Exxon Mobil Corp. agreed to buy Denbury Inc. for $4.9 billion, its biggest acquisition in six years, in a deal that will provide the oil giant the largest network of carbon dioxide pipelines in the US.

The all-stock transaction values Plano, Texas-based Denbury at $89.45 a share, the companies said Thursday in a statement.

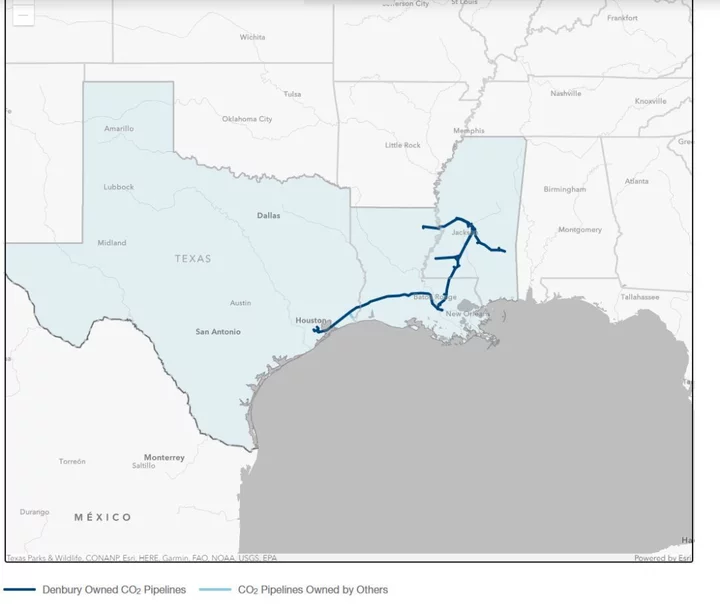

Denbury’s key asset is 1,300 miles (2,092 kilometers) of pipelines dedicated to transporting CO2, critical infrastructure if the US is going to be successful in capturing carbon emissions from heavily-polluting facilities like refineries and chemical plants.

The acquisition is the largest single carbon-management investment since the Inflation Reduction Act passed in August. The law included landmark climate provisions, providing substantial tax incentives for companies to capture CO2 emissions and store them underground rather than pollute the atmosphere.

Buying Denbury will “allow us to move much more quickly than if we were to go out and try to build and replicate that infrastructure ourselves,” said Dan Ammann, president of Exxon’s Low Carbon Solutions business in a Bloomberg Television interview. It will “accelerate the growth of this business and do that on a very profitable basis.”

Exxon shares fell 2% as of 11:27 a.m. in New York. Denbury declined 1.6%.

Carbon capture is the bedrock of Exxon’s climate strategy, which targets net-zero emissions by 2050 from its operations, and buying Denbury would give the oil giant critical and hard-to-replicate infrastructure as it pursues that goal. Exxon has pledged to spend $17 billion on lower-carbon investments through 2027. Capturing carbon from its own operations and third parties in hard-to-decarbonize sectors is a priority.

Denbury’s Rocky Mountain assets are connected to Exxon’s Shute Creek gas facility near LaBarge, Wyoming, which has captured more carbon than any other asset in the US.

The Inflation Reduction Act is a key catalyst for carbon capture, increasing tax credits 70% to $85 for every ton of CO2. Executives, including Exxon CEO Darren Woods, have praised the legislation for its financial support for carbon capture, which Morgan Stanley says could be highly profitable thanks to the tax incentives.

The deal will also provide Exxon with about 47,000 barrels a day of oil, equal to about 1% of its overall production. It’s Exxon’s biggest transaction since buying its core Permian Basin acreage position from the Bass family for about $6.6 billion in 2017.

What Bloomberg Intelligence Says

Exxon Mobil’s proposed $4.9 billion all-stock deal for Denbury is yet another sign that the oil major will favor carbon capture and sequestration over other forms of low-carbon solutions. Denbury fills major gaps in Exxon’s CO2-asset portfolio, including a dedicated pipeline network and existing oil fields that utilize C02 in enhanced oil recovery. - Fernando Valle and Brett Gibbs, senior industry analysts

- Read full report here.

The deal cements a remarkable turnaround for Denbury, which went bankrupt in 2020 after oil prices plunged as Covid-19 crushed demand for crude around the world. At that point, Denbury was a specialist in enhanced oil recovery, a reliable but high-cost method of using CO2 to extract oil from old fields. More than 70% of Denbury’s pipeline network is on the Gulf Coast, home to the largest concentration of industrial emissions in the US.

“Our advisors really worked to find the best way to maximize value for this company,” said Denbury Chief Executive Officer Chris Kendall in an interview. “Exxon clearly became the best option to see a partner with us, to bring the same focus, the same belief in CCS as a great tool for decarbonization and decarbonize that together.”

Since exiting bankruptcy, Denbury stock has climbed fourfold, as techniques used in enhanced oil recovery have gained newfound value as a way to pump carbon dioxide into the ground and prevent it from escaping into the atmosphere — a strategy considered by many as essential for the world to meet its climate goals.

(Updates with Ammann comments from Bloomberg Television interview in fourth paragraph.)