As it seeks to pull off what could the largest initial public offering of the year, Arm Holdings Ltd. spent more than 3,500 words explaining the risks it faces in China, a critical market that accounts for about a quarter of its revenue.

In a chunky section of the IPO filing’s 330-page prospectus, the British designer of chips detailed a litany of challenges in the country: a concentration of business in the People’s Republic of China that “makes us particularly susceptible to economic and political risks affecting the PRC”; a downward spiral in Asia’s biggest economy; rising political tensions with the US and the United Kingdom; and the potential complete loss of control over its pivotal Chinese subsidiary.

Arm runs most of its China business through an independent unit, called Arm Technology Co., which is its single largest customer and accounted for about 24% of its sales in the year ended March. But Arm and its parent, Japan’s SoftBank Group Corp., don’t control that business.

Instead, SoftBank owns approximately 48% of Arm China, with the majority held by local investors, including entities affiliated with Allen Wu, Arm China’s former chief executive officer who was fired over allegations of conflicts of interest in 2020. The prolonged power struggle still leaves open the risk of leadership changes and affect regional operations, Arm said.

“We depend on our commercial relationship with Arm China to access the PRC market,” the filing said. “If that commercial relationship no longer existed or deteriorates, our ability to compete in the PRC market could be materially and adversely affected.”

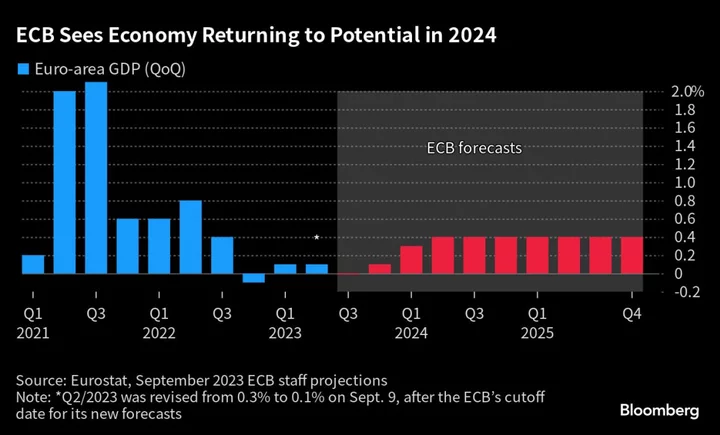

More immediately, a slowdown in the world’s biggest smartphone market and manufacturing hub, as well as steps by the US and its allies to limit China’s access to leading-edge technology, are eating into sales. Arm’s had to sell architecture for lower-performance chips in China, the company said.

Arm’s royalty revenue growth in the China slowed last fiscal year, and the company warned royalty revenues and licensing revenue could take further hits in the future.

Those “shaky ties” with Arm China present a risk to profit in the future, according to Bloomberg Intelligence analysts Marvin Lo and Chris Muckensturm.

“SoftBank’s filings for Arm’s IPO reveal the semiconductor designer’s high vulnerability to the Sino-US tech war and the industry’s smartphone-chip destocking,” they wrote in a research note. “Its commercial relationship with Arm China — the IPO hopeful’s top client which contributed 24% of its revenue in fiscal 2023 — could be disrupted.”

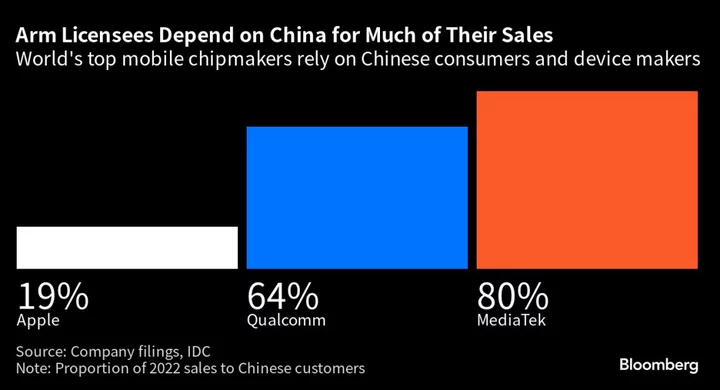

Arm’s biggest customers include Apple Inc., which relies on China for close to 20% of its revenue every year, with its major hardware lines all powered by Arm-based processors. Leading mobile chipmakers Qualcomm Inc. and MediaTek Inc. sell the bulk of their chips, built on Arm designs, to Chinese smartphone makers.

The Cambridge-based company depends on a handful of companies for a majority of its sales. Five entities including Arm China accounted for a combined 57% of Arm’s total revenue for the fiscal year ended March 31, according to the filing.

“A significant portion of our total revenue comes from a limited number of customers, which exposes us to greater risks than if our customer base were more diversified,” the filing said.

Arm is expected to target a valuation of $60 billion to $70 billion in its IPO, Bloomberg News has reported. While Arm had been aiming to raise $8 billion to $10 billion in the IPO, that target could be lower if SoftBank decides to hold onto more of the company after buying Vision Fund’s stake in it. That transaction valued Arm at more than $64 billion, based on the filing.

--With assistance from Liana Baker and Vlad Savov.