China may allow banks to offer unsecured short-term loans to qualified developers for the first time, people familiar with the matter said, a major push to ease the property crisis that’s dragging down growth in the world’s second-largest economy.

As part of a package of new measures to backstop the real estate industry, regulators are considering allowing banks to issue so-called working capital loans to some developers, the people said, asking not to be identified discussing a private matter. Unlike other types of loans available to builders that typically require land or assets as collateral, the new financing facility would be unsecured and available for day-to-day operational purposes, potentially freeing up capital for debt repayment, the people said.

Officials are also weighing a mechanism that would allow one lender to take the lead on supporting a specific distressed builder by coordinating with other creditors on financing plans, the people said.

Implementation would require regulators to exempt bankers from being held accountable for possible bad loans given the high risks involved, the people said, adding that deliberations are ongoing and subject to change. The National Administration of Financial Regulation didn’t respond to a request for comment.

If the support measures are approved, they would represent China’s most forceful attempt yet to plug an estimated $446 billion shortfall in funding needed to stabilize the industry and deliver millions of unfinished homes. President Xi Jinping is also stepping up support for the broader economy, with moves this week indicating increased urgency to stop a downward spiral in the property sector from derailing growth and endangering financial stability.

A Bloomberg Intelligence gauge of developers surged as much as 8.2% on Thursday, while dollar bonds of some real estate companies have soared this week as investors bet on more policy action.

Authorities are finalizing a draft list of 50 developers eligible for financial aid that includes Country Garden Holdings Co. and Sino-Ocean Group, people familiar said earlier, part of a pivot by Beijing to help some of the nation’s most distressed builders. Meanwhile, China’s top lawmaking body said on Wednesday that banks should increase funding for developers to reduce the risk of additional defaults and make certain that housing projects get completed.

While the working capital loans may ease the industry’s near-term funding challenges, it’s unclear how they will ultimately impact developers’ ability and willingness to repay creditors, especially offshore bondholders who have already suffered billions of dollars in losses. Shifting more of the burden to lenders also comes with risk.

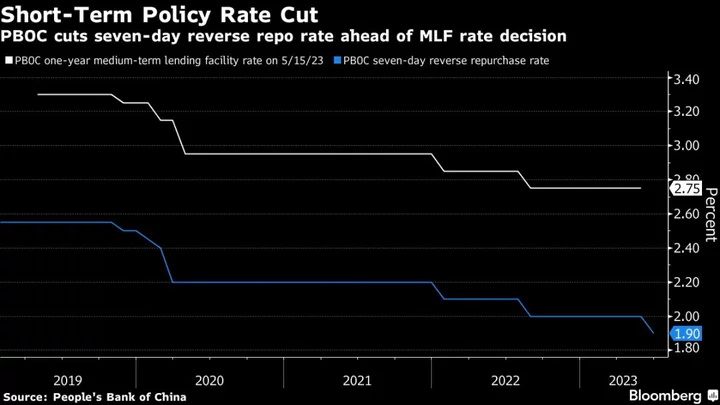

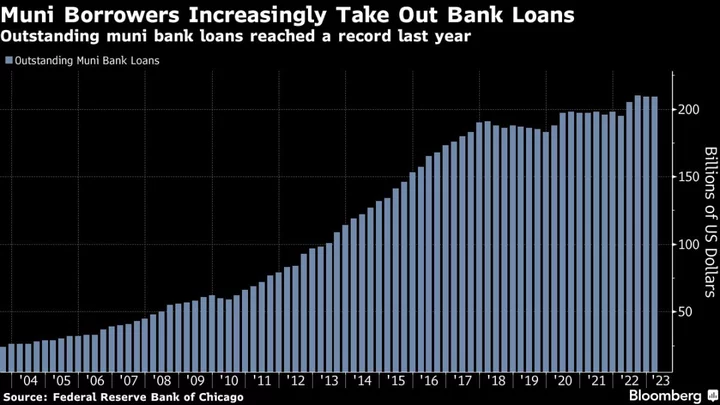

China’s $57 trillion banking industry has already been battling with shrinking margins and record pile of souring loans as authorities have steadily increased pressure on lenders to shore up the economy and the property sector. Net interest margins at commercial banks dropped to a record 1.73% at the end of September, below the industry’s 1.8% threshold seen as necessary to maintain a reasonable amount of profitability.

Outstanding property loans at the end of September fell on a yearly basis for the first time, underlining caution at the banks. At a meeting with top financial regulators last Friday, China’s biggest lenders, brokerages and distressed asset managers were told to meet all “reasonable” funding needs from property firms.