, such as Tiger Global, Coatue Management and SoftBank Group Corp.’s Vision Fund, which in recent years plowed record amounts into startups across the globe. In 2021, these “crossover” funds — firms that invest in public and private companies — made 82 new investments in Europe, according to the report. So far this year, they’ve made four.

“You’ve seen a dramatic pullback, almost a grinding to a halt of their activity,” said Tom Wehmeier, an Atomico partner who helped prepare the report released Tuesday.

Venture capital has dried up everywhere for more established startups, held down by rising interest rates and sluggish public markets. The report estimates that Europe is on pace for $45 billion in tech investing in 2023, a “steep drop” from the $82 billion injected in 2022.

That decline is particularly noticeable for growth-stage companies. North American funds accounted for a quarter of the total invested into these European startups so far in 2023, down from 39% in 2021, according to the report. (The report excluded biotech startups, debt investment and secondary transactions.)

Still, the report found that Europe forms more new startups than in the US and hosts more “highly skilled artificial intelligence professionals.” While exit opportunities for European startups are “muted,” the report estimates that more companies are ready for acquisitions or public offerings in 2024 than in the last five years combined.

Many of those companies will not have the foreign capital that flowed so freely a few years ago. “It emphasizes the need for Europe to build its own base of dedicated and stable capital,” Wehmeier said. “There’s clearly a gigantic opportunity here.”

--With assistance from Mark Bergen.