Just when it looked like Wall Street was seeing a rebound in equity fundraising, bankers and would-be issuers are pumping the brakes.

War in the Middle East, surging Treasury yields and a fickle market for new issues are all risks that are expected to slow already depressed deal flow to a trickle this quarter by ramping up market volatility and dimming investors’ risk tolerance.

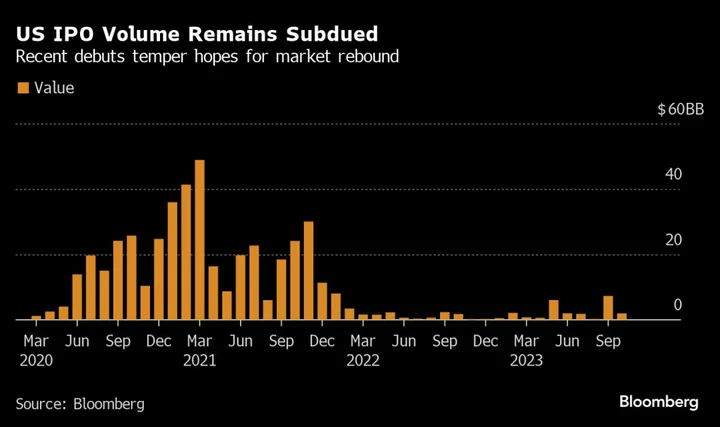

A string of underwhelming initial public offerings has only exacerbated skepticism on Wall Street as a dearth of new issuance nears a second full year. Just $47.6 billion has been raised in initial public offerings on US exchanges since the start of last year — less than the total for the final two months of 2021, data compiled by Bloomberg show.

The collapse has far-reaching repercussions, crimping companies’ access to capital, spurring banks to cut thousands of jobs and limiting the ability of long-time backers to cash in and recycle funds to other investments.

“I’m not expecting a lot of IPO activity between now and the end of the year,” said David DiPietro, head of private equity at T. Rowe Price. Would-be public companies have to be pretty confident in “projections for at least the following year, and it feels like that’s difficult given the external factors that can impact businesses.”

The IPO market’s success historically is driven by strength in equities and demand for riskier assets, and that appetite has faded. With the Federal Reserve signaling it will keep interest rates elevated and oil climbing amid Mideast tensions, the S&P 500 is on track for a third straight monthly loss.

Add to that the potential for a US government shutdown in November that could effectively close the IPO business for weeks and lackluster receptions for offerings like Birkenstock Holding Plc this month, and the reasons are mounting for the new-offering spigot to stay shut well into 2024.

“From talking to clients and others in the ecosystem, there could be a window that opens up in mid-to-late-March and onwards,” said Conor Moore, head of KPMG’s Private Enterprise practice.

Weighing Options

That said, some companies are still willing to test the current environment. Health-care payments software firm Waystar Holding Corp. and Hamilton Insurance Group Ltd. submitted filings last week, while oil and gas producer Mach Natural Resources LP set a price range for its IPO.

Other closely held firms are weighing different options, like private fundraising rounds. Meanwhile, those that are public can sell more shares or issue convertible debt, steps that only partly fill the hole left by an anemic IPO market.

Follow-on offerings have rebounded this year as firms, after raising record sums in 2020 and 2021, return to the capital market to replenish their coffers.

Corporate America and its biggest investors have brought in $77 billion from secondary equity sales this year, up about 50% from this point last year, data compiled by Bloomberg show.

Over the next month or so, as earnings season passes and trading restrictions lift, investors expect an uptick in activity through secondary sales of public companies with backing from private equity and venture capital firms.

“Catalyst-driven financings, specific uses of proceeds and balance-sheet management should continue to underpin follow-on and convertible activity for the remainder of the year,” said Dave Stadinski, global co-head of equity capital markets at Piper Sandler.

Convertibles Shine

Issuance of convertible debt has been one of the few bright spots for corporate fundraising this year, with companies refinancing existing notes and using the instrument to lower borrowing costs.

Convertibles are debt securities with an option to be converted into stock, and that hybrid nature makes them a cheaper alternative for capital raising. They may also weather a government shutdown because most aren’t registered with the Securities and Exchange Commission and therefore don’t need the agency’s approval.

US companies have issued $43.3 billion of convertible bonds this year, compared with roughly $30 billion for all of 2022, leaving this market on pace for a somewhat normal year in terms of volume, data compiled by Bloomberg show.

“Once companies come to the realization that interest rates aren’t coming back down as fast as they thought they were going to be, there is going to be rotation into convertibles to tap the lower cost structure,” said Richard Duffield, head of equity-linked capital markets at Citigroup Inc.