(Bloomberg Markets) -- In Morocco trucks from a Connecticut logistics company ferry car parts and clothing across the Strait of Gibraltar. In Japan a new semiconductor plant transforms a once-quiet farm town. In France a battery plant’s staff learns to supervise new colleagues: robots.

These moments, which might seem unrelated, represent a transformation in world trade. US-China tensions and Russia’s invasion of Ukraine are leading companies to bring supply chains closer to home. A shift from fossil fuels is spurring demand for materials essential for electrification. Artificial intelligence is forcing employees to learn new skills so they won’t be replaced by computers. Long before these trends are reflected in government data, they’re already changing global commerce, which amounts to $32 trillion a year in goods and services, according to the World Trade Organization. Bloomberg Markets dispatched reporters to discover what this upheaval looks like on the ground.

Local Trade Routes Are Stretched Thin

On a good day, Shelby Alamillo crosses the Rio Grande eight times. He drives along the World Trade Bridge, whose eight lanes of dusty roadway connect Mexico’s industrial heartland and South Texas.

A trucker for a company called Super Transporte Internacional SA de CV, Alamillo, 39, is hauling—or, as he says, moving—auto parts to and from the US and Mexico. “It’s very impressive, all the trailers that cross per day,” he says. “The first move that I made, wow, I was in shock.”

Port Laredo, as it’s called, includes an airport, one rail and four vehicle bridges. No other US land, sea or air crossing has been handling a higher dollar value of goods each day. Avocados, furniture and cars make their way north from Mexico. Auto parts, corn and gasoline head south from the US.

For now, Alamillo says, traversing the bridge can take as little as 10 minutes, though about once a week, he runs into backups of three to four hours. The Texas Department of Transportation predicts that by 2050 its average crossing time could reach 8 hours and 47 minutes. This year, South Korea’s Kia Corp. and Austin-based Tesla Inc. announced plans for new electric-vehicle production in the Mexican border state of Nuevo León, where foreign investment is booming.

Traffic is surging as the US tries to source more supplies from Mexico because of the trade war with China. Maeva Cousin, a Bloomberg economist, calculates that US imports of tariffed goods from China are down about $150 billion from where they’d otherwise be. Mexico is filling much of the gap.

The port of entry is situated in Laredo, a city of Spanish colonial buildings and a quarter million residents. Nearby, developers are building millions of square feet of warehouse and industrial space because of the surge in international trade. Local officials are pushing for federal approval to expand the bridge to 10 lanes, as well as add an eight-lane crossing alongside—at a cost of at least $40 million for both. “We’re probably a few years behind where we need to be,” says Gene Lindgren, chief executive officer of the Laredo Economic Development Corp. “But we have a plan to catch up.” —Laura Curtis

Wanted: Robot Wranglers

Wearing white protective clothing from head to toe, the trainees gaze through windows at boxes moving along an automated production line. Yellow robotic arms are handling a precious payload of parts for EV batteries, which must be assembled in a sealed environment to keep out dust and humidity. In southwestern France, the workers are preparing for a marquee kind of job these days: supervising robots.

After just five weeks of training, Ludovic Josien, who previously spent his career in traditional car factories, has to be ready to intervene when the machines do something wrong. “Everything here is really a new world,” he says. “All the modern protocols have to be learned and taken on board very, very fast.”

His employer, three-year-old Automotive Cells Co., or ACC, plays a key role in Europe’s ambitions to challenge China in building EV batteries. Backers include Mercedes-Benz Group AG and Stellantis NV. Josien is learning his trade at what ACC calls a “pilot plant,” where it develops products and tests manufacturing methods in the town of Nersac.

Then, he’ll head 650 kilometers (400 miles) north, to the company’s so-called gigafactory in Douvrin. ACC is hiring two or three people a day as it builds the factory’s staff of 2,000, while employees continue training to keep pace with the latest technology. “We have to do better than the competition while also moving faster,” says Gilles Tardivo, the factory’s manager. —William Horobin

Friends May Also Be Frenemies

Just across the border from Detroit, a field of gravel, sand and grass sits idle in Canada. Winds from nearby Lake St. Clair whistle through the site. On this weekday in May, two warehouse-shaped buildings stand with their pillars exposed as a Canadian flag flutters from a crane.

Consider this Windsor, Ontario, project a monument to the risks of national industrial policy, which can pit one friendly country against another—even when they’re united in their desire to manufacture closer to home rather than in China. The plant had been slated to produce batteries for millions of EVs across North America. NextStar Energy Inc.—a joint venture of Stellantis, which owns the US brands Chrysler, Dodge and Jeep, and South Korea’s LG Energy Solution—said it would create 2,500 jobs.

But NextStar halted the project in May, saying it could get a better aid package from the US. The Canadian and provincial governments had initially offered subsidies worth C$1 billion ($755 million). Afraid of losing an economic prize, Prime Minister Justin Trudeau’s administration in July upped the offer to C$15 billion, and NextStar accepted. In other words, Stellantis and LG extracted an additional C$14 billion from taxpayers. Not bad for two months of no work.

Before the US started offering richer subsidies, the companies and Canada had been fine with a less generous deal, according to Flavio Volpe, president of the Automotive Parts Manufacturers’ Association in Canada. This negotiating strategy, and the government’s response, he says, “will become a business case to study.” —Sam Kim

Innovators Need Incubators

Tucked in the rolling green hills of County Kerry in western Ireland, a startup is conducting an experiment that could shake up global manufacturing. The company, Wazp, makes hand and face mannequins for Ikea that are used in interior design and retail displays.

The Swedish retailer, known for affordable prices, would typically look to low-cost countries such as China for manufacturing. But Wazp can offer Ikea an alternative: 3D printing. A Wazp employee uses the boxy white printer, roughly the size of the office Xeroxes of yore, to make a life-size mesh hand. With a keystroke from a computer, the machine makes one in minutes out of plastic resin, and employees then brush off excess powder as if it were snow from a windshield.

For co-founders Shane Hassett and Mariana Kobal, it’s the next frontier: manufacturing on demand. Hassett and Kobal spent a year at a local university incubator developing a business plan. The Irish government is helping fund the business—until, ideally, the company attracts more private capital. Hassett says profitability is within sight. The company has already expanded into making the outsoles of Vivobarefoot shoes.

Until recently, 3D printing has been used for making prototypes, not for mass production. Hassett says it won’t be long before it supplants labor-intensive factories, bringing manufacturers closer to customers and reducing waste and carbon emissions. As companies look to alternatives to Chinese factories, Hassett sees a booming market. “3D printing has really exploded in the United States and in Europe,” he says. —Brendan Murray

Brexit Offers an Unexpected Boost

In a Namibian village, Tueurora Kaatahi grew up in a homestead made of corrugated iron, held together with cow dung and mud paste. Her grandmother sold sugar, maize meal, salt and tobacco out of her house, and her grandfather raised cattle. In September she’ll complete an unexpected journey: She’ll graduate from SOAS University of London with a master’s degree in creative and cultural studies, which prepares students for a career in the arts.

The first in her family to go to college, Kaatahi benefited from the UK’s decision to turn away from Europe. After Brexit, UK universities braced for a devastating decline in foreign enrollment because EU students faced more barriers. So the government liberalized visa requirements for the rest of the world, resulting in a flood of students from Africa, Asia and the Middle East. Kaatahi plans to work for five years in London before returning to live in Namibia. “I didn’t want to go to any country other than the UK,” says Kaatahi, 29. “You feel connected to the whole world when you’re in London.”

Kaatahi and her non-British classmates are “one bright spot” for the post-Brexit UK, according to Jonathan Portes, an economics and public policy professor at King’s College London. They contributed £41.9 billion ($51.9 billion) to the UK economy during the 2021-22 school year, up 34% from three years before. “We would be in big trouble if we didn’t have these international students,” Portes says. —Bryce Baschuk

War Scrambles Supply Chains

The maritime traffic never stops cutting through the cobalt-blue Mediterranean waters of Brindisi, a port in southern Italy. Cruises, cargo vessels and, increasingly, ships carrying liquefied natural gas negotiate a tangle of concrete piers packed with cables, cranes and containers.

LNG is moving through Brindisi as never before, because the European Union no longer wants to import natural gas from Russia. Before the Ukraine invasion, gas flowed freely from north to south. Now, the direction has reversed. Gas from North Africa and the Middle East is replacing Russia’s, through pipelines and LNG containers often unloaded on Italy’s southern coast, in towns such as Brindisi.

The EU is helping pay for an expansion of Brindisi’s port to let more containers come through the dock. A new pipeline, called EastMed-Poseidon, is wending its way from Israel. Italian gas transport company Snam SpA is planning €2.4 billion ($2.7 billion) in investments for a network of pipelines along Italy’s east coast.

Environmental groups are opposing EastMed-Poseidon and the widening of the port because of the potential impact on marine life. Longtime Brindisi residents worry the energy-related construction will damage the beauty of an ancient town of cobblestones and Roman columns. But others are reveling in the city’s heightened position in global commerce, as well as growing employment in a relatively poor part of Italy. “We are proud of our role and working hard to meet the new challenges and opportunities,” says Gabriele Menotti Lippolis, who leads the Confindustria Brindisi business association. — Alessandra Migliaccio

A Country Hedges Its Bets

Each day, some 60 trucks from XPO Inc. board ferries heading across the Strait of Gibraltar. They’re hauling car parts, clothing and other goods from Africa to Europe. The XPO vehicles rumble through a port near Tangier, the ancient Moroccan city of whitewashed houses and winding streets. The Tanger Med port opened only in 2007 and is already the busiest container port in Africa.

At Greenwich, Connecticut-based XPO, annual revenue in Morocco, recently $99 million, has been growing at a 30% a year clip. Its booming business illustrates how the country is ideally positioned to prosper. It doesn’t matter whether Europe and the US continue relying on China for manufacturing or instead accelerate a shift of their supply chains closer to home. XPO has long handled freight for US and European companies. Now, two of its largest customers are Chinese auto-component makers.

European and American businesses are filling Morocco’s rural north with factories. Thousands of Moroccans already work in Renault SA and other auto-assembly plants, and American aircraft giant Boeing Co. has plans to add as many as 8,700 jobs by 2028. The port is expanding its berth space to handle the EV boom.

The Chinese and Moroccan governments are planning to transform a rugged landscape of rolling hills and sheep farms a half hour’s drive inland into what they’re calling Tanger Tech City, a home for hundreds of Chinese companies. “Morocco is taking the opportunities from several countries—several, let’s say, powerful countries—that want to invest, that want to produce, that want to commercialize from Morocco,” says Luis Gomez, XPO’s European president. —Brendan Murray

High-Tech Factories Bring Low-Tech Troubles

In the Japanese farm town of Kikuyo, mornings begin with some of the country’s worst traffic jams. Thousands of engineers, many suffering through 90-minute commutes, inch past fields of daikon and carrots. It’s the price they pay for working in what will soon become the country’s most advanced semiconductor hub.

To regain its former leadership in the industry, Japan is planning to offer $14 billion in subsidies for new factories and production lines. The government is paying half the cost of a new Taiwan Semiconductor Manufacturing Co., or TSMC, factory in Kikuyo and is in talks to help fund a second plant nearby. From a US perspective, it helps that these crucial chips will be made outside Taiwan, which China considers its territory.

Resentment in Kikuyo is building among residents, undermining political support for the country’s silicon ambitions. More drivers now take side roads to avoid the congestion, speeding down narrow lanes that border the town’s farms.

“TSMC brings nothing but trouble,” says Satoru Futa, a longtime member of Kikuyo’s town council. The 70-year-old blames semiconductor-related traffic for the deaths of three friends. The company says it’s working with local governments to expand roads and encouraging its employees to take public transportation. —Mayumi Negishi

India Is Coming For China

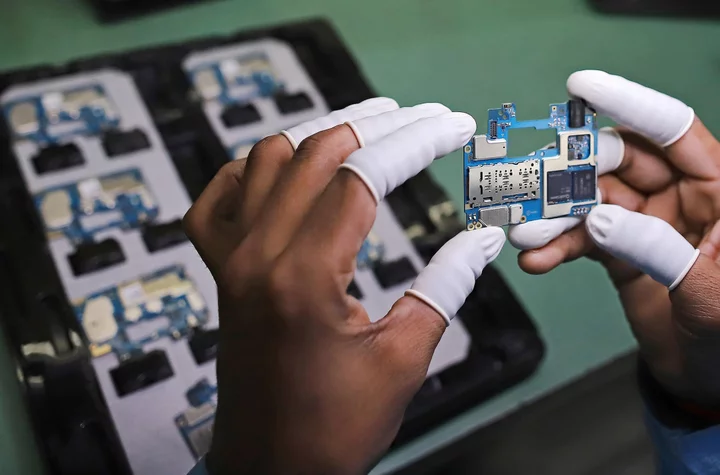

Before they reach the factory floor where they assemble mobile phones, workers at Dixon Technologies (India) Ltd. walk through an “air shower” that blows away any dust they’re carrying. For each phone, the plant must put together hundreds of parts, as if they were tiny jigsaw puzzles. It takes about 45 minutes to assemble each shiny new Motorola handset.

To reduce India’s reliance on China, Prime Minister Narendra Modi is providing financial incentives to promote domestic manufacturers such as Dixon, which operates in Noida, about 40 kilometers from New Delhi. For now, the share of manufacturing in India’s gross domestic product stands at 13%, well below Modi’s 25% goal.

China outperforms India in making sophisticated technology—the so-called value-add that leads consumers to pay more for items such as electronics. Chinese manufacturers’ value-add is currently 49%, compared with 20% for India’s, the government says.

Brand-name companies hire Dixon as a contract manufacturer. Along with Motorola, its phone customers include Samsung Electronics, Nokia, Reliance Jio and Xiaomi. Dixon’s annual revenue, most recently $1.5 billion, is five times as much as it was five years ago. “The factory is running at 100% capacity,” says Chief Financial Officer Saurabh Gupta, who adds that India will need more semiconductor capacity to compete with China. “The change will be painstakingly slow,” he says. —Ruchi Bhatia