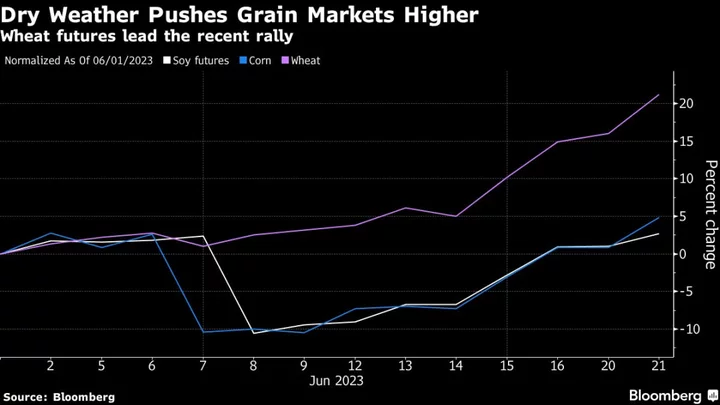

Corn prices are surging as persistent dry weather in the US, the world’s biggest producer, has dragged crop conditions to the worst levels in three decades.

Futures in Chicago have jumped more than 12% over four sessions, the biggest such gain since early March 2022, when the outbreak of the war in Ukraine rattled grain markets. Heat and drought have shriveled the potential for yields in critical growing areas of the Midwest. The portion of the US corn crop rated good to excellent has dropped to 55%, the lowest for this time of year since 1992.

“I’m very concerned about the weather,” said Sherman Newlin, who grows corn and soybean in Illinois. “We have low humidity, 90-degree temperatures and now the wind is sucking the moisture out of crops really fast.”

Conditions have been particularly poor in Illinois, the No. 2 US producer. Only 36% of the state’s crop was rated good to excellent for the week ending June 18, down 12 percentage points from a week earlier.

“I was shocked at the big drop in Illinois ratings,” Newlin said. “I knew we were bad, but: Wow.”

There’s little sign of relief for crops in the forecast. Dryness and stress will remain significant across southern, central and northeastern areas of the Midwest corn and soybean belt, forecaster Maxar Technologies Inc. said in a report dated June 20.

Wheat and soybean futures have also climbed on weather concerns. A German agricultural cooperatives group has cut its estimate for the country’s grain harvest due to drought.

Corn futures for December delivery jumped as much as 4.8% to $6.2625 a bushel, the highest level for the contract since November.

Prices moved higher despite an announcement from the Environmental Protection Agency on biofuel quotas that disappointed the market. Advocates say the updated mandates ignored a surge in production and a wave of investment in new manufacturing plants.

Read More: US Modestly Boosts Biodiesel Quotas Despite Lobbying Frenzy

Soybean oil futures plunged on the news. Prices dropped by the exchange limit, falling 6.9%. Soybean meal, a by-product of oil processing, climbed by as much as the exchange limit as a drop in crushing is expected to make less meal available.

The soy oil market has spent the past few weeks rallying based on the assumption that the EPA would boost its requirements for biodiesel, said Susan David, a grain analyst for No Bull Ag in St. Louis.

“That didn’t happen and the market is now overpriced,” David said. “This was literally buy the rumor, sell the fact for soybean oil.”

The US Department of Agriculture will release it’s annual acreage report on June 30th and a review of the planted area this year will likely add more volatility to prices. According to a S&P Global survey, US farmers planted 91.5 million acres of corn and 87 million acres of soybeans, both below USDA estimates announced in a March report.

“Rain is always a concern until the middle of August,” said Jim Putnam, who grows corn and soybeans in Minnesota.

--With assistance from Isis Almeida, Megan Durisin, Napat Kongsawad and Áine Quinn.