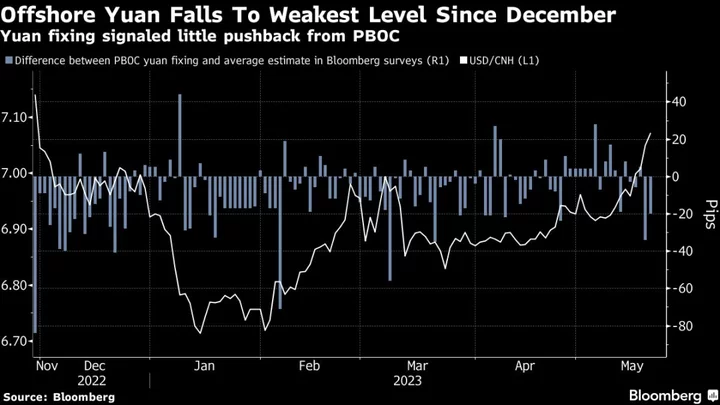

China’s yuan is depreciating at the fastest pace in three months and the central bank, for now, isn’t standing in the way.

The offshore yuan, extending its decline to as low as 7.075 Friday, is headed for the biggest weekly loss in three months after the People’s Bank of China set the currency’s fix weaker than 7 per dollar for the first time since December. Friday’s yuan fix stood broadly in line with the average estimate in a Bloomberg survey of analysts and traders.

“At this point, the authorities are allowing the currency to adjust to the dollar strength and not pushing back yet,” said Khoon Goh, head of Asia Research at Australia & New Zealand Banking Group. “This will embolden the market to push dollar-yuan higher and test the authorities tolerance level.”

The currency has traded softly after a string of disappointing China data dented recovery hopes. The greenback’s surge overnight, driven by optimism about US debt ceiling talks and hawkish Fed comments, has also hurt the yuan. PBOC’s calm reaction followed Governor Yi Gang’s speech in March that the level of 7 per dollar was no longer a psychological hurdle.

The market now is awaiting to see how the PBOC will manage the yuan as the US Federal Reserve nears an end to its rate-hike cycle and China reopens. Recent depreciation of the yuan is within a “controllable range”, a state-owned newspaper reported Friday.

The central bank’s reaction so far is in stark contrast with last year, when the PBOC deployed a variety of tools to help support the yuan. Measures such as stronger-than-expected fixings, the lowering of reserve requirements for bank’s foreign currency deposits, nudging costs for forward trading and the issuing of trading guidance to banks to warn off speculators, were all used.

Onshore yuan narrowed losses to trade little changed at 7.0387 per dollar as of 2:00 p.m. Beijing time on Friday as heavy dollar selling emerged in the spot market, according to traders who asked not to be named as they are not authorized to speak publicly.

“The PBOC is willing to allow normal market adjustments, especially as USD/CNY moves have been generally in line with rate differentials,” Citigroup strategists said in a note. “Tools like the FX RRR and imposing ceilings on outbound lending could still be adjusted if needed,” they added.

(Updates with backgrounds of FX policies last year in the sixth paragraph, yuan prices and trader quote in the seventh and Citigroup view in the eighth paragraph)