The unofficial rulebook of American politics includes these general guidelines:

Elections follow the economy. Presidents try to claim too much credit when things are good.They get too much blame when things are bad.

But this weird post-pandemic, inflation-addled economy has been scrambling preconceived notions for years. And it is with that background that anyone should read this decidedly good economic news: Inflation is unquestionably cooling.

What we don't know: Will cooling inflation neutralize Republicans' potent argument that massive amounts of government spending on everything from infrastructure to fighting climate change helped cause inflation?

Will it help President Joe Biden with selling "Bidenomics," the idea he's pushing to support the economy from the middle and bottom up rather than the top down?

Inflation is cooling. From CNN Business' report by Alicia Wallace: "US annual inflation slowed to 3% last month, according to the latest Consumer Price Index released Wednesday by the Bureau of Labor Statistics."

What that means: Prices generally aren't rising as fast. There have been 12 straight months in which inflation has cooled, and the annual rate has fallen from historic highs of above 9% last June.

What that does not necessarily mean: The sour feeling so many Americans have about the economy will suddenly end. Most prices aren't going down, so anyone feeling the pinch of higher prices is still going to be feeling it.

Elements of the economy are good -- extremely low unemployment suggests that if an American wants a job, that person can have it. But investors actually gave a thumbs down to unexpectedly large job gains because it was read as a sign the Federal Reserve would continue to raise interest rates to further contain inflation. Its target inflation rate is 2% annually.

Inflation has made everyday life feel much more expensive since the pandemic ended. Interest rates have shot up. But prices of big-ticket items like houses have not fallen, meaning some trappings of economic stability, like home ownership, feel farther away for many Americans.

RELATED: Grocery prices held steady in June, offering some relief

Meanwhile, perceptions of the economy are that people have been left behind.

CNN's Krystal Hur and Bryan Mena talked earlier this month to Americans who feel like a recession has already hit -- like Al Brown, laid off from his job at a software company in North Carolina, and trying now to figure out how to support his fiancee and their two children. His gym membership is gone. They're selling things from around the house. It's a far different story at Brown's kitchen table than the one told by government spreadsheets. Read the full story.

Even the Fed acknowledges that raising rates should ultimately make the unemployment rate rise too. Part of the medicine for inflation is bound to put some Americans out of work.

Inflation is also not being felt evenly. CNN reported this month about how Florida has become the nation's inflation hotpost, largely due to housing costs.

People don't feel financially secure. As CNN's Jeanne Sahadi recently wrote: "More than 2,500 US adults said they would need to earn, on average, $233,000 a year to feel financially secure and $483,000 annually to feel rich or to attain financial freedom, according to a new survey from Bankrate. Just for comparison's sake, the median earnings for a full-time, year-round worker in 2021 was $56,473, according to the US Census Bureau."

A CNN poll conducted by SSRS in May found the vast majority of Americans -- just over three-quarters -- think the economy is in bad shape and two-thirds disapprove of Biden's handling of it.

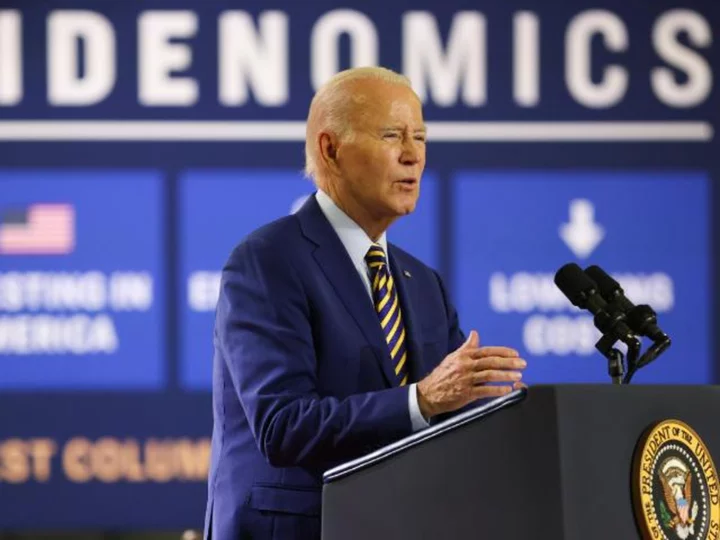

Selling 'Bidenomics.' All of this will affect how Americans view Biden's pitch to rewire how the government supports the economy and do a U-turn away from the low-tax ethos of Reaganomics, named for former President Ronald Reagan. The idea was that allowing corporations and the wealthy to pay lower taxes would let money "trickle down" into society.

At a speech in Chicago in late June to frame his economic outlook, Biden said it was the media that coined the term Bidenomics. But much like former President Barack Obama eventually embraced the term Obamacare as shorthand for the Affordable Care Act, Biden is leaning into branding his plans for the economy.

"That's Bidenomics in action," the president bragged in a statement after Wednesday's inflation report.

CNN's Tami Luhby explained the concept: "Growing the economy from the middle out and the bottom up -- not the top down -- is Biden's mantra."

So look for the economic portion of the coming presidential campaign to be framed around how much the government should spend to help build up infrastructure and education as opposed to whether it should be keeping taxes as low as possible to foster corporate growth and wealth.

That policy debate will take place as people continue to grapple with the new cost of American life. Taming inflation, even though it is very good news, probably will not give most people a sense of ease about the economy.