Hello from New York, where we’re looking to fill the hole left by last week’s Succession finale. Back to reality, where living in one of the world’s costliest cities has some people looking left and right for a touch of relief — even if it means traveling to Argentina where 100% inflation makes Taylor Swift tickets a world-class bargain. Here are some things you need to know for the week ahead.

The big chill: A highly anticipated defense forum in Singapore kicked off with a friendly handshake between Pentagon chief Lloyd Austin and Chinese Defense Minister Li Shangfu. It ended Sunday with few other signs of optimism that the world’s biggest economies could avoid an eventual collision. Austin used his speech at the Shangri-la Dialogue to chide China over its refusal to meet directly. The remarks came as a Chinese vessel harassed an American warship transiting the Taiwan Strait, drawing attention to the biggest potential military flashpoint between the two powers.

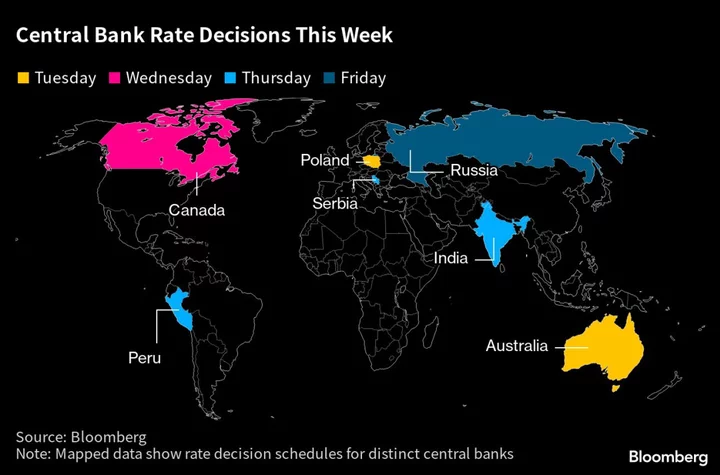

The big rate decisions: With the Federal Reserve approaching a possible pause in interest rate-hiking, two close-call decisions in Australia and Canada this week offer a foretaste of the quandary US officials have in store. Elsewhere, multiple rate decisions from India to Russia, Chinese trade and inflation numbers, other consumer-price reports from Turkey to Brazil, and testimony by the European Central Bank president will be among the highlights.

The big Bitcoin battle: The coders who maintain Bitcoin’s blockchain are clashing over whether to stamp out the meme tokens swarming the network. An explosion of meme tokens choked the Bitcoin blockchain in May and some crypto purists fret that future frenzied trading of memecoins like the frog-themed Pepe will again snarl the network.

The big debt drama: President Joe Biden signed legislation to kick the debt-limit down the road, staving off a catastrophic US payments default. Crisis-averted, at least until January 2025 when it’s possible, even likely, that the debacle will repeat itself once again as federal leaders increasingly use the must-pass legislation as political leverage. While this may be a bipartisan victory for those behind the negotiations, Congress isn’t out of the woods just yet.

The big breakthrough: A blockbuster lung cancer drug from AstraZeneca called Tagrisso was found to improve survival by more than half in a subset of patients, according to results released at the American Society of Clinical Oncology in Chicago Sunday. The results boost the company’s ambitions to widen its oncology portfolio. In another advancement, an experimental therapy from French drug developer Servier slowed the progression of a type of brain cancer by more than 16 months on average. Those results could lead to one of the first targeted therapies for the most common form of the tumor in adults younger than age 50.

The big vote: Mexican President Andres Manuel López Obrador’s ruling party is expected to win one of the last opposition party strongholds in Sunday’s gubernatorial election. The victory would be critical to the Morena party ahead of the 2024 presidential election, especially as the region, which contains a mix of wealthy and working-class neighborhoods, is often a bellwether for how Mexicans might vote in general elections.

The big thought: Alaska has been winking in and out of the American consciousness since its purchase from Russia in 1867. But the Arctic’s brief age of innocence is over. Bloomberg Opinion’s Liam Denning has the first in a series of articles looking at how climate change and geopolitics are reshaping the High North’s strategic landscape, from the military balance of power to the quest for oil and gas and mineral resources.

ICYM our Big Take: The partnership between Adidas and Ye, formerly known as Kanye West, was the stuff of sneakerhead legend — and its demise has the shoe company scrambling to replace nearly half of its profits. At the Adidas headquarters in Germany, executives have spent months mulling their inventory dilemma. They’ve considered unstitching the Yeezy logo off each shoe. Here’s the full Businessweek feature by Kim Bhasin and Tim Loh.

And finally, Bloomberg’s Sommer Saadi speaks to Liam Griffin about the private hire cab and courier company Addison Lee. Griffin explains how some of their people and parcel metrics are a reflection of London’s economic health. The chief executive tells this episode of In the City that the company is operating at 70% of pre-Covid levels. Listen to the podcast on iHeart, Apple Podcasts, Spotify and the Terminal.