UniSuper, one of Australia’s largest pension funds, has reported that investments across its A$115 billion ($77 billion) portfolio are more harmful to the environment than previously estimated.

The fund has published a revised version of its climate risk report, showing higher carbon footprints across all investment strategies used by more than 600,000 members for their retirement savings. UniSuper had previously removed the disclosures from an earlier version of the report after finding some errors, Bloomberg reported in March.

Ernst & Young LLP was engaged to review the fund’s emission data, according to the updated report. As part of the review, the consulting firm interviewed UniSuper staff and checked the accuracy of calculations, the document shows.

A spokesman for UniSuper confirmed an updated report was published last month, but declined to comment on the revisions or why they were higher.

Australia’s A$3.4 trillion pension industry is under mounting pressure to stand up environmental claims, especially as it continues to be a big investor in fossil fuel companies. The Australian Securities and Investments Commission is running a ruler over climate claims of financial institutions, amid a growing concern that some may be making statements that could mislead retail investors.

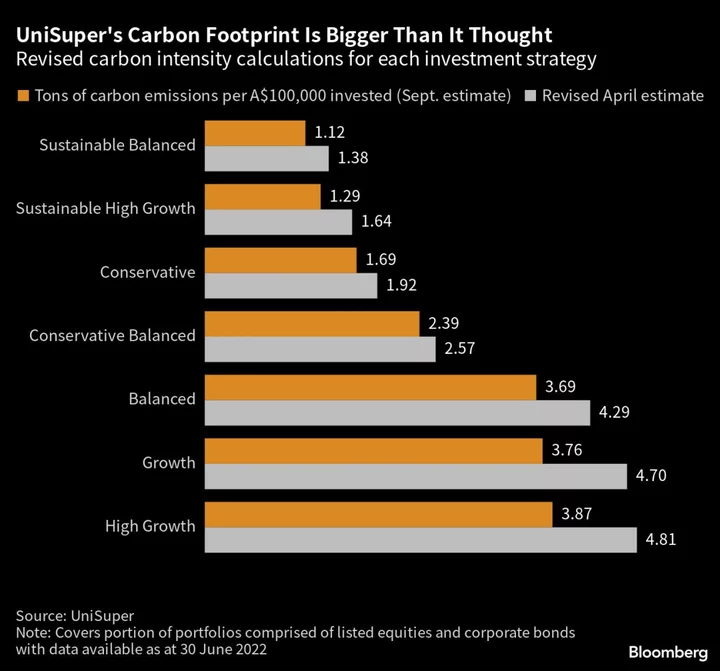

UniSuper’s new report revises the carbon intensity levels of its balanced portfolio, the default option for members, to 4.29 tons of emissions per A$100,000 invested from 3.69 tons in the original version published in September. When the investments are grouped by asset classes, one of the biggest revisions is in the international equities portfolio where levels almost doubled to 2.92 tons per A$100,000 from 1.56 tons.

The calculations include only Scope 1 and 2 emissions, based on the portion of the portfolio’s listed equities and corporate bonds that provided carbon data as at June 30, 2022, according to the new report.

“One of the key limitations in calculating a carbon footprint is the completeness of available emissions data,” UniSuper said in the report. “Measuring and estimating emissions accurately can be challenging.” The fund added that it “strongly encouraged” the mandatory adoption of climate-related financial disclosures to ensure consistency across companies.

Another Australian pension fund, Active Super, had also removed its responsible investment report from its website, Bloomberg reported in March. The fund is undertaking a review of ESG-related materials, a spokesman said in an emailed statement this week.

Climate issues are an increasing concern for Australian workers. Employers must pay 10.5% of their salaries into pension accounts, known as superannuation, which rises to 11% in July. UniSuper and Active Super are among some funds that have voluntarily published climate risk disclosures, which can help workers decide which fund they will choose to manage their savings for retirement.

“There’s a worrying trend of super funds removing climate disclosures from their websites in response to scrutiny by regulators over greenwashing and members are very concerned,” said Brett Morgan, superannuation funds campaigner for Market Forces, which is behind a project calling for UniSuper to divest from fossil fuels.

The Australian government is consulting on new climate-related financial disclosure standards, an idea that appears to be gaining broader support in the investor community. The finance sector currently uses a mixture of in-house and external sources for the collection and aggregation of emissions data.

ASIC launched its first greenwashing court action against Mercer Superannuation Australia Ltd. in February and has warned it’s primed for more cases, including in the superannuation sector. It issued 11 infringement notices and agreed on 23 corrective actions in relation to greenwashing in the nine months through March.