Australia’s central bank unexpectedly raised its key interest rate and kept the door ajar to further hikes as inflation remains well above target and labor costs jump.

The Reserve Bank raised its cash rate by a quarter-percentage point to 4.1%, the highest level since April 2012, bringing its cumulative tightening to 4 percentage points since May last year. Only 10 of 30 economists surveyed by Bloomberg predicted the rate rise while money markets saw about a one-in-three chance of a hike.

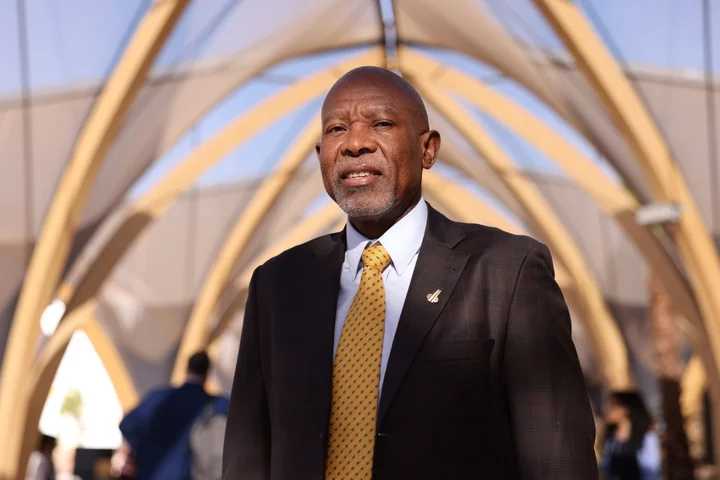

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve,” RBA Governor Philip Lowe said in his post-meeting statement.

Market expectations that the RBA’s tightening cycle has further to run sent the currency and government bond yields higher. The Australian dollar was 0.8% stronger on the day at 66.71 US cents at 2:37pm local time. Stocks extended losses after the decision.

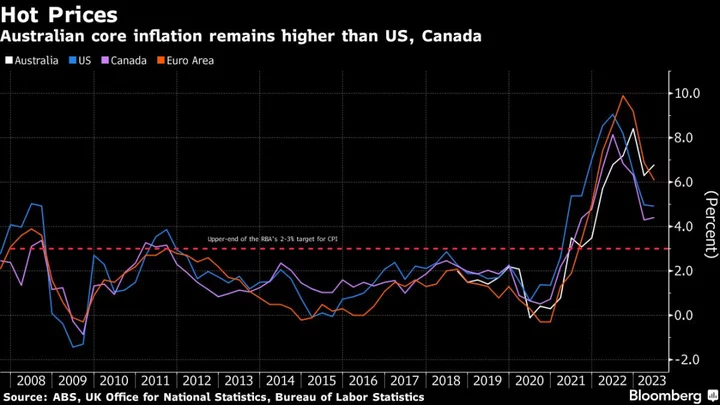

The central bank’s back-to-back hikes reflect accelerating services inflation, a tight labor market and a turnaround in house prices. Lowe says RBA decisions are now driven by data — which has proved volatile — and the key issue remains consumer prices running at around 7%, versus a 2-3% target.

That has been compounded by Australia’s industrial relations umpire raising the national minimum wage by 5.75%, effective July 1, for about one-in-five of the nation’s workers. The decision prompted some economists to revise up their peak rate forecasts — with Deutsche Bank AG now seeing 4.6% in September.

“The board remains alert to the risk that expectations of ongoing high inflation contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment,” Lowe said in his statement.

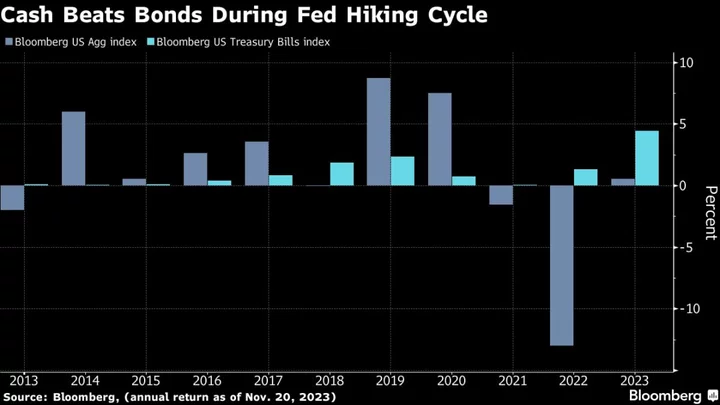

Compared with global counterparts, the RBA has taken a slower and more cautious policy approach, worried about very high levels of household debt and how far it can push up borrowing costs. In contrast, Asia-Pacific peers like New Zealand have gone harder earlier and are now signaling their tightening cycle is concluded.

Elsewhere, Bank of Canada policy makers are also mulling a rate rise ahead of next week’s Federal Reserve meeting, when the US central bank is expected to pause its aggressive tightening campaign.

Lowe will have an opportunity to further flesh out the RBA’s thinking and its outlook for the economy in a speech Wednesday at 9:20 a.m. Sydney time.

Tuesday’s surprise hike came a day before data is expected to show Australia’s A$2.3 trillion ($1.5 trillion) economy grew at its weakest quarterly pace since the three months through September 2021, suggesting the RBA’s tightening over the past year is slowing activity.

Still, underlying strength remains, bolstered by substantial savings built up during the pandemic and very low unemployment. A recovery in the property market is also likely to see home owners feeling wealthier and more inclined to spend.

“The board is still seeking to keep the economy on an even keel as inflation returns to the 2–3% target range, but the path to achieving a soft landing remains a narrow one,” Lowe said.

--With assistance from Tomoko Sato, Matthew Burgess and Georgina McKay.

(Adds market reaction, further statement details.)