The Philippines marketed its first US-currency Islamic note, aiming to expand its funding base and capitalizing on a compression in spreads.

The Southeast Asian country offered a benchmark-sized five-and-a-half year sukuk, with final price guidance at 80 basis points over Treasuries, according to a person with knowledge of the matter. That means officials stand to raise the funds at a lower premium over government debt than in January, when they sold securities with a comparable tenor, according to data compiled by Bloomberg.

Philippine Finance Secretary Benjamin Diokno said this week that the government expects to raise around $1 billion from the deal.

The Philippines, which has investment-grade credit ratings, is seeking to attract more Middle Eastern investors to its debt as it looks to fund a budget deficit and support economic growth. The deal follows on the heels of a $2 billion sale of Sharia-compliant notes by Indonesia earlier this month.

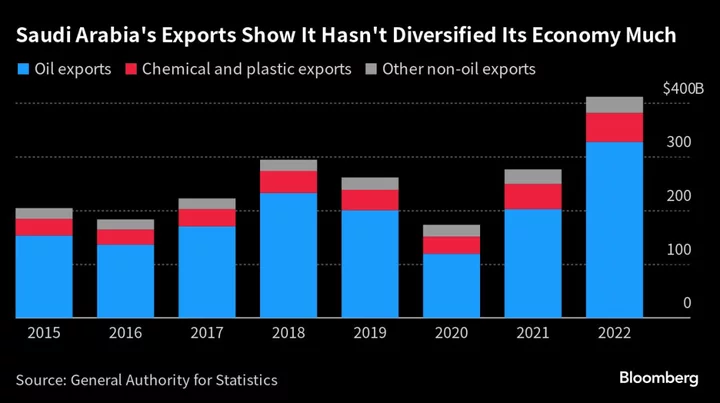

“Demand for quality credit is high so it makes sense for the sovereign to do this now as investors have more risk appetite,” according to Trinh Nguyen, a senior economist at Natixis. “The Middle East is flush with cash thanks to years of high oil and gas prices and with the Fed pausing and potentially cutting in 2024, the Philippines want to capitalize on these opportunities.”

Spreads on Asia investment-grade dollar bonds have tightened to near historic lows in recent weeks, luring back regional borrowers to the US-currency debt market. Still, year-to-date issuance of such notes are running at a decade low, according to data compiled by Bloomberg.

The guidance on the Philippines’ new deal is about 36 basis points outside the government’s debt curve of existing international bonds, according to data compiled by Bloomberg.

Signs that the Federal Reserve may have concluded its tightening cycle have also helped push down yields over the last month, helping revive issuance.

The Sukuk offering will allow the government to broaden its funding sources, after also tapping the retail dollar bond market recently. President Ferdinand Marcos Jr.’s administration will continue working to obtain A level credit rating, according to Finance Secretary Diokno in a statement on Wednesday.

The government is seeking to ease its fiscal burden and narrow the budget shortfall to 3% of economic output by the end of Marcos’ term in 2028, from around 7% last year.

--With assistance from Tassia Sipahutar and Manolo Serapio Jr..

(Updates with final guidance on pricing)