Big Oil won’t be missed by its renewable power competitors.

Shell Plc’s pivot away from wind farms and solar parks to the oil and gas that drove record profits is the latest example of the world’s biggest energy companies spurning a crucial tool for cutting carbon dioxide emissions. BP Plc previously softened its target for cutting fossil fuel production.

The green pullbacks may be a worrying sign for investors and policymakers seeking a quicker energy transition, but they also have the effect of widening the lanes for renewables firms in the game from the start. They include Spain’s Iberdrola SA, Denmark’s Orsted A/S and Germany’s RWE AG.

“Oil companies pulling back from renewables isn’t great for climate change, but it’s good for the existing competitors,” said Deepa Venkateswaran, an analyst at Sanford C Bernstein & Co. “If they had decided to subsidize renewables with oil and gas profits, and they were willing to accept lower returns, that wouldn’t have been good for utilities.”

The shift may be most notable in the offshore wind sector, where oil companies have used their financial heft to win government auctions at record-setting prices in the US and Europe. That, along with inflation and supply-chain constraints, helped upend the economics of a technology crucial to decarbonizing the power grid.

In the span of just a few years, Shell went from having an ambition to be the world’s biggest power producer to one without any renewable-electricity capacity target. It plans to invest more than six times as much on fossil fuels as it will on clean power in the coming years, according to a strategy update last week.

Meanwhile, BP wants to refocus its low-carbon spending on more profitable areas such as biofuels and convenience stores while being more selective with its power push.

Still, there’s no sign the low-carbon transition is slowing. This year, clean energy is set to attract a record $1.7 trillion of investment — about two-thirds more than the global investment in fossil fuels, according to data from the International Energy Agency.

That marks the eighth consecutive year green energy attracted more cash. Investment in solar power alone will surpass the amount of money going into oil production for the first time, the IEA expects.

Most of that money is destined for renewable-power projects that will be the backbone of any effort to reduce greenhouse gas emissions. They include projects as small as a few solar panels on a rooftop to multibillion-dollar wind farms coming online in the North Sea, the Atlantic Ocean off the US and waters off China’s east coast.

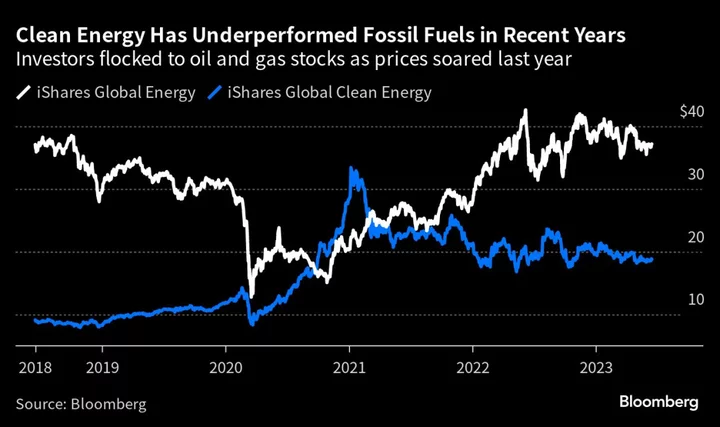

Still, times have been tough for major renewable power companies in recent years. Even as the deployment of wind and solar sets records, the business case is being undermined by soaring inflation and rising interest rates.

The costs of massive steel turbines have increased so much and so quickly — more than 20% since the end of 2019 — that they’ve put some projects at risk. And wind, especially harnessed offshore, is a business that’s been particularly attractive for European oil companies with experience working on major projects at sea.

“The way markets deal with price wars is someone blinks, and if Shell is blinking, it will relieve that price pressure,” said Michael Liebreich, former chief executive officer of BloombergNEF and an energy consultant who’s advised Shell. “It’s normal market hygiene.”

As far as the health of the transition itself, the reduction in Big Oil money won’t make much difference for key bottlenecks such as electric grid capacity.

UK Windfall Tax on Renewables Could Hurt Decarbonization Efforts

Competition has been a core problem for the wind industry. Governments have come to expect that technological advancements and industrial scale will keep driving power prices down.

However, perpetually falling prices, especially when costs increase, aren’t sustainable and have put renewables’ impressive growth at risk of cooling. The exits of some players may make it easier for the companies that stay in the space to raise prices to a sustainable level and to ramp up investment.

“It’s become increasingly clear that it is not easy to make money in renewables and that is where the difference between us and most other actors is,” said Mads Nipper, chief executive officer of Orsted. “We’re more experienced at this and probably better than them.”