European shares slipped as tech shares were dragged down by Infineon Technologies AG’s outlook, while the Bank of England raised interest rates to a new 15-year high.

The Stoxx 600 Index fell 0.7% as of 12:10 p.m. in London, with tech shares underperforming. Infineon slumped as the chipmaker’s fourth-quarter forecasts for margin and revenue both missed analyst estimates as inventory levels edged higher. The update put pressure even on peers, with Europe’s largest tech firm ASML Holding NV down 1.2%.

ASML and Infineon shares were responsible for roughly one-third of the losses on the blue-chip Euro Stoxx 50 Index.

Among other single stock moves, Societe Generale SA rose as the French lender beat most analyst estimates even as key revenue lines weakened amid a lackluster trading environment. Deutsche Lufthansa AG fell as Europe’s biggest airline group saw its profit beat offset by net debt and increasing costs. Anheuser Busch InBev NV ticked higher as the world’s largest brewer reported earnings that beat analysts’ estimates.

The UK central bank lifted its key rate a quarter point to 5.25%, a smaller hike than the half-point increase delivered in June. It warned that its fight against inflation may require tighter borrowing conditions for a prolonged period. The more domestically-focused FTSE 250 Index rose 0.4%.

The Bank of England has “picked the safer route” by raising rates by another 25 basis points instead of a larger increase, said Richard Flax, chief investment officer at European digital wealth manager Moneyfarm. “With the UK economy already tipping toward a recession and growth flat-lining, a 50-basis point hike would have exacerbated the decline.”

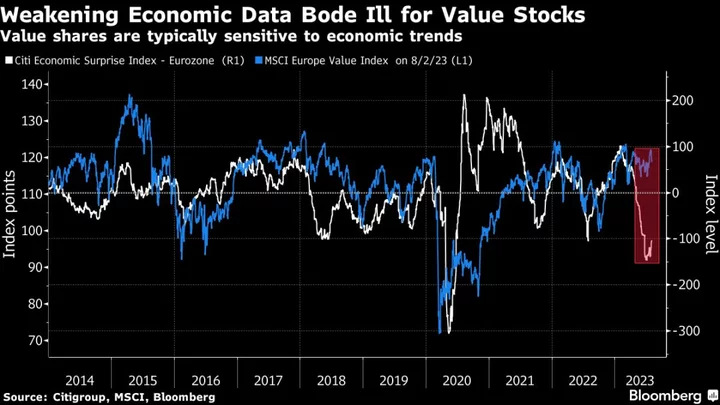

Meanwhile, Pictet AM’s Chief strategist Luca Paolini raised global equities to neutral but cut European equities to underweight from neutral, citing deteriorating economic outlook.

For more on equity markets:

- Value Is a Call on the Economy, Not Just Rates: Taking Stock

- M&A Watch Europe: Axa, CTS Eventim, Fnac, Dealmaking Regulation

- Spain’s IPO Pipeline Flags Revival of Dormant Market: ECM Watch

- US Stock Futures Unchanged; Upwork, Remitly, Confluent Gain

- Haleon Raises Forecast as First Half Shines: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

Author: Macarena Muñoz and Sagarika Jaisinghani