Chinese President Xi Jinping’s elevation of a long-serving technocrat as the central bank’s top Communist Party official signals policy makers will avoid any drastic shifts for now as the world’s second-biggest economy struggles to regain momentum.

Pan Gongsheng’s appointment Saturday as party chief of the People’s Bank of China indicates the bank will stay the course, consistent with its recent approach of only modestly cutting interest rates and encouraging banks to lend more to targeted areas. The government has faced calls for greater stimulus in recent weeks as data continues to show the economy losing steam.

“It’s abundantly clear that the leadership is opting for continuity with this particular pick,” said Christopher Beddor, deputy China research director at Gavekal Dragonomics. “The leadership and PBOC are very well aware that Pan is a known quantity and well-regarded by both domestic and global investors, and they have occasionally taken advantage of that fact.”

With a resume that includes top positions at Chinese commercial banks and research stints at Harvard and Cambridge, the 59-year-old Pan has been entrusted to help steer China’s economy out of a post-Covid slump as concerns mount over lingering weakness in areas like consumer spending and real estate.

Read More: China’s Economic Woes Are Multiplying and Xi Has No Easy Fix

Still, his appointment leaves key questions unanswered about the PBOC’s role as Xi shakes up the upper echelons overseeing the financial system. Pan failed to make it onto the Communist Party’s Central Committee at its twice-a-decade leadership shuffle last year — a rank held by his predecessor at the central bank, Guo Shuqing.

Leadership Shuffle

On Saturday, Guo retired from his party role while current PBOC Governor Yi Gang relinquished his position as the bank’s deputy party chief. The Wall Street Journal reported earlier that Pan will also take on the governor title, a position appointed separately by the government, which would see the central bank revert to the norm in recent decades of having both top jobs held by one person.

“Pan’s relatively weak party ranking could lead to less PBOC influence in economic decision making at the highest levels,” said Adam Wolfe, emerging markets economist at Absolute Strategy Research Ltd. “Of course, the system is essentially a black box at that level, so it’s not clear how much it will matter that he isn’t on the Central Committee.”

What Bloomberg Economics says

In terms of the immediate policy outlook, Pan’s insider status, structural stresses from high debt and overcapacity that limit PBOC room for maneuver, and the need to gain consensus on major policy shifts mean continuity is the best bet.

— Tom Orlik, Chief Economist for Bloomberg Economics

Click here for the research

Unlike the US’s Federal Reserve and central banks in Europe, the PBOC is not independent. It answers to the State Council, China’s cabinet led by Premier Li Qiang, and needs approval before making major policy decisions such as setting interest rates or managing the currency.

“The bank is less likely to take any major leading role in macroeconomic decision-making under Xi’s third term, and would become more of a technical consultant,” said Hui Feng, co-author of The Rise of the People’s Bank of China and a senior lecturer at Griffith University in Australia.

Currency and Property

First among the challenges Pan faces is his area of recent expertise — the yuan. In addition to holding a deputy governor role at the central bank since 2012, he became head of China’s foreign exchange regulator in 2016, overseeing the country’s $3 trillion in foreign reserves.

Under Yi’s leadership, the PBOC transformed its interest rate system to a more market-based one, and also ceased intervening formally in the currency even though it still has several tools at its disposal. The central bank on Friday vowed to step up efforts to stabilize the yuan after it approached the lowest level in 15 years.

Like most Chinese bureaucrats, Pan usually sticks to the official script when he’s in the limelight. One of his more lively remarks came in 2017, in the midst of Beijing’s crackdown on cryptocurrencies.

“If you sit by the river and watch, one day the corpse of Bitcoin will float in front of you,” he said at an event, according to local media.

Read More: China Overhauls Financial Regulatory Regime to Control Risks

As the PBOC’s deputy governor, Pan has been the point person for managing the imposition of guardrails on China’s once-surging property market. In 2020, he was credited with introducing the so-called three red lines policy, a set of regulatory measures designed to rein in highly indebted developers like China Evergrande Group. This year’s post-Covid recovery in the sector has proven short lived, and authorities are considering stimulus measures such as lowering costs on outstanding mortgages.

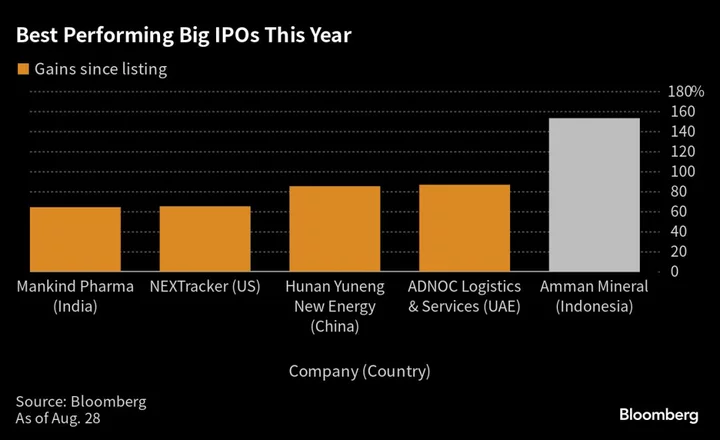

Prior to joining the PBOC, Pan was in charge of the initial public offerings of some of China’s biggest state-owned banks, including Agricultural Bank of China Ltd. The recent reorganization of financial regulatory bodies means the PBOC will likely focus on more on mandates related to monetary policy and financial stability as the new regulator takes over functions such as oversight of financial holding companies.

“As to the expectation that the governor and party secretary roles may be reconsolidated with Pan: it’s not yet entirely clear how much that would matter with the new institutional setup,” said Beddor from Gavekal Dragonomics. “It’s quite a new operating environment now for the PBOC.”