Australia’s economy maintained its momentum in the three months through June, with the expansion underpinned by exports and sectors less impacted by the Reserve Bank’s 12 interest-rate increases.

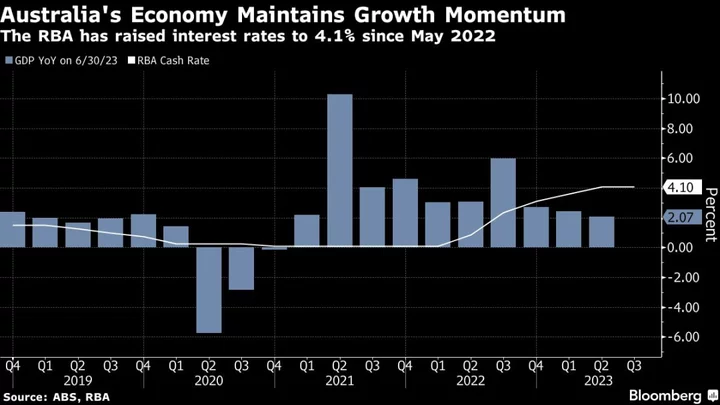

Gross domestic product advanced 0.4%, the same pace as the prior quarter and in line with economists’ estimates, official data showed Wednesday. From a year earlier, the economy grew 2.1% from an upwardly revised 2.4%.

While the result likely bolsters the Reserve Bank’s confidence it can bring the economy in for a soft landing, the data point to a further deterioration in the position of rate-sensitive consumers, an outcome the RBA will closely monitor. It regularly highlights uncertainty over the outlook for the household sector.

“From the RBA’s perspective, today’s report suggests the economy is navigating the tightening cycle with an encouraging degree of resilience,” said Andrew Boak, chief economist for Australia at Goldman Sachs Group Inc. Still, he said that elevated unit labor costs and persistently poor productivity “underscore the risk that inflation will prove uncomfortably sticky.”

Australia’s expansion is forecast to weaken from here as households face a squeeze from higher rates and prices, with today’s data showing private consumption rose just 0.1% last quarter. The savings ratio declined to 3.2% from a downwardly revised 3.6% three months earlier.

GDP per capita also contracted for a second consecutive quarter, down by 0.3% in both the March and June periods.

The weakness reflects the impact of the RBA’s 4 percentage points of hikes since May 2022 and is among reasons for the central bank’s three consecutive rate pauses at 4.1%.

“We think the accumulation of monetary tightening could start to hit the consumer more sharply in the next few quarters,” said Robert Thompson, macro rates strategist at the Royal Bank of Canada. “Whether this is enough to get inflation down to avoid further rate hikes remains to be seen.”

There is also growing uncertainty around China — the biggest buyer of Australian goods and services — as it grapples with a housing crisis. In recent times, Australia has benefited from China-driven high export prices that helped return the budget to surplus for the first time in 15 years.

Central banks worldwide are now near the peak of their tightening cycles as inflationary pressures begin to abate. The Federal Reserve is seen as likely to skip its September meeting with consumer prices rising modestly in July in what was the smallest back-to-back inflation readings in over two years.

That has bolstered expectations that the US economy will avoid a slump. Economists see about a 50% chance Australia’s A$2.5 trillion ($1.6 trillion) economy will slip into recession over the next 12 months.

For Australia’s center-left government, today’s GDP data will be a rare burst of good news amid still-elevated consumer prices and high borrowing costs.

“The National Accounts show the Australian economy remaining sturdy in the face of unrelenting pressure,” Treasurer Jim Chalmers said after the release, highlighting the slowdown in China. “We know there are challenges ahead, but we face them from a position of relative strength.”

Today’s GDP report also showed:

- Exports added 0.8 points to growth while machinery and equipment contributed 0.2 point

- Public investment advanced 8.2%, contributing 0.4 point to GDP

- Inventories were the biggest drag, subtracting 1.1 percentage point

- Compensation of employees climbed 1.6%, adding 0.4 point

--With assistance from Tomoko Sato.

(Adds comments from economists.)