Commerzbank AG’s shares declined after the German lender’s upgrade to its outlook for full year net interest income disappointed analysts and investors.

The bank predicts net interest income of about €7 billion and said there’s “additional upside potential.” That compares with previous guidance of more than €6.5 billion, according to first-quarter results published Wednesday. Commerzbank is already predicted to post about 7.3 billion euros for the metric this year, according to analyst estimates.

The shares fell as much as 5.2% in early trading in Frankfurt on Wednesday, the steepest drop since late March. The were trading 3.8% lower at 9:08 a.m. amid declines across the industry.

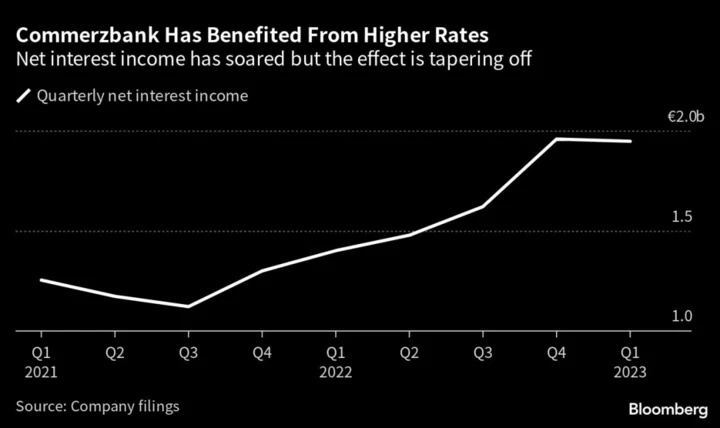

While the results are evidence of how the European Central Bank’s radical monetary policy tightening has shifted the fortunes of the continent’s lenders on lending income, it also demonstrates that the effect is beginning to taper. Still, rising rates have allowed Commerzbank Chief Executive Officer Manfred Knof to increase revenue targets several times, while he’s also boosted the profitability outlook and vowed to resume investor payouts.

Commerzbank also saw several pressure points, including a continued increase in provisions at its Polish unit mBank, taking the total amount of money set aside for legal risks in the country to 1.4 billion euros. The lender confirmed previous guidance for full-year net income “well above” 2022 and costs at about 6.3 billion euros despite inflationary pressures.

The lender “continued to benefit from higher interest rates and a good fee business,” it said in the statement. “Underlying net interest income reached a record high, even though the momentum slowed slightly compared to the previous quarter due to higher interest rates on deposits.”

The bank also said it received approval for a share buyback worth 122 million euros.

It’s a theme seen across the European banking industry as lenders currently earn 3.25% on money they park at the ECB, while most are still passing on only a small fraction of that to their clients on deposits. The trend is expected to stay intact for the remainder of the year even though intensifying competition for savings means that many banks are starting to raise the rates they offer.

Read More: Europe’s Banks Stay Upbeat on Profit Even as Loan Demand Ease

Knof’s headwinds including a struggle to wind down a portfolio of foreign-currency denominated mortgages in Poland. He’s also missed several cost targets, prompting Chief Financial Officer Bettina Orlopp to instead focus on improving the cost-income ratio, a key metric which measures the gap between expenses and revenue.

Costs rose slightly in the first quarter as Commerzbank set aside more money for bonuses to pay for the “strong” performance in the period, it said. The ongoing job cuts had a “positive effect” on costs, it also said.