A lightening-fast policy reset from Nigeria’s newly elected president has placed Africa’s biggest economy back on the radar of global investors, but they’re likely to tread with caution.

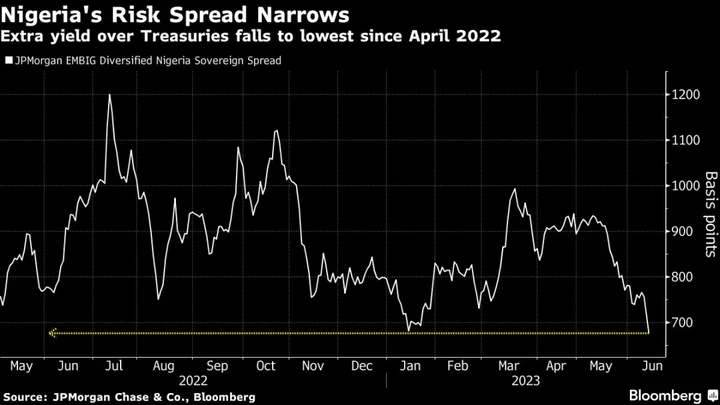

President Bola Tinubu’s moves — unshackling the currency and dismantling in a stroke a costly decades-old system of fuel subsidies — have made Nigerian dollar bonds among the top emerging market performers this week, while the Lagos stock exchange has been the biggest gainer worldwide in local-currency terms.

But Tinubu must prove his commitment to follow through on all the reforms before “badly scarred” investors decide to dive in, according to Hasnain Malik, a strategist at Tellimer in Dubai. Foreign fund managers have endured “a market-unfriendly response, asset-value collapse and trapped capital” several times in the past two decades, he added.

It remains to be seen if this is the turning point that makes Nigeria genuinely investable, Malik wrote.

“If not then this is merely an opportunistic trade for those who believe they will be lucky enough to time their exit before the next crisis.”

The main issue is how far authorities might go in overhauling a dysfunctional currency system. Former central bank Governor Godwin Emefiele had allowed multiple exchange rates to develop, pushing many transactions to the black market. Investors fled after Nigeria was ejected several years ago from several mainstream bond indexes.

On Wednesday, the central bank stood aside, allowing the naira to slide 29% to 664 per dollar at the close. But the jury is out on whether authorities free the naira entirely or leave some controls in place.

“The end-game for monetary/FX policy still remains quite uncertain,” Goldman Sachs Group Inc.’s Andrew Matheny and Bojosi Morule said.

They predict higher interest rates to offset pressure on the currency, with benchmark interest rates currently at minus 3.7%, once adjusted for inflation. What’s more, they estimate a $12 billion backlog of unmet dollar demand, which the central bank will need to clear before it can unify all the multiple exchange rates.

“Devaluing the currency is a necessary but not sufficient condition for unifying the official and parallel-market exchange rates,” Matheny and Morule wrote. Nonetheless, they were “positively surprised by the pace of policy changes.”

Derivatives traders are bracing for steeper declines in the naira. In the non-deliverable forwards market, the 12-month contract slumped 8.5% to 855 against the dollar, set for its biggest drop since March 2020. The three-month tenor fell 3.3% to 755 against the dollar.

“As a rule, these de-peggings generally turn into a buying opportunity, but rarely on Day One,” said Paul McNamara, a London-based fund manager at GAM UK. “It’s a step in the right direction but there is a fair bit that would need to happen before we get more confident.”

McNamara said he was still “investigating” after the money manager stopped looking at Nigeria “a long time ago.”

Besides moving on the currency and fuel subsidies, Tinubu, the former governor of Lagos state who was sworn in May 29, is targeting 6% per annum economic growth. He has committed to doubling electricity generation and ease the way for foreign investors to repatriate profits.

READ MORE: Nigeria’s $10 Billion Fuel Subsidies Are ‘Gone,’ Tinubu Says

On Thursday, the stock market paused for breath, having risen more than 6% this week, while one of the main sovereign dollar bonds, the security due 2047, gained less than half a cent, after a 2-cent rise on Wednesday.

Naira bonds have seen more subdued moves, given uncertainty over inflation, interest rates and the exchange rate.

“In local markets, price discovery in dollar-naira will still need to improve after yesterday’s adjustment,” said Samir Gadio, head of Africa strategy at Standard Chartered Bank. “For now, a positive momentum for Nigeria’s external bonds is likely to persist, as the pace of reforms has exceeded expectations.”

--With assistance from Srinivasan Sivabalan and Monique Vanek.

(Adds details on non-deliverable forwards in 11th paragraph, comments by GAM in 12th and 13th paragraphs)