The $85 billion firm owned by Liechtenstein’s royal family is sending its cash well off the beaten path to Armenia, Georgia and Angola, where it sees local debt outperforming more popular emerging markets.

Headquartered in Pfaeffikon, Switzerland and fully owned by the Princely House of Liechtenstein, LGT Capital Partners set up its emerging-market and frontier bond funds in 2021 and oversees investments from institutional clients alongside the family. The following year, its local debt fund outperformed 99% of peers, beating them on average by 19 percentage points, according to Bloomberg data tracking about 5,000 emerging-market bond funds.

This year, with asset performance across emerging markets disappointing bulls, LGT says it’s shunning popular trades like Mexico or Egypt and is instead looking to take positions in local debt of nations that aren’t in any benchmark indexes.

“One of the secrets of our performance is we try to be invested in the markets which are not crowded,” Jetro Siekkinen, the firm’s head of emerging-market fixed income, said in an interview. “Every single manager in the world — more or less — in the emerging market space is investing in exactly the same instruments.”

The further-flung, smaller markets tend to be driven by more country-specific sets of risks and potential rewards than the bigger countries, where investments are more sensitive to broad changes in global risk sentiment, he said. That gives investors with some courage and local knowledge an edge, as well as insulation against losses driven by external shocks, the firm argues.

“In a case of higher uncertainty, like last year, there were no foreigners who would be running away from the market,” Siekkinen said. “These countries are purely driven by what we call idiosyncratic country-specific drivers.”

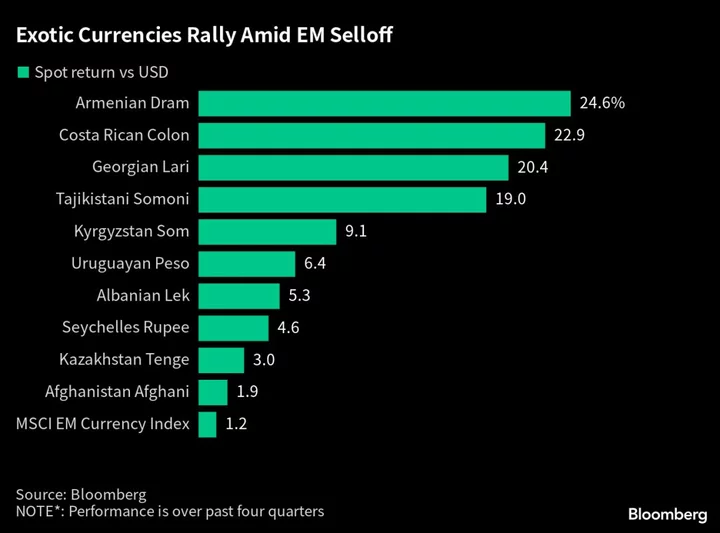

He pointed at the currency performances of his top bets in the exotic space: the Armenian dram up 25%, the best performance among about 70 exotic currencies tracked by Bloomberg over the past four quarters; and the Georgian lari, up more than 20%. In the same period, 20 out of 23 major emerging-market currencies have lost value against the dollar.

Both Armenia and Georgia have benefitted from Russian inflows since the invasion of Ukraine last year, and yet only a tiny portion of their their local government debt is owned by foreign investors, making a collapse of the market due to outflows less likely, Siekkinen said.

The firm has avoided investments related to Russia’s government itself since 2014, he said, citing concerns about governance and other failings on ESG criteria.

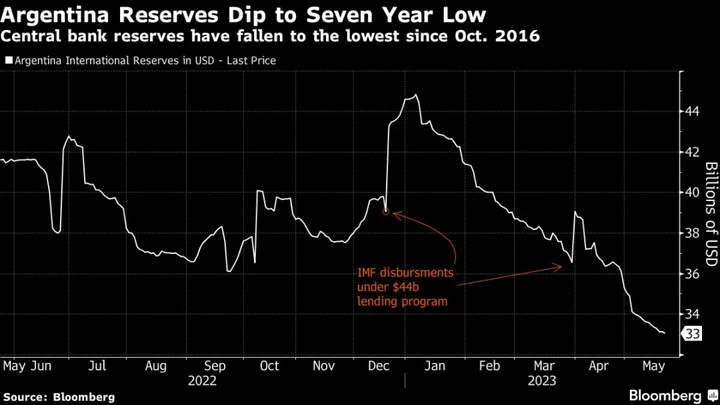

To be sure, investing in frontier markets is also fraught with risk. Most of the 18 countries with sovereign dollar debt that’s trading at levels that investors consider to be “distressed” are frontier markets, such as Ethiopia, El Salvador, Maldives and Tajikistan, according to data compiled by Bloomberg.

While larger emerging markets have averted default in the wake of economic turmoil caused by Russia’s invasion of Ukraine and tighter global liquidity conditions, smaller markets including Sri Lanka and Ghana have suspended debt repayments, joining other nations looking to restructure their debts.

One risk that LGT looks to avoid entirely is currency devaluation, and so it’s staying away from markets like Egypt, where it says the risk-reward isn’t attractive enough. And it also doesn’t want to hold onto risk in Nigeria, as a new president prepares to take office under the spectre of an expected tumble in the naira.

“We stay totally out and have a zero allocation on a country like Egypt,” Siekkinen said. “We usually don’t speculate on the size and the timing of the devaluation, so we’d rather stay out if we see kind of an imminent devaluation on the market.”

Some more unconventional top picks for the fund this year include Uganda, Uruguay and Uzbekistan. Local debt yields in each are above the inflation rate, and Siekkinen says their steep yield curves compensate for interest-rate risk.

“We have a fairly big allocation in these three countries,” he said. “Investors should look at the wider universe beyond the traditional emerging markets,” he added. “There’s a lot of interesting, attractive investment opportunities outside that universe.”

--With assistance from Colleen Goko.

(Updates with details of the fund’s co-investors in second paragraph.)