The European Central Bank is stepping up scrutiny of lenders’ liquidity reserves and may communicate stricter requirements to individual firms later this year, according to people with knowledge of the matter.

The ECB’s annual review of the risks faced by banks will likely pay more attention to the management of liquid funds, including the potential for a higher bar on key metrics such as the liquidity coverage ratio, the people said, asking to remain anonymous as the matter is private. That comes on top of increased interaction between banks and the ECB on the topic, said the people.

The collapse of Credit Suisse Group AG in March and US lenders including Silicon Valley Bank has thrown into question how truly prepared banks are to withstand strain on deposits and the effectiveness of the metrics investors and regulators use to measure their ability to withstand a crisis.

While liquidity is a key part of banking supervision, watchdogs had more recently been focused on more pressing issues of bank capital and credit risk in the era of low rates. The ECB started pushing banks to look more closely at liquidity in late 2021 as higher inflation pointed to rising funding costs. The recent collapse of US lenders heightened the scrutiny.

An ECB spokesman declined to comment.

The ECB will probably receive the initial results of its annual review of the risks banks face over the summer, said the people. Later this year, officials will split banks into different groups depending on how vulnerable their business models are to funding outflows, said two of the people.

Wealthy client deposits are likely to be a focus because individual withdrawals can quickly drain a bank’s liquidity reserves, said the people. That was one element of the crisis at Credit Suisse. Market funding and retail clients’ perception of their savings’ safety will probably also be relevant, the people said.

Swiss regulators had declared Credit Suisse’s liquidity to be fine just days before its emergency weekend rescue by competitor UBS Group AG. By that time, it was on the verge of collapse, even with a central bank lifeline.

European bankers and regulators have been keen to point out that Credit Suisse was a special case and that there isn’t a direct read-across to the region from recent turmoil in the US either. The euro area hasn’t seen that kind of a run, notably because all lenders in the bloc are subject to liquidity regulation. They also show a lower average exposure to interest rate risk in their banking books than US firms, according to the ECB.

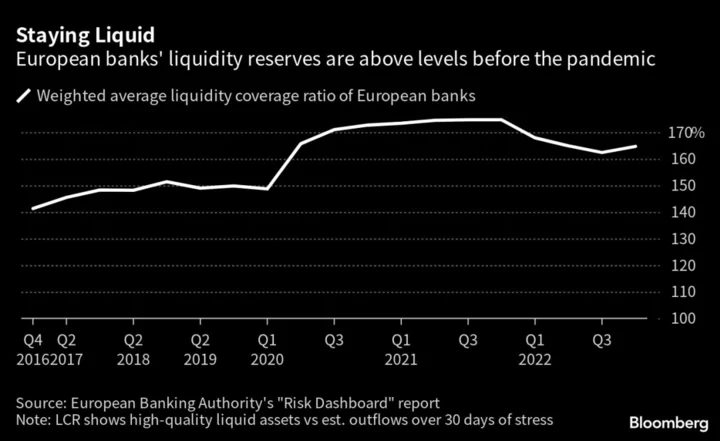

European banks are obliged to hold more high-quality liquid assets than they would expect to see flow out over 30 days of stress. The ECB has the power to increase that requirement, known as the liquidity coverage ratio, although officials acknowledge publicly that it has rarely done so.

The weighted average ratio for European banks stood at 165% in the fourth quarter, well above the 100% minimum, according to data from the European Banking Authority. Individual lenders publish their own figures, but generally don’t disclose any additional requirements on top of the minimum.

As an alternative to raising the LCR bar, the ECB may criticize individual banks over the quality of their reserves or ability to manage them, said the people. Lenders that hold smaller buffers than peers may be notified they are laggards, adding to pressure to improve reserves or potentially face a lower score on their ability to manage risks, said the people.

Recent developments, and in particular the speed of information and decisions taken by depositors and other market players confirm that “increased attention needs to be paid” to bank liquidity and funding, according to Andrea Enria, the ECB’s top oversight official.

With monetary policy tightening, “we have identified a need to focus on the sustainability of banks’ funding plans,” Enria told European finance ministers on Monday. “As a result, more prominence has been given to liquidity and funding risks in the supervisory priorities.”

--With assistance from Jan Bratanic and Steven Arons.

Author: Nicholas Comfort and Jan-Henrik Förster