Shares in Asia are braced for a cautious open Thursday after US stocks ticked higher and Treasuries fell on data showing consumers expect inflation to persist.

Equity futures for Australia were little changed and those for Hong Kong edged lower, even as an index of US-listed China shares gained ground. Japanese markets are closed for a holiday.

The S&P 500 rose 0.4% Wednesday, ahead of the Thanksgiving holiday, resuming a November rally that has lifted the index around 8%, on track for its best month since July last year.

Treasuries fell Wednesday, weighing on Australian and New Zealand government bond yields in early Asian trading. Trading in cash Treasuries in Asia will be closed given Japan’s holiday.

The Wednesday selling in Treasuries pushed the two-year and five-year yields three basis points higher. The increase in yields reflected fresh data showing US consumers expect inflation will climb at an annual rate of 4.5% over the next year, up from the 4.4% expected earlier in the month, according the University of Michigan.

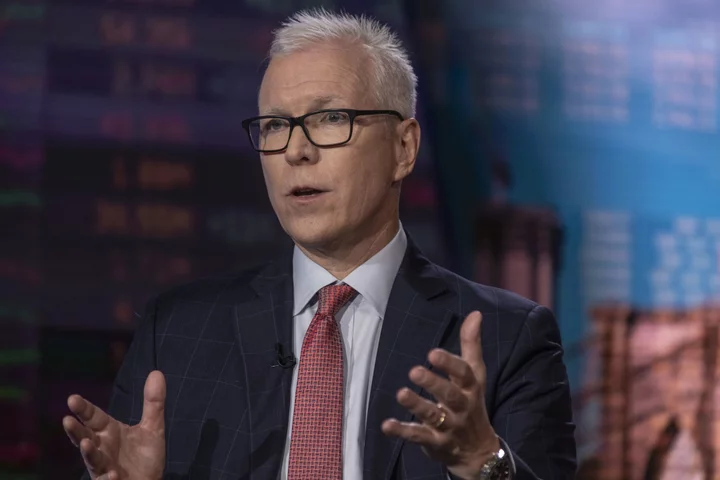

“For a data-dependent Fed, this is not good news as they do not want to see consumer inflation expectations become unanchored, since historically it becomes increasingly difficult to reset consumer psychology towards a lower inflationary environment,” said Quincy Krosby, chief global strategist for LPL Financial.

Rising US yields helped the dollar, which rose against major currencies Wednesday, staunching a decline from earlier in the week. The yen was steady at above 149 per dollar Thursday after weakening in the prior session.

In Asia, Indonesia’s central bank is expected to keep its benchmark interest rate steady. Data set for release include Taiwan industrial production and Singapore consumer prices.

China’s property sector remains in focus. China’s Shenzhen rolled out two new homebuying measures to spur activity in its property market. Country Garden Holdings Co. and Sino-Ocean Group have also been included on China’s draft list of 50 developers eligible for a range of financing support, according to people familiar with the matter.

Elsewhere, reports showed some market participants are wary of reconnect with the Industrial & Commercial Bank of China Ltd. following a cyberattack that affected trading.

Investors were also keenly awaiting news on a Brookfield Asset Management-led offer to buy Origin Energy Ltd., after media reports a shareholder meeting planned for Thursday would be delayed.

Oil fell on news that the OPEC+ group of oil producing countries would delay a meeting, reducing the likelihood of an imminent production cut to buoy prices. Brent crude and West Texas Intermediate both fell close to 1% Wednesday.

Some of the main moves in markets:

Stocks

- Hang Seng futures fell 0.3% as of 7:28 a.m. Tokyo time

- S&P/ASX 200 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was little changed at $1.0885

- The Japanese yen was little changed at 149.53 per dollar

- The offshore yuan was little changed at 7.1633 per dollar

Cryptocurrencies

- Bitcoin fell 0.2% to $37,555.75

- Ether fell 0.2% to $2,078.67

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.40% Wednesday

- Australia’s 10-year yield advanced four basis points to 4.48%

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.