The euro zone’s buoyant consumers will save the economy from a hard landing, according to European Central Bank Governing Council member Edward Scicluna.

While sluggish manufacturing, weak exports, high funding costs and geopolitical uncertainty are restraining growth, spending is holding up as citizens benefit from a resilient labor market and resume their pre-pandemic lives, the head of Malta’s central bank said in an interview.

“What’s really encouraging is that, in spite of all these blows, people post-Covid really want to consume,” Scicluna said, speaking at the International Monetary Fund meetings in the Moroccan city of Marrakech. “Everybody is talking about a recession. But the point is, the people don’t seem to want it.”

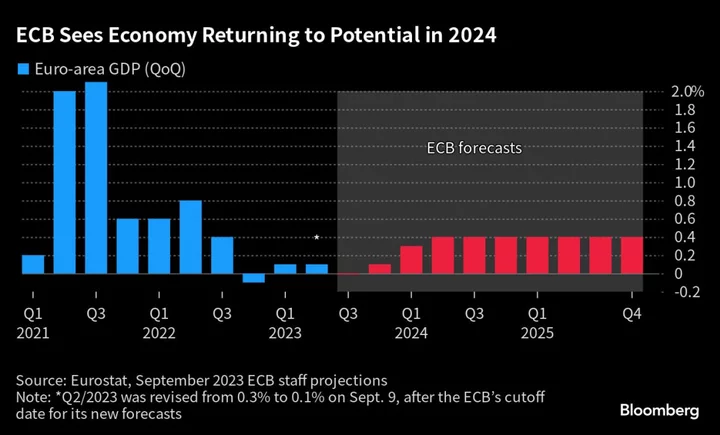

The ECB predicts growth will resume next year after five quarters in which the 20-nation economy practically stagnated. Much of that rebound is expected to be fed by consumers as generous wage deals put more cash in their pockets just as inflation retreats.

That dynamic provided some optimism at the IMF as well. While its economists revised down growth projections for the euro area for this year and next, they do see a recovery taking place in 2024.

Alfred Kammer, the director of the IMF’s European department, told reporters on Friday that the region was at a turning point, and that consumers are starting to recoup purchasing power, stoking demand.

“There are certain circumstances which are suppressing the economy — high rates of interest, industrial lethargy, exports and so on, but in spite of those, you still have that consumption,” Scicluna said. “I don’t see a hard landing.”

It’s of utmost importance that the ECB ensures inflation retreats to its target as planned to ensure workers are reasonable when they negotiate wages, he said.

“We must be credible with unions, in the sense that we’re moving toward 2% in 2025,” Scicluna said. “They need to be compensated for the past, but if they are convinced that reaching 2% really is not a pipe dream, then that gets reflected in their wage claims.”

He argued that after 10 consecutive interest-rate increases that took the deposit rate to a record 4%, the ECB has done enough for now.

“We have to be patient and see inflation going down,” he said. “We are all agreed that if there are shocks threatening our inflation path we’ll have to take action, but at this point in time, the way we see it, it’s coming down. So leave rates be.”

That also means that “it’s a bit too early to start discussing when you will lower them,” he added.